- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Is Kratos Still a Good Pick After Its 280% Surge and New Defense Contracts in 2025?

Reviewed by Bailey Pemberton

If you have been watching Kratos Defense & Security Solutions, you have probably noticed that its story is catching more eyes lately. After all, with a jaw-dropping 280.0% gain year-to-date and a staggering 304.4% return over the past year, this stock has quickly shifted from under the radar to front and center on many investors’ watchlists. The explosion over the past month alone—54.7%—reflects a sharp uptick in interest, driven by excitement around key defense contracts and a broader surge in spending in the aerospace and security sectors. Just last week, the stock soared 13.8%, hinting at a market that is re-evaluating the company’s position in high-growth government and military tech initiatives.

With all this price action, one big question naturally arises: is Kratos Defense & Security Solutions truly worth its current price, or is the market getting carried away? To help answer that, let’s dive into how the stock stacks up on valuation. Our valuation score—where each of six checks for undervaluation adds one point—comes in at 0 out of 6. Not the best news for bargain hunters, but keep in mind that numbers only tell part of the story. Up next, we will break down the different valuation approaches so you can see exactly where Kratos stands, and stick around—there is an even sharper tool for figuring out what this stock is really worth coming at the end of the article.

Kratos Defense & Security Solutions scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kratos Defense & Security Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a standard tool used to estimate the intrinsic value of a company, by projecting its future cash flows and discounting them back to today's value. This approach aims to provide a present-day estimate of what the business is truly worth based on expected future performance.

Looking at Kratos Defense & Security Solutions, its latest twelve months free cash flow was negative, at -$54.2 million. While this is a weak starting point, analysts expect a turnaround, projecting positive free cash flow of $27.0 million by 2027. Forecasts continue beyond that, reaching approximately $105.9 million by 2035, with annual growth rates gradually increasing each year. Notably, these longer-term estimates are extrapolations beyond the five years of direct analyst coverage, making them more speculative.

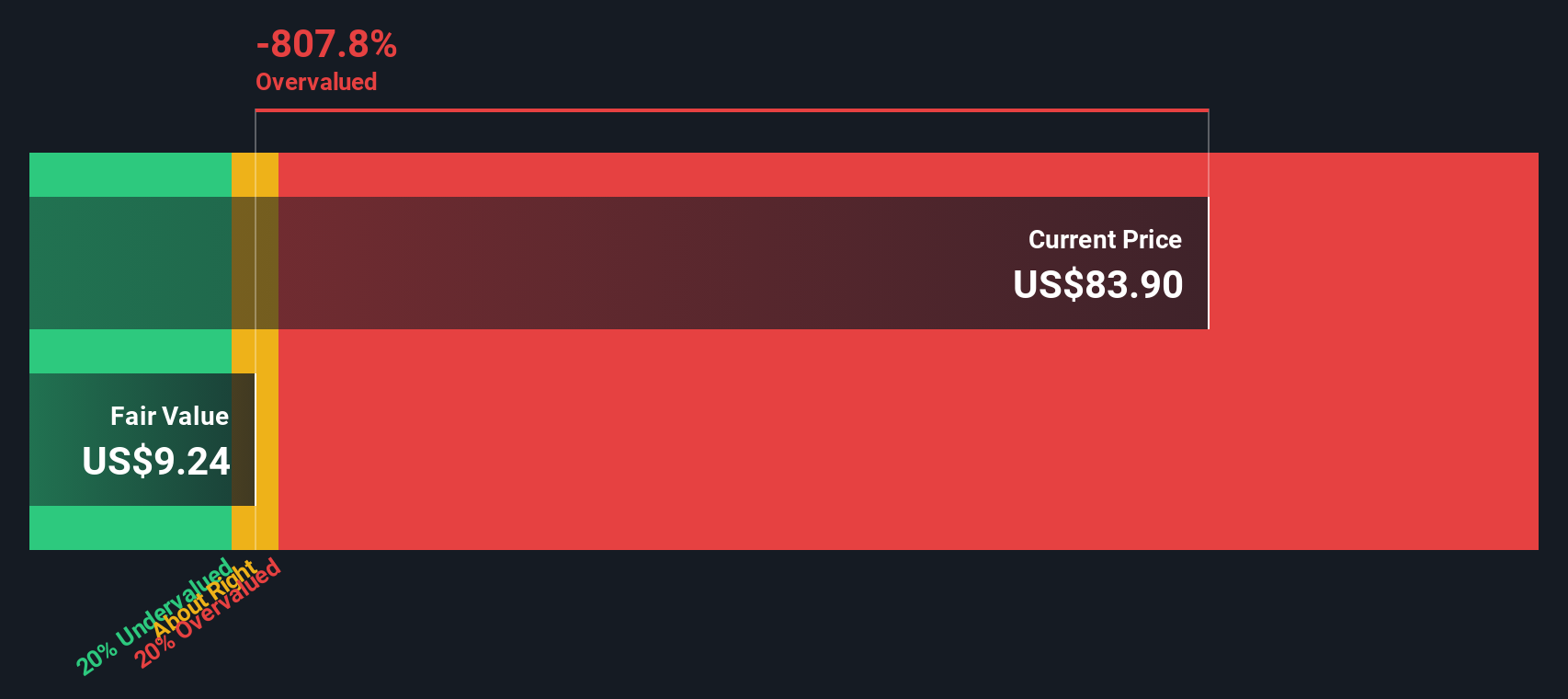

After adding up and discounting all those projected cash flows using a 2 Stage Free Cash Flow to Equity model, the estimated fair value for Kratos comes out to $8.70 per share. This figure is dramatically below the stock's recent price, signaling the market may be pricing in far more optimistic assumptions than what the model projects. The implied intrinsic discount of -1051.8 percent means Kratos is substantially overvalued based on current DCF assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kratos Defense & Security Solutions may be overvalued by 1051.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Kratos Defense & Security Solutions Price vs Sales

For companies like Kratos Defense & Security Solutions, the Price-to-Sales (P/S) ratio is a popular tool for valuation, especially when earnings may be volatile or negative. The P/S ratio helps compare what investors are willing to pay for each dollar of revenue, making it a suitable metric for assessing firms where profitability is still growing or inconsistent.

A "normal" or "fair" P/S ratio varies by industry, company growth prospects, profitability, and perceived risks. Generally, higher expected sales growth or stronger profit potential justifies a higher ratio, while rising risks or weak margins pull that number lower.

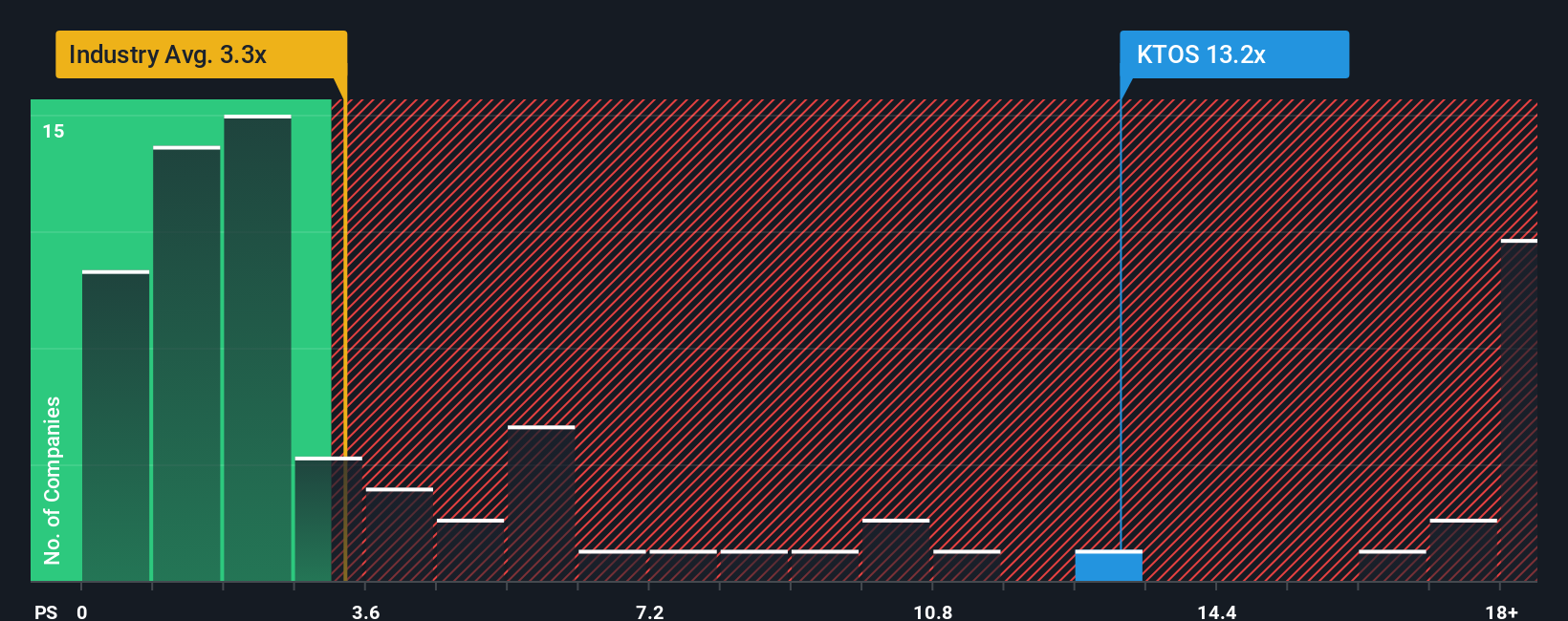

Currently, Kratos trades at a lofty 13.95x P/S. That stands in sharp contrast to the broader aerospace and defense industry's average of just 3.41x, and even the peer group’s average of 4.51x. The gap highlights just how much the market is betting on Kratos’ future revenue expansion and opportunities.

To add more nuance, Simply Wall St’s proprietary Fair Ratio for Kratos is 2.63x. Unlike simple benchmarks, the Fair Ratio incorporates far more detail. It is calculated based on factors such as earnings growth forecasts, industry positioning, the company’s specific risk profile, profit margins, and market cap. This produces a more tailored benchmark that better reflects Kratos’ unique situation, rather than a one-size-fits-all comparison.

Since Kratos’ current P/S ratio is much higher than its Fair Ratio, the stock looks significantly overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kratos Defense & Security Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is an accessible, story-driven tool that lets you connect your view of a company’s future, including its opportunities, risks, and growth potential, to specific financial forecasts and a calculated fair value. Rather than relying solely on strict valuation models, Narratives allow you to capture the bigger picture by expressing your assumptions about future revenue, margins, and earnings, directly linking the story you believe in with concrete numbers.

Narratives are featured within Simply Wall St’s Community page, where millions of investors share, refine, and debate their perspectives. This approach is both powerful and easy to use. Unlike static analysis, each Narrative updates dynamically as new developments, such as earnings reports or news events, roll in, helping you keep your investment thesis current. Narratives do not just explain what a fair value might be; they help you decide how Kratos Defense & Security Solutions compares by letting you measure your chosen fair value against the market price at any time.

For example, one investor using recent earnings forecasts might project a fair value for Kratos as high as $80, citing strong contracts. Meanwhile, another investor focused on margin risks and cash flow concerns could see it closer to $60, showing there are always different, well-founded stories to drive your decision.

Do you think there's more to the story for Kratos Defense & Security Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives