- United States

- /

- Construction

- /

- NasdaqGS:MYRG

Does Xcel Energy’s $500M Multi-State Contract Change The Bull Case For MYR Group (MYRG)?

Reviewed by Simply Wall St

- In July 2025, MYR Group Inc. revealed that a subsidiary secured a five-year Design-Build Electric Distribution Master Service Agreement with Xcel Energy, valued at over US$500 million and spanning multiple states through 2029.

- This contract expands MYR Group's role in electric distribution infrastructure and highlights the strength of their partnerships with major utilities.

- We’ll explore how this multi-year agreement with Xcel Energy could impact MYR Group’s project backlog and future revenue expectations.

Find companies with promising cash flow potential yet trading below their fair value.

MYR Group Investment Narrative Recap

To be a MYR Group shareholder today is to believe in the company’s ability to secure and successfully execute major multiyear contracts, capturing long-term demand from utilities investing in grid upgrades. The Xcel Energy agreement could meaningfully strengthen MYR Group’s project backlog in the near term, supporting visible revenue, but continued pressure on margins from previous T&D project losses remains the single largest risk for near-term earnings. The impact of this new contract on stabilizing income mix versus rising labor costs warrants close attention.

Among recent events, the completion of the US$75 million share repurchase program stands out, signaling management’s confidence in MYR Group’s cash flow and balance sheet. This buyback, finalized just months before the Xcel Energy win, offers context on how management aims to balance capital returns with growth catalysts from expanding utility partnerships.

However, against this backdrop, investors should be aware that ongoing margin pressures from higher labor and contract costs in key segments...

Read the full narrative on MYR Group (it's free!)

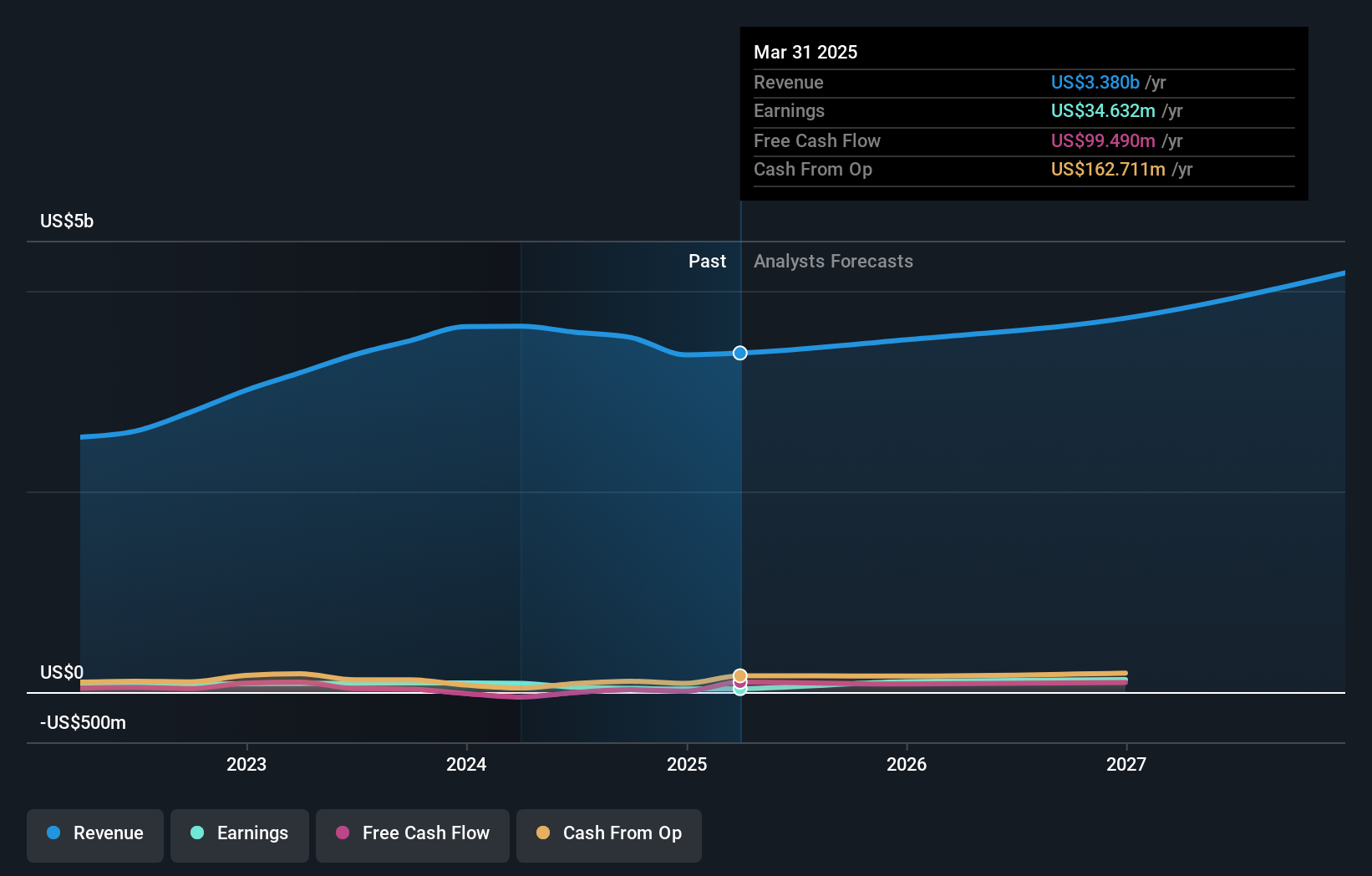

MYR Group's outlook calls for $4.1 billion in revenue and $276.2 million in earnings by 2028. This projection is based on analysts' assumptions of 6.6% annual revenue growth and a $241.6 million increase in earnings from the current level of $34.6 million.

Uncover how MYR Group's forecasts yield a $194.25 fair value, in line with its current price.

Exploring Other Perspectives

Individual fair value estimates for MYR Group from the Simply Wall St Community span from US$168.65 to US$194.25, with 2 distinct perspectives represented. While some see opportunity in contract wins and a growing backlog, risks from contracting profit margins remain a focal point to consider for future results.

Explore 2 other fair value estimates on MYR Group - why the stock might be worth as much as $194.25!

Build Your Own MYR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MYR Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free MYR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MYR Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MYRG

MYR Group

Through its subsidiaries, provides electrical construction services in the United States and Canada.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives