- United States

- /

- Machinery

- /

- NasdaqGS:LECO

Lincoln Electric (LECO): Evaluating Valuation as Analysts Highlight Growth Moves and Alloy Steel Australia Acquisition

Reviewed by Simply Wall St

Most Popular Narrative: 5.7% Undervalued

The prevailing analyst narrative sees Lincoln Electric Holdings trading at a slight discount to its calculated fair value, reflecting cautious optimism about the company's future earnings growth and margin expansion capability.

Expanded opportunities in end markets tied to infrastructure (such as power generation, data centers, and HVAC), alongside domestic and international government initiatives, are likely to sustain demand for welding products and consumables. Especially as energy transition and infrastructure spending ramps up, this trend supports multi-year revenue and margin growth.

What if the next wave of infrastructure spending could turbocharge Lincoln Electric’s profit engine? This narrative is grounded in detailed assumptions about future growth, margins, and recurring revenue. Want to know which key factors push their fair value target above today’s price? The full narrative unpacks the numbers that are powering this bullish outlook.

Result: Fair Value of $253.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on price hikes instead of true demand, along with ongoing international market weakness, could challenge the optimistic outlook for Lincoln Electric Holdings.

Find out about the key risks to this Lincoln Electric Holdings narrative.Another View: What Do Market Ratios Suggest?

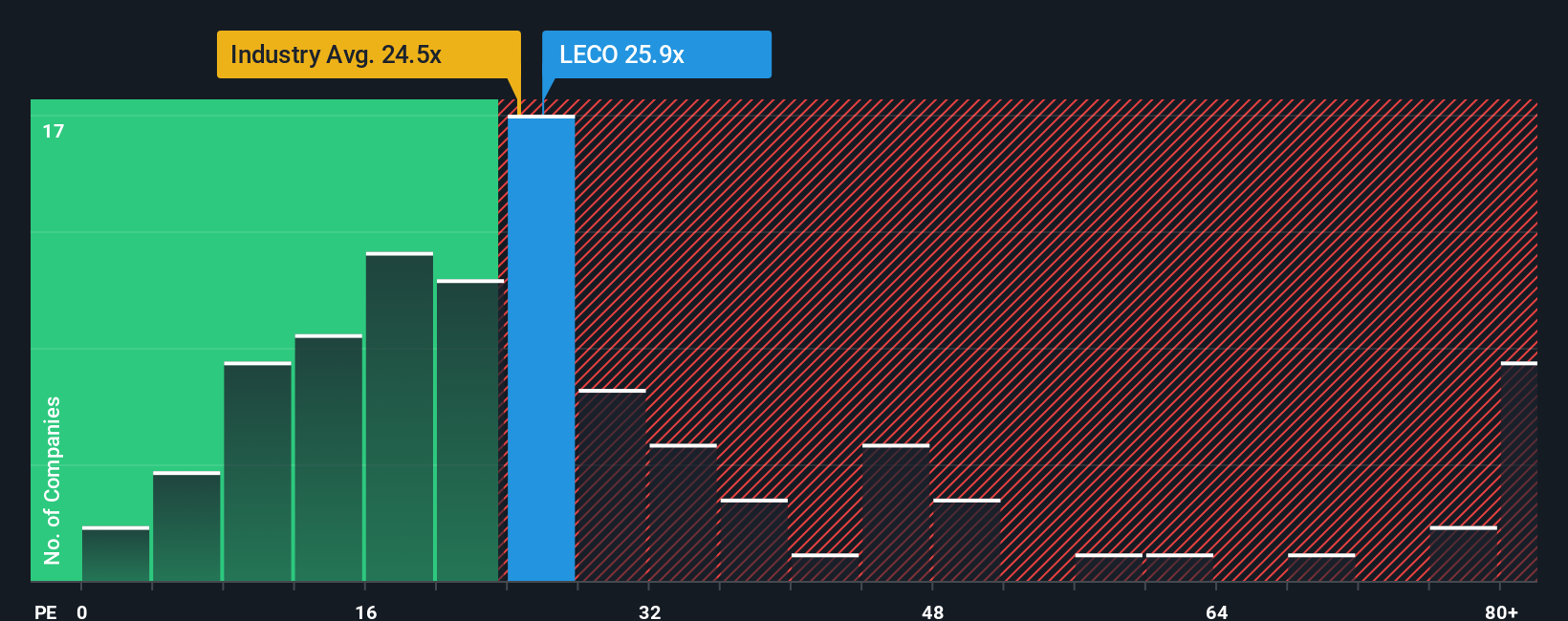

Looking from a different angle, traditional price-to-earnings comparisons tell a less optimistic story for Lincoln Electric. Based on this approach, shares appear somewhat expensive relative to the industry, which raises the question: is confidence too high?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Lincoln Electric Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Lincoln Electric Holdings Narrative

If you want to interpret the numbers differently or like to perform your own analysis, you can craft your own narrative in just minutes. Do it your way

A great starting point for your Lincoln Electric Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Curious about where other investors are spotting the next big winners? Secure your edge by searching for stocks that match your goals and risk appetite with these handpicked market ideas.

- Accelerate your search for reliable growth with companies offering dividend stocks with yields > 3%, providing the stability of consistent income streams.

- Take advantage of advances in medicine and technology by targeting innovation. Explore healthcare AI stocks driving breakthroughs in healthcare.

- Supercharge your potential returns by focusing on value plays. Find opportunities with undervalued stocks based on cash flows identified by powerful cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LECO

Lincoln Electric Holdings

Through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives