- United States

- /

- Construction

- /

- NasdaqGS:MYRG

Valuation in Focus: MYR Group (MYRG) After Analyst Downgrade and Fresh Buyback Program

Reviewed by Kshitija Bhandaru

MYR Group (MYRG) shares caught attention after KeyBanc shifted its outlook, citing that recent improvements in efficiency and strong earnings are now reflected in the price, and a $75 million buyback has just begun.

See our latest analysis for MYR Group.

The slight pullback in MYR Group’s share price comes just after a notable streak of operational wins, capped by a $75 million buyback and a recent downgrade from KeyBanc acknowledging that efficiency gains are now reflected in the price. Despite this, investors have still enjoyed a 1-year total shareholder return of 86%, and long-term holders have seen substantial gains. This is evidence that momentum has been strong, though some are now pausing to reassess risk versus reward at current levels.

If news like this has you looking for fresh ideas, now’s the perfect chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

With analyst downgrades citing a fair valuation and the company’s own buyback program signaling ongoing confidence, the real question is whether MYR Group’s future upside remains, or if the market has already priced it all in.

Most Popular Narrative: 4.8% Undervalued

With MYR Group closing at $199.55, the most widely followed fair value narrative pegs shares at $209.60, suggesting investors see even more upside at current levels. This calls for a deeper look at how analysts have built their case.

Sustained momentum in electrification spanning grid upgrades, data center buildouts, and transportation, coupled with robust private and public sector investment, is expected to drive strong demand for MYR Group's infrastructure services. This is projected to elevate the overall addressable market and support top-line growth.

Want to know the financial leap behind this price target? The central claim hinges on aggressive assumptions for future profits and margins, not just today’s revenue growth. Unpacking the methods and numbers behind this fair value might surprise anyone who thinks the story is already priced in.

Result: Fair Value of $209.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking renewables exposure and ongoing labor cost pressures could challenge the outlook. As a result, future earnings growth is not a given from here.

Find out about the key risks to this MYR Group narrative.

Another View: Is the Price Already Rich?

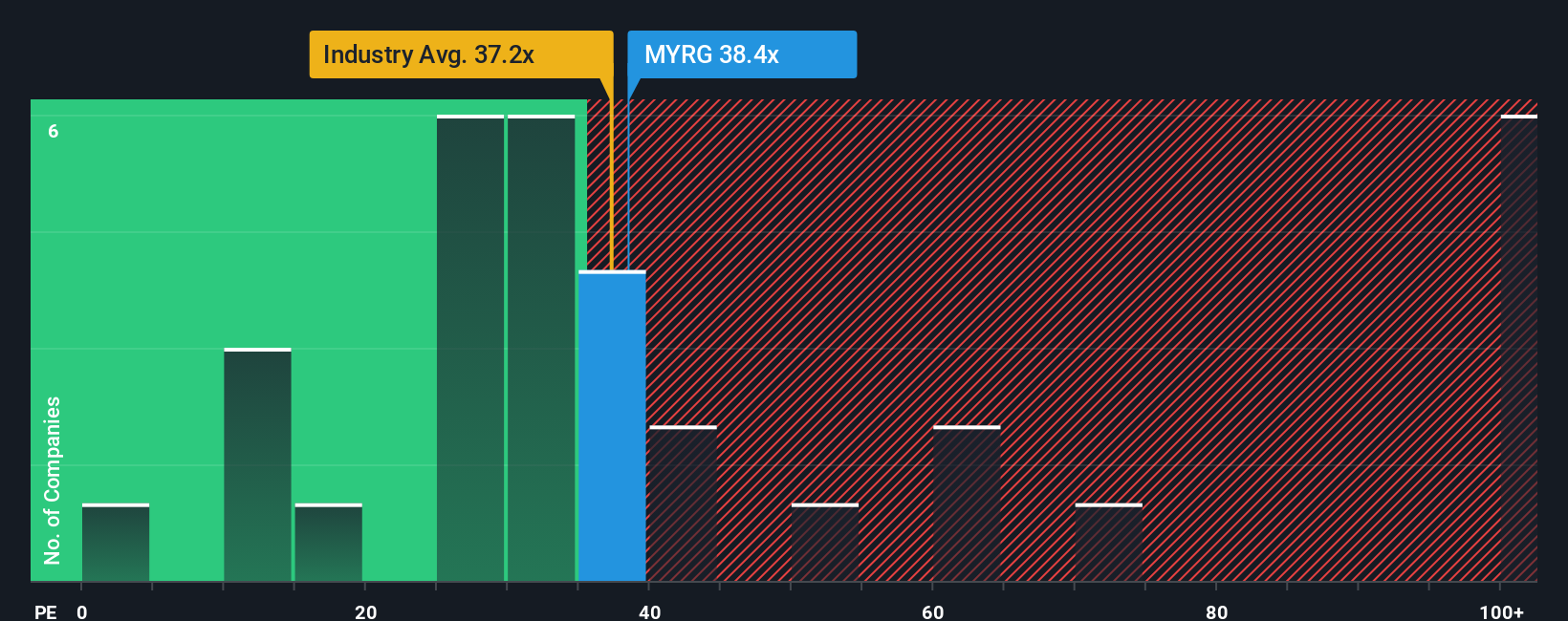

While analyst valuations point to upside, looking at the current price-to-earnings ratio of 40.6x tells a more cautious story. This figure is notably higher than both the peer average (35x) and the fair ratio our data suggests the market could target (31.4x). Such a gap signals higher valuation risk and means investors may be paying a premium for future growth that may already be priced in. Does the stock truly have more room to run, or is the optimism already accounted for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MYR Group Narrative

If you want to dig into the numbers yourself or test a different angle, you can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding MYR Group.

Ready to Find Your Next Big Opportunity?

Staying ahead means always knowing where tomorrow's winners are. Don’t let fresh market moves pass you by. Grab your edge today with these high-potential stock ideas from Simply Wall Street’s screeners:

- Capitalize on rising income with these 19 dividend stocks with yields > 3% offering yields above 3%, ideal for investors seeking steady growth and reliable returns.

- Unlock innovation by tapping into these 26 quantum computing stocks at the forefront of breakthroughs in quantum computing, AI, and future-defining technology.

- Cement your strategy by targeting value and resilience through these 887 undervalued stocks based on cash flows where market prices don't yet reflect strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MYRG

MYR Group

Through its subsidiaries, provides electrical construction services in the United States and Canada.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives