- United States

- /

- Construction

- /

- NasdaqCM:HUHU

HUHUTECH International Group Inc. (NASDAQ:HUHU) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

The HUHUTECH International Group Inc. (NASDAQ:HUHU) share price has done very well over the last month, posting an excellent gain of 28%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

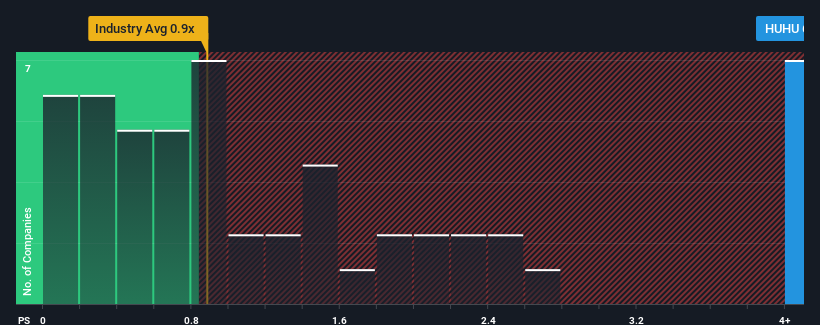

Since its price has surged higher, given around half the companies in the United States' Construction industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider HUHUTECH International Group as a stock to avoid entirely with its 6.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for HUHUTECH International Group

How Has HUHUTECH International Group Performed Recently?

The revenue growth achieved at HUHUTECH International Group over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on HUHUTECH International Group's earnings, revenue and cash flow.How Is HUHUTECH International Group's Revenue Growth Trending?

In order to justify its P/S ratio, HUHUTECH International Group would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.5%. This was backed up an excellent period prior to see revenue up by 79% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

When compared to the industry's one-year growth forecast of 9.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why HUHUTECH International Group is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does HUHUTECH International Group's P/S Mean For Investors?

HUHUTECH International Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that HUHUTECH International Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - HUHUTECH International Group has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on HUHUTECH International Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HUHUTECH International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HUHU

HUHUTECH International Group

Designs and implements integrated facility management systems and industrial automation monitoring systems in the People’s Republic of China and Japan.

Low with imperfect balance sheet.

Market Insights

Community Narratives