- United States

- /

- Construction

- /

- NasdaqGM:IESC

Does IES Holdings (NASDAQ:IESC) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies IES Holdings, Inc. (NASDAQ:IESC) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for IES Holdings

What Is IES Holdings's Debt?

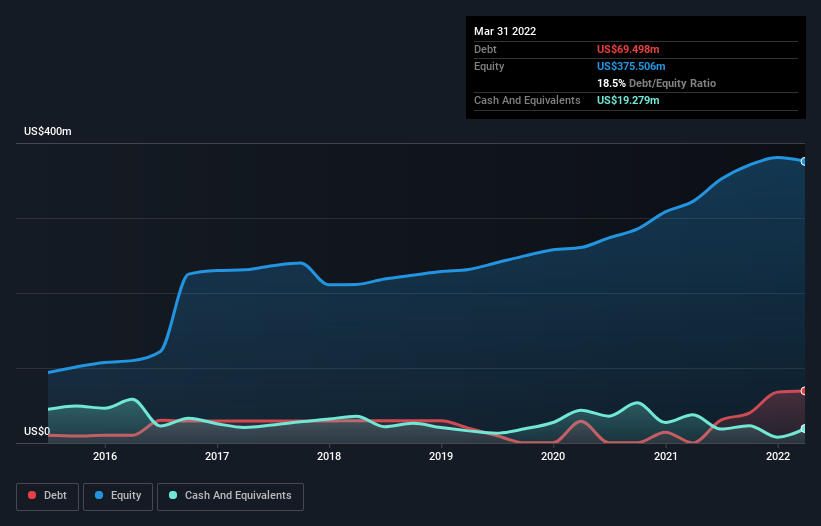

The image below, which you can click on for greater detail, shows that at March 2022 IES Holdings had debt of US$69.5m, up from US$140.0k in one year. On the flip side, it has US$19.3m in cash leading to net debt of about US$50.2m.

A Look At IES Holdings' Liabilities

The latest balance sheet data shows that IES Holdings had liabilities of US$347.3m due within a year, and liabilities of US$108.4m falling due after that. On the other hand, it had cash of US$19.3m and US$414.9m worth of receivables due within a year. So its liabilities total US$21.5m more than the combination of its cash and short-term receivables.

Of course, IES Holdings has a market capitalization of US$609.2m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

IES Holdings's net debt is only 0.54 times its EBITDA. And its EBIT covers its interest expense a whopping 44.1 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. While IES Holdings doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since IES Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, IES Holdings produced sturdy free cash flow equating to 58% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, IES Holdings's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Taking all this data into account, it seems to us that IES Holdings takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with IES Holdings (at least 1 which is concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IESC

IES Holdings

Designs and installs integrated electrical and technology systems, and provides infrastructure products and services in the United States.

Outstanding track record with flawless balance sheet.