- United States

- /

- Construction

- /

- NasdaqGS:LGN

Assessing Legence Shares After Regional Bank Sector Loan Growth Headlines

Reviewed by Bailey Pemberton

Thinking about what to do with Legence stock right now? You are not alone. After a bit of a bumpy ride this past week, with shares dipping 1.9%, some investors are pausing to reassess where things could go next. Zooming out, Legence has managed to hold onto a slim 0.4% gain over the last month and a stronger 7.8% rise year to date. Clearly, the mood has shifted a few times this year, mainly driven by broader industry news and changing investor sentiment about the outlook for mid-sized banks like Legence.

In the financial headlines, there has been renewed attention on regional banks, with regulators mulling over capital requirement tweaks and the sector seeing improved loan growth. While none of this has led to huge price swings for Legence specifically, it has sparked fresh conversations about risk and opportunity, and the stock’s valuation is central to that debate.

For anyone crunching the numbers, Legence currently lands a valuation score of 3 out of 6 when we run it through our checklist of key undervaluation factors. That means the company is undervalued in half of the main categories we track, suggesting both potential and caution for investors who are looking for a good entry point.

Of course, there are many ways to tackle the question: “Is Legence really undervalued?” Next, let us break down these valuation approaches, and at the end, we will explore a smarter, more holistic way to judge whether this stock truly deserves a place in your portfolio.

Approach 1: Legence Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach aims to calculate what Legence shares are worth today, based on expectations of how much cash the business will actually generate in the future.

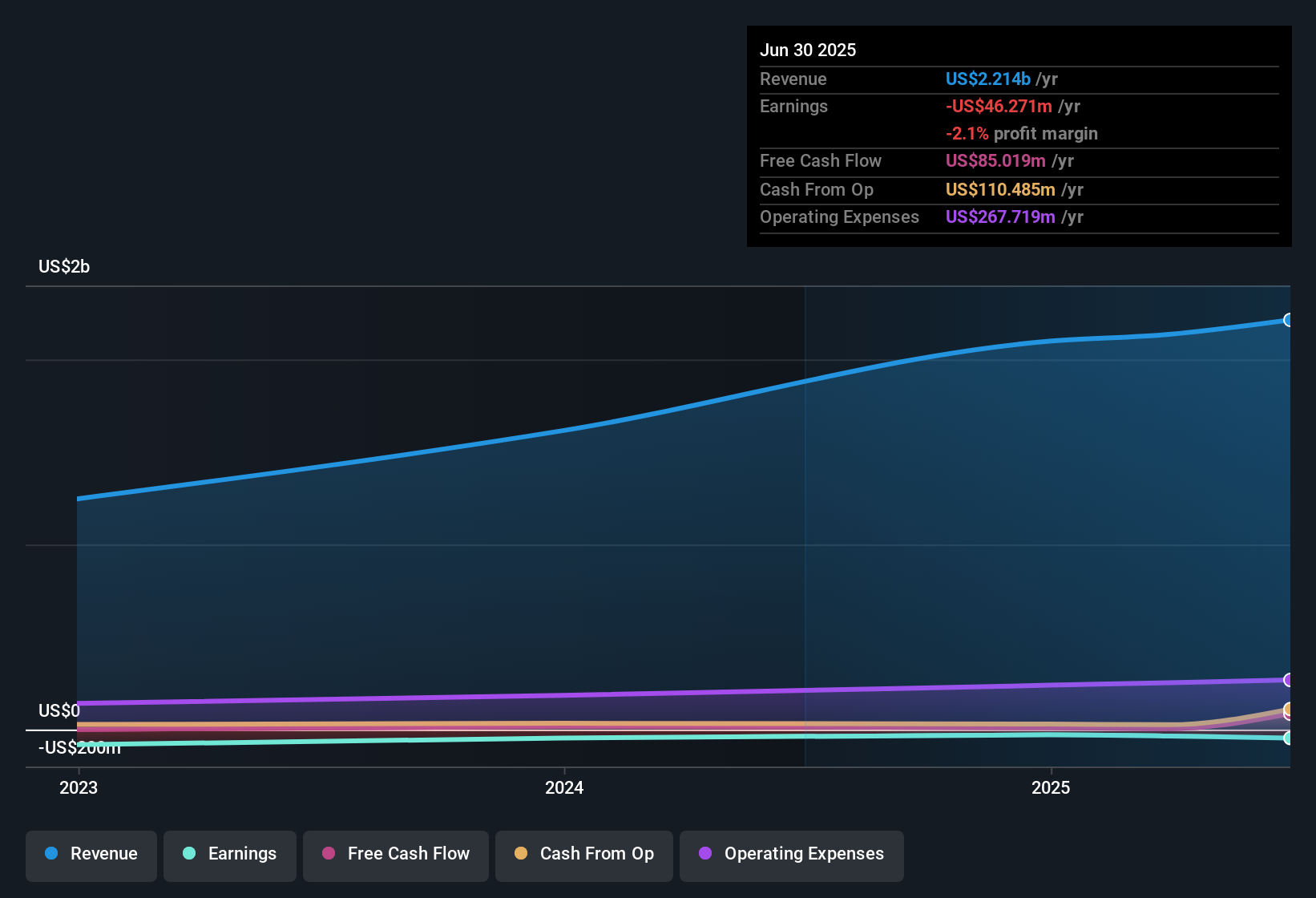

For Legence, the current Free Cash Flow (FCF) is $84.2 million, forming the foundation for future growth calculations. Analyst estimates predict annual FCF rising to $236.5 million by 2029. Only projections for the next five years are analyst-backed, and after that, growth rates are extrapolated. These projections use the 2 Stage Free Cash Flow to Equity model to provide a long-term view, even as the certainty of the estimates declines further into the future.

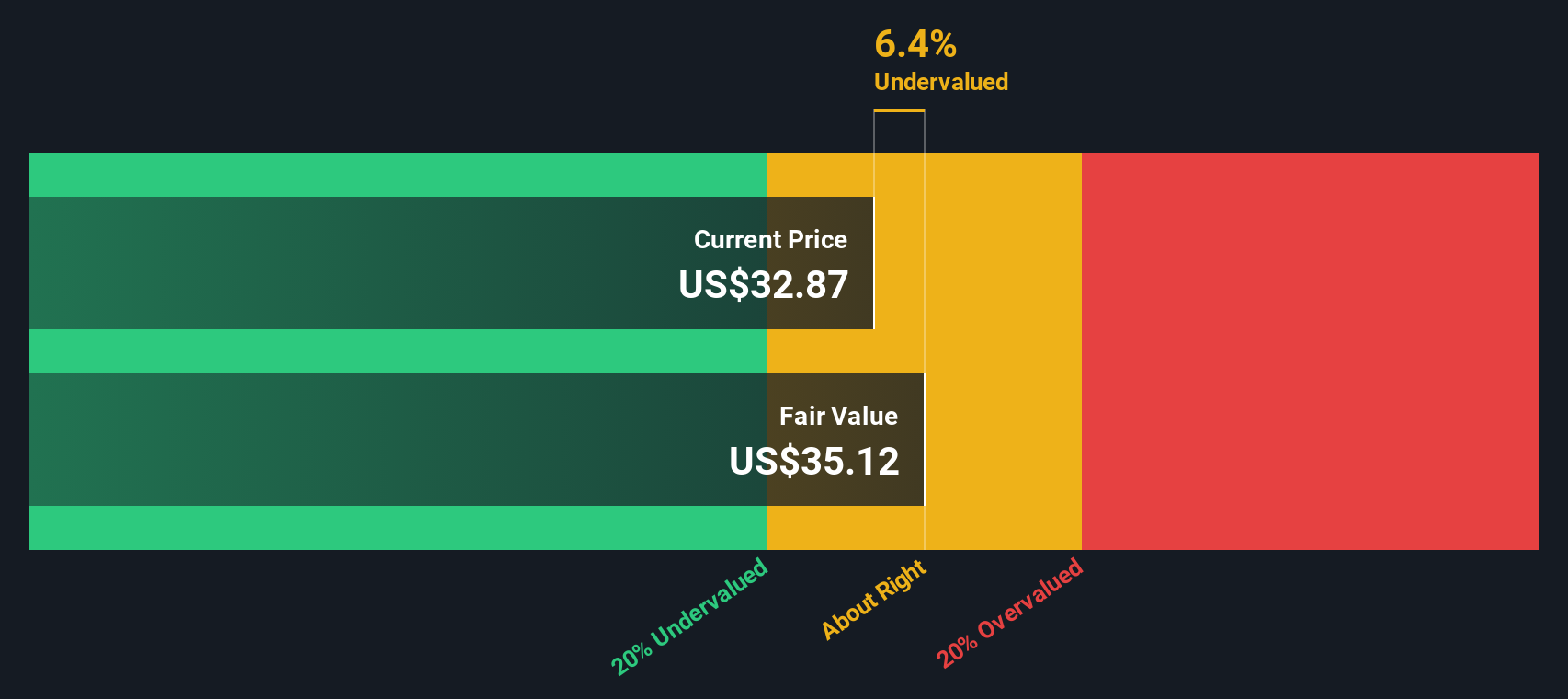

Bringing it all together, the DCF model calculates an estimated intrinsic value of $35.12 per share for Legence. This is about 6.4% higher than where the stock currently trades, suggesting the shares are only slightly undervalued when compared to their calculated fair value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Legence's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Legence Price vs Sales

For businesses in the construction sector like Legence, the Price-to-Sales (P/S) ratio is often the most useful yardstick for valuation. Sales-based multiples are especially valuable when earnings can be volatile due to shifting project costs or economic swings, making them a preferred method for analyzing profitable but cyclical companies.

The "right" P/S multiple for a company is not set in stone. It tends to move higher when the market expects robust future growth and lower risk, and it compresses when growth prospects dim or risk rises. Factors like margin stability, market standing, and investor confidence all play a role in setting what investors see as a fair P/S ratio.

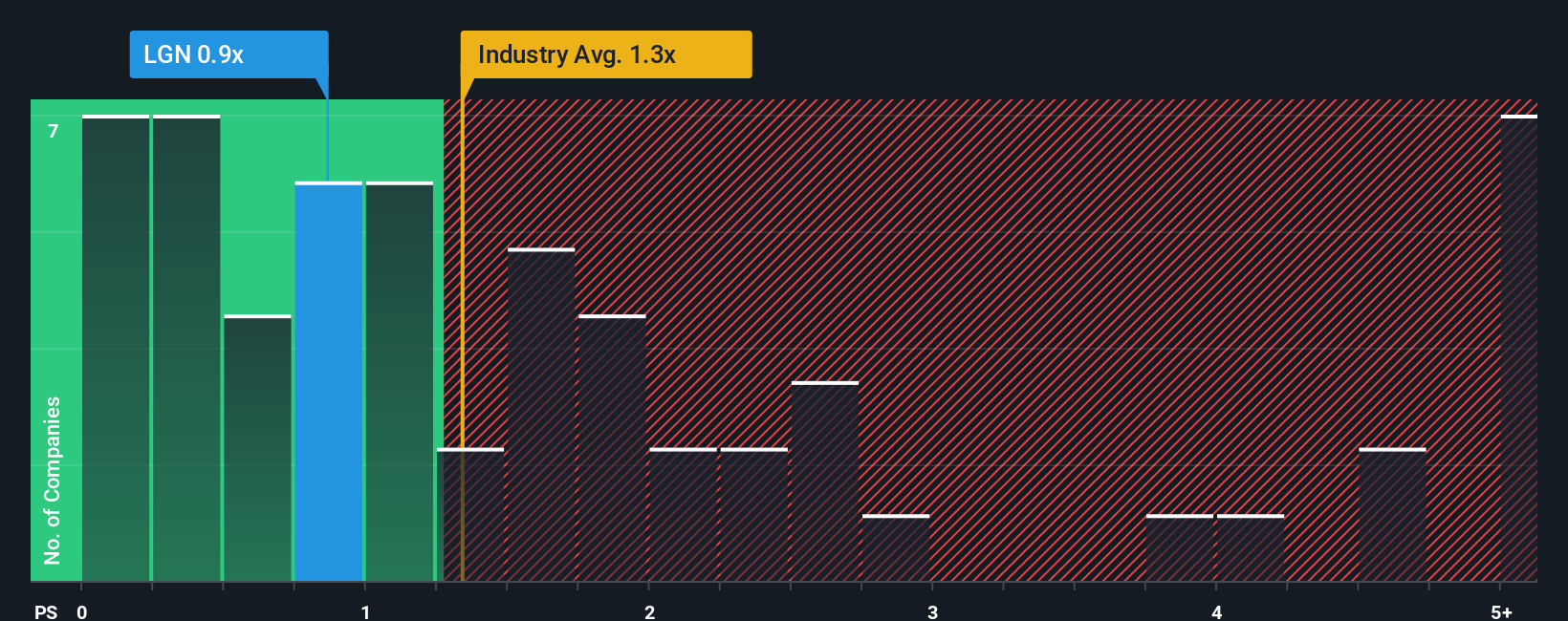

Currently, Legence trades at a P/S ratio of 0.87x. For context, the average across the construction industry sits at 1.41x, while the peer group sits even higher at 1.82x. These numbers hint that the market is attaching a lower value to Legence’s sales than to its peers. However, simple comparisons can be misleading, as they ignore important considerations such as company-specific growth rates, profitability, and risk.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio is calculated using a blend of factors, including growth outlook, profit margins, company size, industry trends, and risk profile, instead of just looking at what competitors are trading at. This holistic approach gives a more meaningful sense of what Legence’s P/S multiple should be right now, based on its own fundamentals and risk return profile.

Comparing Legence’s actual P/S ratio to its Fair Ratio, the numbers are almost identical, differing by less than 0.10x. This suggests that the market price is about right when all relevant factors are considered.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Legence Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your opportunity to tell the story behind Legence’s numbers by expressing your own view on its fair value through your assumptions about future growth, profit margins, risks, and opportunities.

Narratives go beyond simple ratios by linking the company's prospects to a financial forecast and, ultimately, to a unique fair value. This approach makes investing more personal and strategic, as you can see how your perspective compares to others’ in real time.

Narratives are easy to use and built directly into Simply Wall St’s Community page, where millions of investors share and update their views as new earnings or major news emerges. By creating or following a Narrative, you can compare Legence’s Fair Value to its current Price and determine whether your outlook suggests a buying opportunity or a risk to avoid.

For example, some investors forecast a strong rebound for Legence, leading to a Fair Value well above today’s price. Others take a more cautious view and set their Fair Value notably lower. Using Narratives helps you make smarter, more dynamic investment decisions in any market environment.

Do you think there's more to the story for Legence? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGN

Legence

Provides engineering, installation, and maintenance services for mission-critical systems in buildings in United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives