- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) Investors Are Less Pessimistic Than Expected

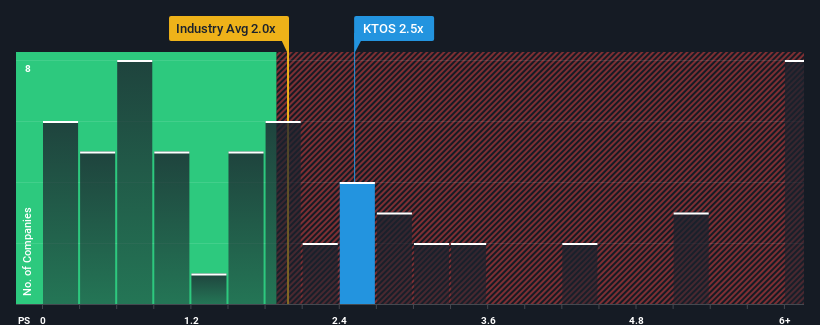

Kratos Defense & Security Solutions, Inc.'s (NASDAQ:KTOS) price-to-sales (or "P/S") ratio of 2.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United States have P/S ratios below 2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Kratos Defense & Security Solutions

What Does Kratos Defense & Security Solutions' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Kratos Defense & Security Solutions has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kratos Defense & Security Solutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Kratos Defense & Security Solutions' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.4% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 8.2% per year growth forecast for the broader industry.

In light of this, it's curious that Kratos Defense & Security Solutions' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Kratos Defense & Security Solutions' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Kratos Defense & Security Solutions you should know about.

If these risks are making you reconsider your opinion on Kratos Defense & Security Solutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with reasonable growth potential.