- United States

- /

- Trade Distributors

- /

- NasdaqCM:IPW

iPower Inc. (NASDAQ:IPW) May Have Run Too Fast Too Soon With Recent 31% Price Plummet

The iPower Inc. (NASDAQ:IPW) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 66% in the last year.

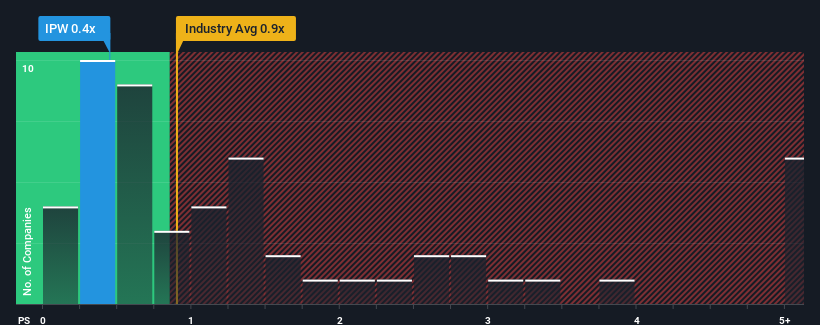

In spite of the heavy fall in price, there still wouldn't be many who think iPower's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in the United States' Trade Distributors industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for iPower

What Does iPower's P/S Mean For Shareholders?

iPower could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think iPower's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

iPower's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 67% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 3.2% over the next year. That's shaping up to be materially lower than the 5.3% growth forecast for the broader industry.

In light of this, it's curious that iPower's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From iPower's P/S?

iPower's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of iPower's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware iPower is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If these risks are making you reconsider your opinion on iPower, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if iPower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IPW

iPower

Operates as an online retailer and supplier of consumer home, pet, garden, outdoor, and consumer electronics products for commercial and home cultivators growing specialty crops, and home goods customers in the United States.

Excellent balance sheet low.

Market Insights

Community Narratives