- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

Investors Appear Satisfied With Hillman Solutions Corp.'s (NASDAQ:HLMN) Prospects

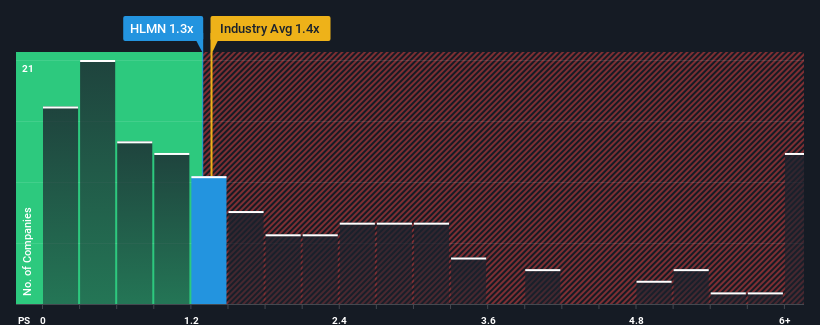

With a median price-to-sales (or "P/S") ratio of close to 1.4x in the Machinery industry in the United States, you could be forgiven for feeling indifferent about Hillman Solutions Corp.'s (NASDAQ:HLMN) P/S ratio of 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Hillman Solutions

How Hillman Solutions Has Been Performing

While the industry has experienced revenue growth lately, Hillman Solutions' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hillman Solutions will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Hillman Solutions' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 7.9% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 4.1% per year as estimated by the nine analysts watching the company. With the industry predicted to deliver 5.5% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why Hillman Solutions is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Hillman Solutions' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Hillman Solutions maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Hillman Solutions with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives