- United States

- /

- Trade Distributors

- /

- NasdaqGS:KRT

Karat Packaging (KRT) Dividend and Analyst Upgrades: A Turning Point for Institutional Confidence?

Reviewed by Sasha Jovanovic

- Earlier this week, Karat Packaging attracted attention after sector sentiment lifted on improved U.S.-China relations and the company announced its latest quarterly dividend, drawing yield-focused investors and institutional buyers such as DAVENPORT & Co LLC.

- Analyst upgrades and increased institutional investment have contributed to heightened interest, with recent sustainability and profitability initiatives at the company further supporting positive expectations for future performance.

- We'll explore how analyst upgrades and renewed institutional interest in Karat Packaging could impact its longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Karat Packaging Investment Narrative Recap

To be a shareholder in Karat Packaging, you need conviction in the continued growth of demand for eco-friendly and disposable foodservice packaging, alongside the company's ability to maintain margins despite global trade risks. This week’s shift in sector sentiment from improved U.S.-China relations and fresh analyst upgrades could provide short-term support, but the most pressing catalyst remains sustainable revenue growth, while the largest risk continues to be customer concentration. For now, broader diplomatic momentum does not materially alter either factor.

Among recent announcements, the board's approval of another quarterly dividend, delivering a significant yield, stands out, especially as institutional and yield-focused investors enter the stock. While this strengthens the income appeal for some shareholders, it adds to ongoing questions about dividend sustainability, given industry competition and cost structures, which remain central to the underlying investment story.

However, investors should not overlook the fact that customer concentration remains a critical risk for Karat Packaging, particularly if...

Read the full narrative on Karat Packaging (it's free!)

Karat Packaging's outlook anticipates $550.2 million in revenue and $40.7 million in earnings by 2028. This projection assumes a 7.6% annual revenue growth rate and reflects an $8.6 million increase in earnings from the current $32.1 million.

Uncover how Karat Packaging's forecasts yield a $31.50 fair value, a 29% upside to its current price.

Exploring Other Perspectives

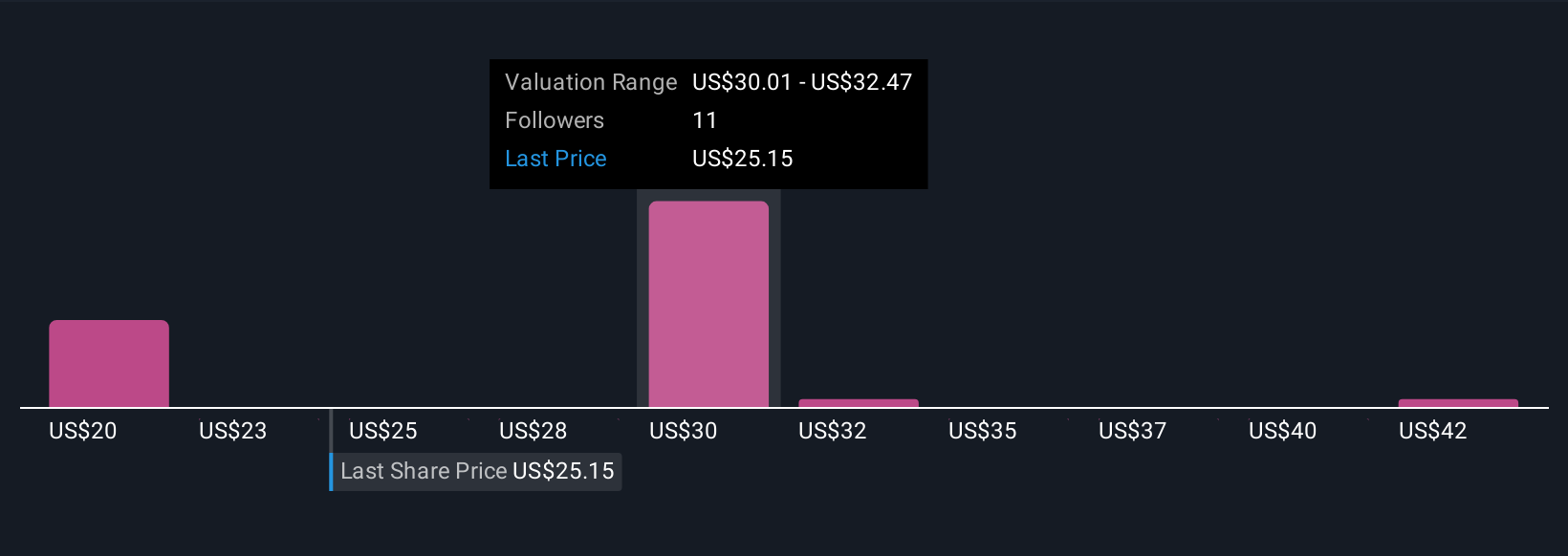

Retail investors in the Simply Wall St Community have posted fair values for Karat Packaging ranging from US$20.11 to US$44.77, based on four distinct forecasts. With such varied outlooks, it is clear that market confidence hinges on whether Karat can continue expanding in sustainable packaging amid ongoing trade and margin pressures.

Explore 4 other fair value estimates on Karat Packaging - why the stock might be worth 18% less than the current price!

Build Your Own Karat Packaging Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karat Packaging research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Karat Packaging research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karat Packaging's overall financial health at a glance.

No Opportunity In Karat Packaging?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karat Packaging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRT

Karat Packaging

Engages in the manufacture and distribution of single-use disposable products in plastic, paper, biopolymer-based, and other compostable forms used in various restaurant and foodservice settings.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives