- United States

- /

- Trade Distributors

- /

- NasdaqGS:KRT

Karat Packaging (KRT): Reassessing Valuation After Analyst Upgrades, Institutional Moves, and Dividend News

Reviewed by Kshitija Bhandaru

Karat Packaging (KRT) has been making headlines after a fresh wave of analyst upgrades, with institutions like DAVENPORT & Co LLC taking new positions in the stock. Supportive sector sentiment and a recent dividend announcement are also contributing to renewed attention.

See our latest analysis for Karat Packaging.

Karat Packaging’s share price has faced some pressure recently, with a 90-day return of -16% and a year-to-date decline near 20%. However, momentum has shown signs of stabilizing as positive sector sentiment and fresh institutional interest take hold. Despite these short-term moves, the long-term story stands out. There has been a strong 80% total shareholder return over the past three years, which hints at solid growth potential ahead.

If you’re curious to see how other fast-climbing companies with strong backing are performing, now’s a great time to discover fast growing stocks with high insider ownership

With recent upgrades, a dividend boost, and healthy long-term returns, does Karat Packaging offer investors a compelling value at today's prices, or is the market already factoring in its future growth potential?

Most Popular Narrative: 24.2% Undervalued

Karat Packaging’s last close of $23.89 is significantly below the narrative fair value of $31.50, suggesting a potential mispricing by the market. This prompts a closer look at the company's growth opportunities and the financial assumptions supporting that higher valuation.

Growing demand for eco-friendly, compostable, and biodegradable packaging, driven by heightened environmental regulations and shifting consumer preferences toward sustainability, is expanding Karat's end markets. This trend is expected to continue supporting revenue growth as adoption increases among national restaurant chains and foodservice operators.

What drives this much higher valuation? The primary factor is a set of ambitious projections for revenue, earnings, and future profit margins that could surprise even experienced investors. Interested in understanding the critical assumptions about future growth that are reflected in these figures? Discover the full backstory in the complete narrative.

Result: Fair Value of $31.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and heavy reliance on a few major customers could threaten Karat Packaging’s earnings outlook if industry conditions shift unexpectedly.

Find out about the key risks to this Karat Packaging narrative.

Another View: Comparing Value Methods

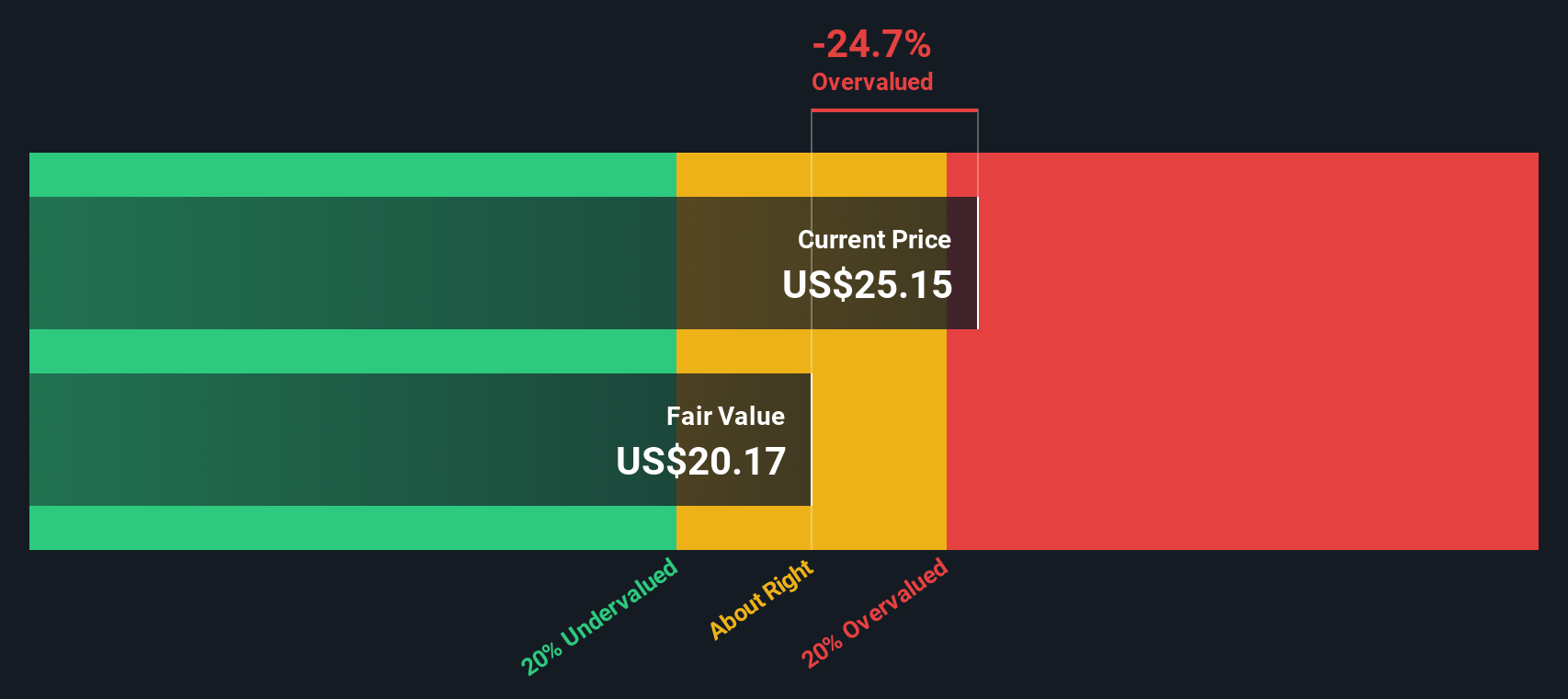

While consensus analysts see Karat Packaging as undervalued, our DCF model tells a different story. By assessing future cash flows, the SWS DCF model suggests the stock may now be trading above its fair value, which signals less upside than projected by analyst targets. Which approach will prove more accurate as conditions shift?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Karat Packaging for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Karat Packaging Narrative

If you see things differently or want to uncover your own insights using our data, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Karat Packaging research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the next step to uncover stocks with strong upside potential. Don’t miss out on unique opportunities that could sharpen your investing edge and boost your confidence.

- Amplify your passive income by tapping into these 18 dividend stocks with yields > 3% that consistently offer yields above 3% and reward patient investors.

- Spot companies leading innovation in artificial intelligence and shape your portfolio with these 25 AI penny stocks showing exciting growth prospects in a transforming world.

- Reveal hidden gems trading below their true worth by searching through these 881 undervalued stocks based on cash flows with attractive valuations based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karat Packaging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRT

Karat Packaging

Engages in the manufacture and distribution of single-use disposable products in plastic, paper, biopolymer-based, and other compostable forms used in various restaurant and foodservice settings.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives