- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Will Mercury Systems' (MRCY) Cyber Partnership Reinforce Its Competitive Position in the Defense Sector?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Nightwing and Mercury Systems announced an agreement to integrate Nightwing's cyber resiliency technology into Mercury's defense hardware, offering pre-integrated cybersecurity and anti-tamper solutions for government clients.

- This partnership leverages Nightwing's deep military and intelligence experience to strengthen application integrity, aligning with increasing cybersecurity demands across the defense sector.

- We'll explore how this cybersecurity collaboration may influence Mercury Systems' investment outlook amid rising geopolitical and supply chain risks.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Mercury Systems Investment Narrative Recap

To be a Mercury Systems shareholder, you'd need to believe the company can translate strong defense sector tailwinds and rising technology demands into sustained revenue and margin growth, despite near-term challenges from legacy contracts and modest expected growth. The recent cybersecurity partnership with Nightwing is aligned with key industry trends, but does not materially shift the main short-term catalyst, the pace at which Mercury replaces its low-margin backlog with new, higher-margin contracts, nor does it mitigate the biggest risk of limited top-line growth from legacy program constraints in the immediate future.

Among recent announcements, the June 2025 US$131.3 million NAVAIR contract stands out, reinforcing Mercury's position in critical secure data transfer systems for naval aircraft. This contract is directly relevant to ongoing catalysts, as it demonstrates continued success in winning sizable, advanced-technology awards that have the potential to help shift Mercury’s contract mix toward higher-value, margin-accretive programs, a key factor for future earnings improvement.

Yet, what you may not expect is how legacy factory allocation can continue to limit Mercury's...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' outlook anticipates $1.1 billion in revenue and $44.5 million in earnings by 2028. This implies a 6.1% annual revenue growth rate and a $82.4 million increase in earnings from the current level of -$37.9 million.

Uncover how Mercury Systems' forecasts yield a $72.62 fair value, in line with its current price.

Exploring Other Perspectives

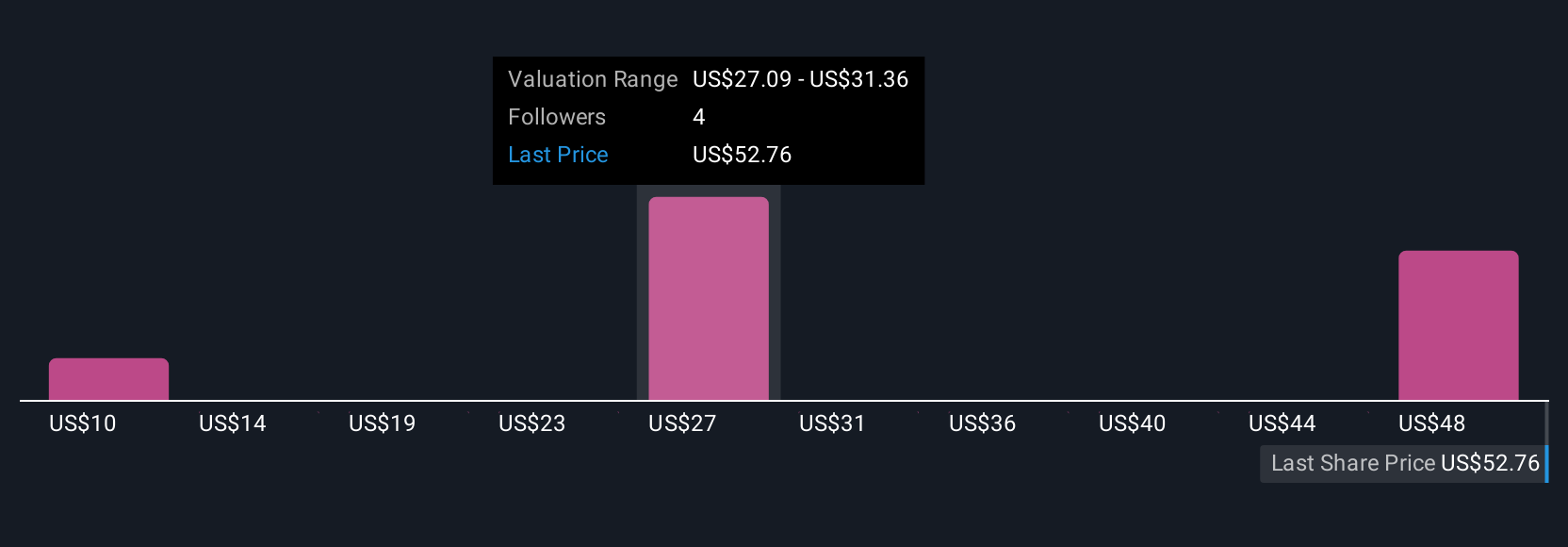

Simply Wall St Community members provided four fair value estimates for Mercury Systems stock, ranging from as low as US$10 to as high as US$72.63 per share. As you consider these highly varied opinions, remember ongoing margin constraints from legacy contracts could be just as critical to the company's longer-term performance as any single positive development.

Explore 4 other fair value estimates on Mercury Systems - why the stock might be worth as much as $72.62!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives