- United States

- /

- Machinery

- /

- NasdaqGS:MIDD

Middleby (MIDD) Credit Amendment and Spin-Off Plans Might Change the Case for Investing

Reviewed by Simply Wall St

- On August 19, 2025, The Middleby Corporation and certain subsidiaries amended their credit agreement by extending the maturity date to April 28, 2028, and made changes to enable the planned separation of Middleby's food processing business into a standalone public company.

- This amendment provides Middleby with enhanced financial and operational flexibility, highlighting a significant step toward reshaping its corporate structure and future growth trajectory.

- We'll examine how the credit agreement amendment supporting the food processing spin-off impacts Middleby's investment narrative and outlook.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Middleby Investment Narrative Recap

To be a Middleby shareholder, you’d need to believe in the company’s ability to innovate and grow through both operational improvements and the strategic restructuring now underway. The recent credit agreement amendment, which extends debt maturities and facilitates the food processing spin-off, offers added flexibility, but it’s not a game changer for the immediate catalyst: a recovery in demand from the quick service restaurant segment. However, it does little to reduce the key risk of margin pressure from inflation and supply chain issues, which remain front and center for the business. Among recent developments, the substantial increase in buyback authorization, now up to 12.5 million shares, with 11.91% of shares already repurchased, stands out. While this capital return policy may support shareholder value in the short term, it amplifies concerns about balance sheet constraints, especially given ongoing high debt levels and the need to invest for long-term growth. Yet, investors should also keep in mind that despite added flexibility, the push for buybacks could still limit Middleby’s ability to...

Read the full narrative on Middleby (it's free!)

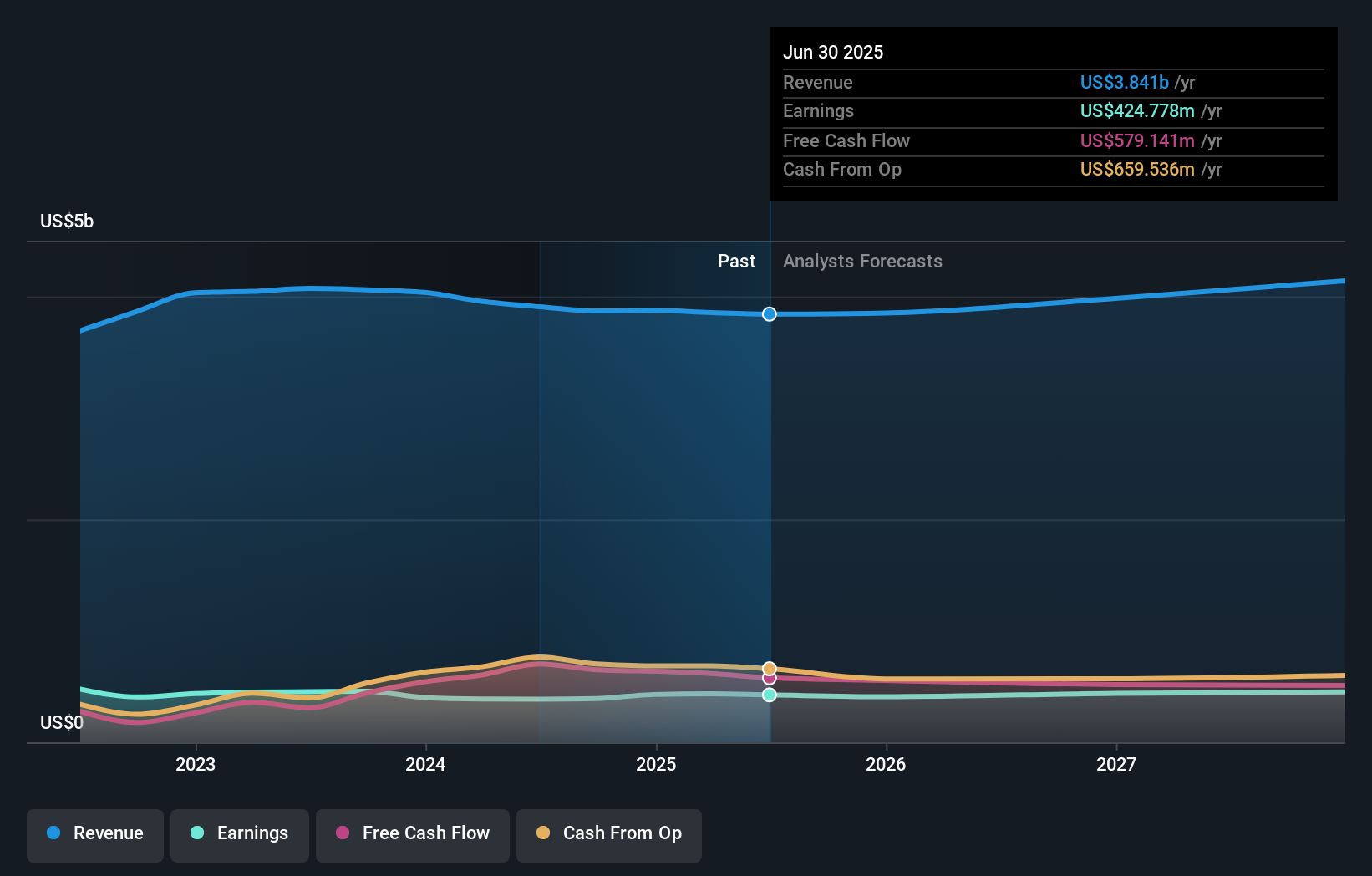

Middleby's outlook anticipates $4.2 billion in revenue and $464.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.1% and an earnings increase of $39.6 million from current earnings of $424.8 million.

Uncover how Middleby's forecasts yield a $150.14 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates for Middleby ranging from US$110.00 to US$150.14, based on two unique analyses. While some see deep value, the ongoing risk of margin pressure from persistent cost inflation could weigh on business performance, making it crucial to consider a variety of viewpoints.

Explore 2 other fair value estimates on Middleby - why the stock might be worth as much as 9% more than the current price!

Build Your Own Middleby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Middleby research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Middleby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Middleby's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MIDD

Middleby

Designs, manufactures, markets, distributes, and services commercial restaurant, food processing, and residential kitchen equipment worldwide.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives