- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Mercury Systems (MRCY): Assessing Valuation Following Nightwing Partnership and Upbeat Analyst Sentiment

Reviewed by Kshitija Bhandaru

Mercury Systems (MRCY) sparked fresh interest after announcing a partnership with Nightwing to boost cyber resiliency in its hardware. Investors are tracking both this move as well as several recent upward earnings estimate revisions.

See our latest analysis for Mercury Systems.

Mercury Systems’ share price has seen significant swings lately, with a standout 46.9% gain over the past 90 days and a notable 73.9% year-to-date share price return. The recent announcement of a Nightwing partnership and upbeat analyst sentiment have fueled renewed optimism. However, investors should also note that total shareholder return over five years remains slightly negative, hinting at earlier headwinds and a still-evolving turnaround story.

If today’s surge in defense tech caught your attention, take the next step and discover other top performers with our See the full list for free.

With all these catalysts in play and a remarkable rally so far this year, investors might wonder whether Mercury Systems remains undervalued at current levels or if the market has already anticipated the company’s next phase of growth.

Most Popular Narrative: Fairly Valued

With Mercury Systems last closing at $73.58 and the most watched narrative assigning a fair value of $72.63, the debate over pricing is razor-thin. This close call puts the focus on what underpins analysts’ conviction and whether recent momentum has truly reset expectations.

Expanding penetration into programs that require secure, high-performance embedded processing and open-architecture modular solutions positions Mercury to benefit from the defense sector's shift toward greater digitization and AI/ML adoption. This supports higher-margin, higher-value contracts along with improved long-term gross and net margins.

Curious what projections justify such a slim gap between market price and fair value? There is a futuristic thesis, rooted in data and digital transformation. Get all the surprising details and see which shifting assumptions have the biggest impact on this finely balanced outcome.

Result: Fair Value of $72.63 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or disappointing fiscal 2026 growth could quickly challenge the current optimism surrounding Mercury Systems’ turnaround and future earnings trajectory.

Find out about the key risks to this Mercury Systems narrative.

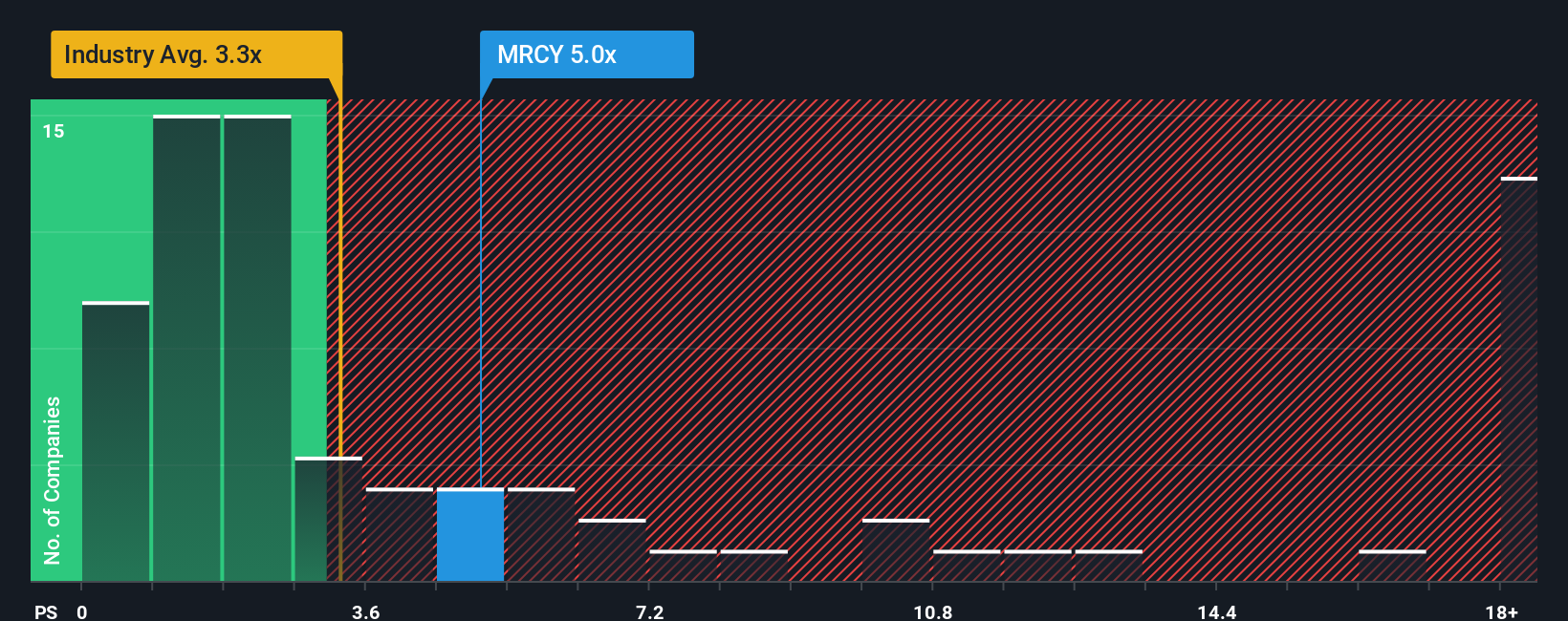

Another View: Multiples Signal Stretch

Looking from a sales ratio perspective, Mercury Systems trades well above the industry average. Its price-to-sales ratio sits at 4.8x, compared to 3.3x for the typical US Aerospace & Defense company, and far above the fair ratio of 1.6x. This premium suggests investors may be pricing in ambitious future gains. The question remains: is the market getting ahead of itself, or is this the start of sustainable growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mercury Systems Narrative

If you want to explore the numbers firsthand or have a different angle on Mercury Systems’ outlook, you can craft your own analysis and see how your story stacks up. Do it your way

A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop now. Broaden your investment radar by tapping into top opportunities across exciting, high-potential sectors with the Simply Wall St Screener.

- Unlock rapid growth potential by scanning these 24 AI penny stocks benefiting from advances in automation, machine learning, and real-world applications.

- Supercharge your income stream and spot generous yields by browsing these 19 dividend stocks with yields > 3% delivering consistently strong payouts and stable fundamentals.

- Catch undervalued gems flying under the radar before the crowd by targeting these 889 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives