- United States

- /

- Machinery

- /

- NasdaqCM:LBGJ

Unpleasant Surprises Could Be In Store For Li Bang International Corporation Inc.'s (NASDAQ:LBGJ) Shares

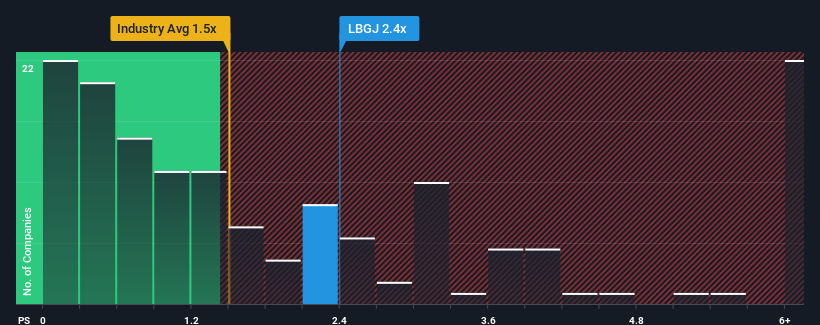

When close to half the companies in the Machinery industry in the United States have price-to-sales ratios (or "P/S") below 1.5x, you may consider Li Bang International Corporation Inc. (NASDAQ:LBGJ) as a stock to potentially avoid with its 2.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

We've discovered 4 warning signs about Li Bang International. View them for free.See our latest analysis for Li Bang International

What Does Li Bang International's P/S Mean For Shareholders?

For instance, Li Bang International's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Li Bang International's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Li Bang International?

In order to justify its P/S ratio, Li Bang International would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 32% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 1.9% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's odd that Li Bang International's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be extremely difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Li Bang International currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the high P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Li Bang International (3 are concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LBGJ

Li Bang International

Engages in the design, development, production, and sale of stainless-steel commercial kitchen equipment under the Li Bang brand in China.

Moderate and overvalued.

Market Insights

Community Narratives