- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Reassessing Intuitive Machines (LUNR) Valuation After Recent Volatility and Mixed Share Price Momentum

Reviewed by Simply Wall St

Intuitive Machines (LUNR) has had a choppy run lately, with the stock down over the past week but still up in the past month and past 3 months, leaving investors reassessing its risk reward profile.

See our latest analysis for Intuitive Machines.

The 13.1% 1 month share price return and 16.2% 3 month share price return suggest momentum is tentatively rebuilding. However, the 44.2% year to date share price decline and weaker 1 year total shareholder return show investors are still pricing in substantial execution risk.

If Intuitive Machines has you watching space exposed names more closely, it could also be worth scanning aerospace and defense stocks for other ideas riding similar themes.

With shares still trading well below analyst targets despite explosive top line growth but deep losses, investors now face a key question: is Intuitive Machines a misunderstood value in the making, or is the market already discounting its future moonshot potential?

Most Popular Narrative Narrative: 30.5% Undervalued

With Intuitive Machines last closing at $10.78 against a narrative fair value of $15.50, the story hinges on aggressive growth turning today’s losses into future earnings power.

The accelerating commercial use of space both by public space agencies and private enterprises is expanding the total addressable market for lunar transport, data transmission, and infrastructure services. Intuitive Machines' sole source NASA Near Space Network contract, expansion into Mars relay and data services, and pipeline for defense related lunar missions position the company for substantial revenue growth as global demand for lunar and deep space access scales in the coming decade.

Want to see how bold these growth bets really are? The narrative leans on steep revenue ramps, margin flips, and a punchy future earnings multiple. Curious which assumptions do the heavy lifting behind that target price? Dive into the full story to unpack the projections driving this valuation call.

Result: Fair Value of $15.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained execution missteps or delays in major government contracts could quickly erode confidence, compress valuation multiples, and derail this growth-driven upside case.

Find out about the key risks to this Intuitive Machines narrative.

Another Lens on Valuation

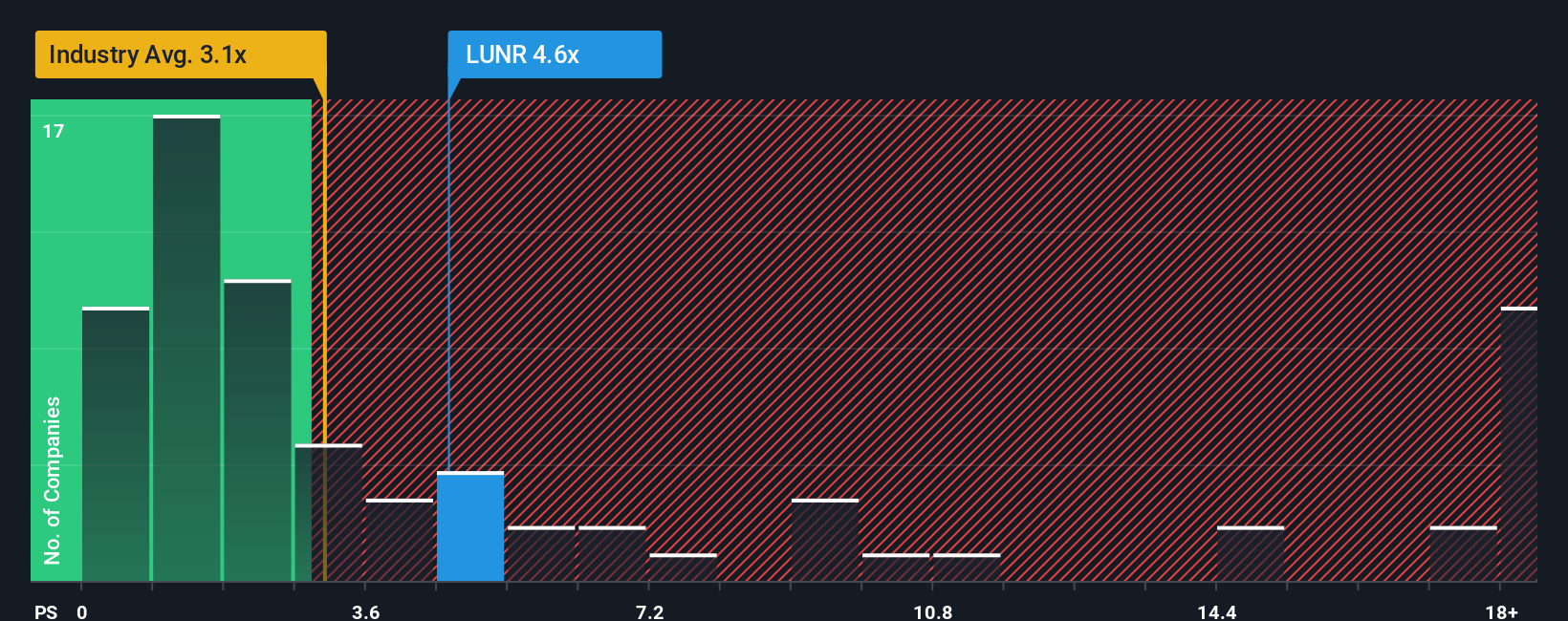

While the narrative fair value points to upside, the price to sales ratio tells a different story. Intuitive Machines trades at 5.8 times sales, richer than both the US Aerospace and Defense average of 3 times and its peer fair ratio of 2.3 times. This implies meaningful valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in just minutes using Do it your way.

A great starting point for your Intuitive Machines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the next wave of opportunities, put Simply Wall St’s powerful stock screeners to work and do not let standout ideas pass you by.

- Capture early stage growth potential by scanning these 3636 penny stocks with strong financials that match your risk appetite and show real financial substance behind their small market caps.

- Capitalize on the AI revolution by targeting these 26 AI penny stocks positioned at the heart of automation, data intelligence, and next generation software demand.

- Lock in long term income potential by focusing on these 13 dividend stocks with yields > 3% that combine meaningful yields with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion