- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Is Mercury Systems' (MRCY) New Space Force Deal Signaling a Shift Toward Higher-Value Defense Contracts?

Reviewed by Simply Wall St

- AeroVironment announced a new production agreement with Mercury Systems to provide FPGA-based solutions for the U.S. Space Force’s SCAR program, extending Mercury’s contribution to the BADGER deployable ground communications system and supporting delivery of two additional units.

- This agreement builds on Mercury’s prior involvement in defense communications hardware and highlights the company’s expanding footprint in next-generation space and satellite technology integration initiatives.

- We'll examine how Mercury's increased role in the SCAR program could influence expectations around its shift toward higher-value defense contracts.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mercury Systems Investment Narrative Recap

The core idea behind owning Mercury Systems is belief in its ability to transition from low-margin legacy programs to higher-value defense contracts, fueled by innovation in secure aerospace technology. The recent extension of its BADGER-related production agreement supports its alignment with next-generation military communications but may have a limited impact on the most immediate catalyst: the pace at which Mercury replaces legacy backlog with higher-margin deals. The biggest near-term risk remains slow top-line growth from capacity still tied up in low-yield contracts.

Among recent updates, Mercury’s latest full-year earnings reveal ongoing sales growth to US$912.02 million and a significantly reduced net loss of US$37.9 million. This signals progress in operational improvements but does not alleviate the primary challenge that outstanding legacy contracts continue to limit margin and earnings growth, an issue reflected in analyst expectations for only modest near-term revenue expansion.

On the other hand, the less visible risk investors should watch comes from Mercury’s continued reliance on accelerating order deliveries to pull forward revenue in the face of...

Read the full narrative on Mercury Systems (it's free!)

Mercury Systems' narrative projects $1.1 billion revenue and $44.5 million earnings by 2028. This requires 6.1% yearly revenue growth and an $82.4 million increase in earnings from the current $-37.9 million.

Uncover how Mercury Systems' forecasts yield a $65.43 fair value, in line with its current price.

Exploring Other Perspectives

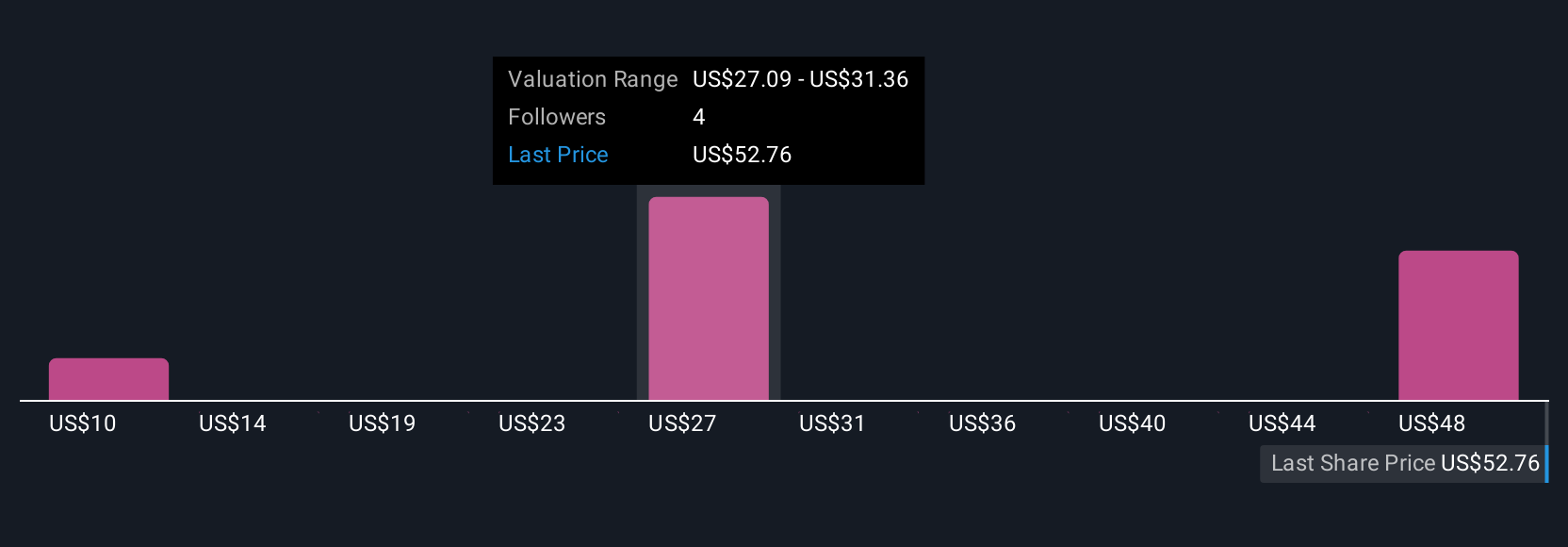

Simply Wall St Community members estimate Mercury’s fair value anywhere between US$10 and US$65.43, reflecting a broad spectrum of four investor views. With margin expansion still constrained by legacy contracts, consider several perspectives before forming your own outlook.

Explore 4 other fair value estimates on Mercury Systems - why the stock might be worth less than half the current price!

Build Your Own Mercury Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury Systems' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives