- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ISSC

With EPS Growth And More, Innovative Solutions and Support (NASDAQ:ISSC) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Innovative Solutions and Support (NASDAQ:ISSC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Innovative Solutions and Support

How Fast Is Innovative Solutions and Support Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Innovative Solutions and Support has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

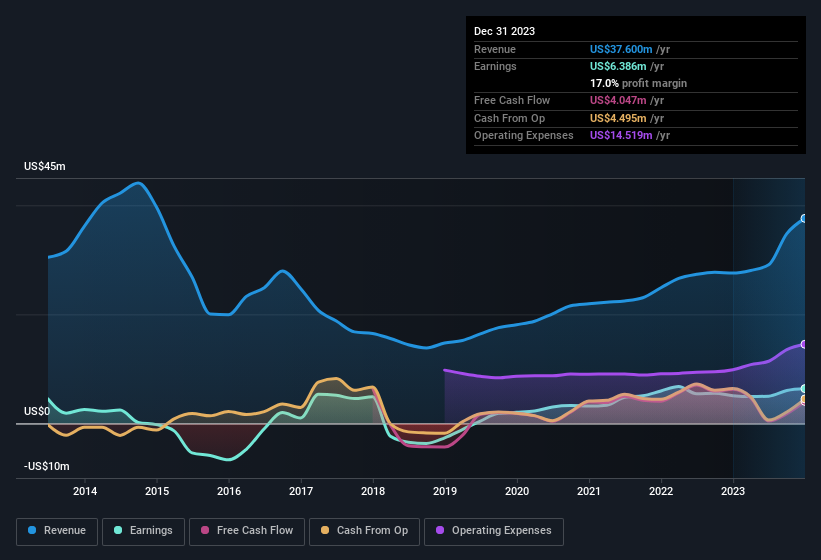

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Innovative Solutions and Support remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 36% to US$38m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Innovative Solutions and Support isn't a huge company, given its market capitalisation of US$125m. That makes it extra important to check on its balance sheet strength.

Are Innovative Solutions and Support Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

For the sake of balance, it should be noted that Innovative Solutions and Support insiders sold US$44k worth of shares last year. But that doesn't beat the large US$114k share acquisition by Independent Chairman & Presiding Director Glen Bressner. Overall, that is something good to take away.

Along with the insider buying, another encouraging sign for Innovative Solutions and Support is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$41m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 33% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Innovative Solutions and Support To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Innovative Solutions and Support's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Innovative Solutions and Support. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Innovative Solutions and Support, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ISSC

Innovative Solutions and Support

A systems integrator, designs, develops, manufactures, sells, and services flight guidance, autothrottles, and cockpit display systems in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives