- United States

- /

- Construction

- /

- NasdaqGM:IESC

We Ran A Stock Scan For Earnings Growth And IES Holdings (NASDAQ:IESC) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like IES Holdings (NASDAQ:IESC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for IES Holdings

How Quickly Is IES Holdings Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that IES Holdings' EPS has grown 30% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

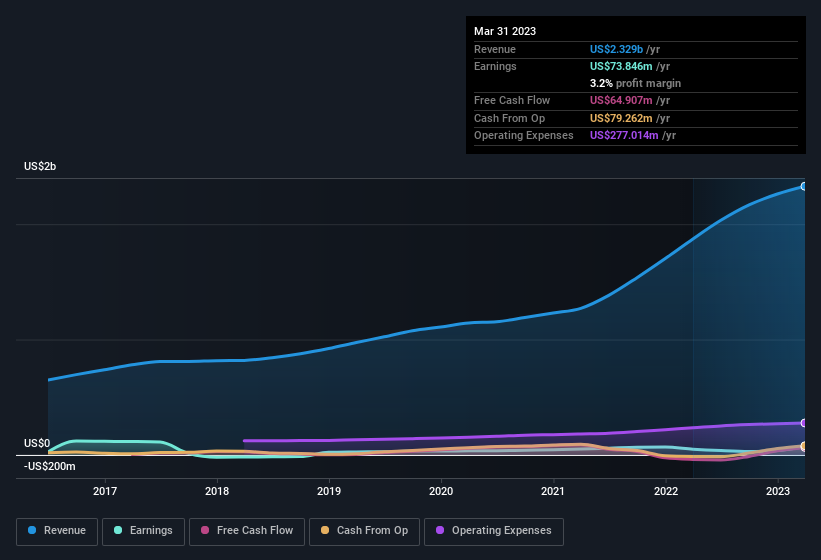

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note IES Holdings achieved similar EBIT margins to last year, revenue grew by a solid 24% to US$2.3b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check IES Holdings' balance sheet strength, before getting too excited.

Are IES Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it IES Holdings shareholders can gain quiet confidence from the fact that insiders shelled out US$210k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the Director, David Gendell, who made the biggest single acquisition, paying US$146k for shares at about US$29.76 each.

The good news, alongside the insider buying, for IES Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at US$27m. That's a lot of money, and no small incentive to work hard. Despite being just 2.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Jeff Gendell is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like IES Holdings with market caps between US$400m and US$1.6b is about US$3.7m.

IES Holdings offered total compensation worth US$2.2m to its CEO in the year to September 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does IES Holdings Deserve A Spot On Your Watchlist?

For growth investors, IES Holdings' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. Now, you could try to make up your mind on IES Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IES Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IESC

IES Holdings

Designs and installs integrated electrical and technology systems, and provides infrastructure products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives