- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR): Revisiting Valuation After New Analyst Views on Lunar Contracts and Lanteris Deal

Reviewed by Simply Wall St

Intuitive Machines (LUNR) is back in focus after fresh analyst commentary tied together a busy roadmap, ranging from the pending Lunar Terrain Vehicle decision and potential CLPS CT4 award to its next IM 3 lunar mission.

See our latest analysis for Intuitive Machines.

Despite an 11.76% 1 day share price return and a 34.28% 90 day share price return lifting Intuitive Machines to 11.4 dollars, the stock is still digesting a 40.99% year to date share price decline. Its 3 year total shareholder return remains positive at 14.34%, which may indicate that momentum is rebuilding as investors reassess the growth story around upcoming lunar milestones.

If this kind of catalyst driven move has your attention, it could be a good time to explore other aerospace names via aerospace and defense stocks and see what else is lining up new contracts.

Yet with analysts flagging upside to 15.5 dollars and a slate of NASA linked contracts still ahead, is Intuitive Machines trading at a meaningful discount, or is the market already baking in its next leg of lunar driven growth?

Most Popular Narrative: 26.5% Undervalued

With Intuitive Machines closing at 11.4 dollars against a widely followed fair value of 15.5 dollars, the current setup hinges on aggressive growth and margin expansion playing out as expected.

The accelerating commercial use of space both by public space agencies and private enterprises is expanding the total addressable market for lunar transport, data transmission, and infrastructure services; Intuitive Machines' sole source NASA Near Space Network (NSNS) contract, expansion into Mars relay and data services, and pipeline for defense related lunar missions position the company for substantial revenue growth as global demand for lunar and deep space access scales in the coming decade.

Curious how a young, loss making space company earns a premium style valuation? The narrative leans on rapid revenue compounding, a sharp profitability swing, and a rich future earnings multiple. Want to see which specific growth and margin assumptions have to land for that price to make sense? Read on to unpack the full playbook behind this fair value.

Result: Fair Value of $15.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and heavy reliance on a few large government contracts mean that any delays or cancellations could quickly undermine the bullish growth narrative.

Find out about the key risks to this Intuitive Machines narrative.

Another View: Rich On Sales

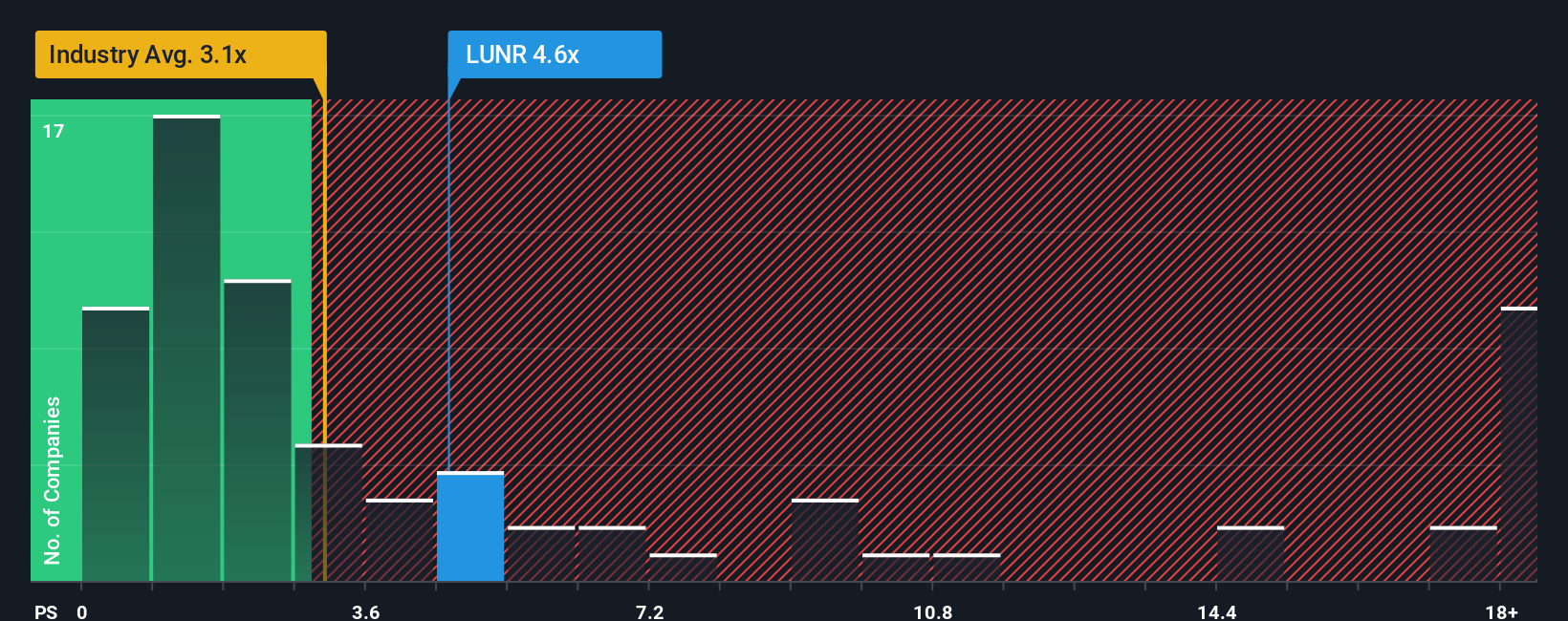

While the narrative suggests a 26.5% upside to fair value, the market is already paying a steep price for Intuitive Machines' growth story. On a sales basis, the stock trades at 6.2 times revenue, more than double the US Aerospace and Defense average of 3 times and well above the 2.4 times fair ratio our models suggest the market could drift toward. Against direct peers on 1.8 times, that gap signals real valuation risk if execution stumbles or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Machines Narrative

If this framework does not quite fit your view, or you prefer to stress test the numbers yourself, you can build a personalised story in minutes using Do it your way.

A great starting point for your Intuitive Machines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next watchlist upgrade by using the Simply Wall Street Screener to spot opportunities you do not want to regret missing.

- Capture early stage potential by scanning these 3572 penny stocks with strong financials that pair low share prices with improving fundamentals and room for serious upside.

- Position your portfolio for secular growth by targeting these 30 healthcare AI stocks bringing smarter diagnostics, personalized treatment, and scalable medical technologies to a massive global market.

- Lock in cash flow today and tomorrow through these 15 dividend stocks with yields > 3% that combine solid yield with the financial strength to keep paying through the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026