- United States

- /

- Machinery

- /

- NasdaqCM:MNTX

Manitex International, Inc. (NASDAQ:MNTX) Stock's 33% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Manitex International, Inc. (NASDAQ:MNTX) share price has dived 33% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

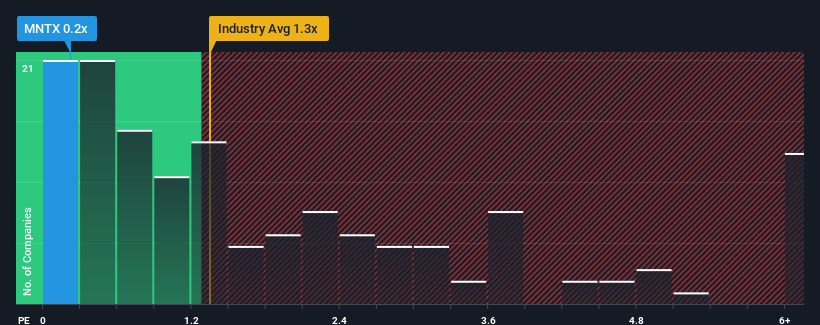

Following the heavy fall in price, Manitex International's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Machinery industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Manitex International

How Has Manitex International Performed Recently?

Recent revenue growth for Manitex International has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Manitex International will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Manitex International.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Manitex International would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 5.0% gain to the company's revenues. Pleasingly, revenue has also lifted 59% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 3.1% each year as estimated by the sole analyst watching the company. With the industry predicted to deliver 4.3% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Manitex International is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Manitex International's P/S Mean For Investors?

The southerly movements of Manitex International's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Manitex International currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Plus, you should also learn about these 3 warning signs we've spotted with Manitex International (including 1 which can't be ignored).

If these risks are making you reconsider your opinion on Manitex International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MNTX

Manitex International

Provides engineered lifting solutions in the United States, Italy, Canada, Chile, France, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives