- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

How Investors May Respond To FTAI Aviation (FTAI) As FAA Weighs Approval Of Third PMA Part

Reviewed by Sasha Jovanovic

- In recent commentary, Jim Cramer and Tourlite Capital Management expressed confidence in FTAI Aviation, highlighting upcoming catalysts such as an investor day at its Montreal facility, anticipated FAA approval for a third PMA part, and the potential launch of a second Strategic Capital Initiative vehicle.

- These views come alongside very large two-year average annual revenue growth and strong earnings expansion for FTAI’s engine-focused business, which together have reinforced investor interest despite broader aviation sector headwinds.

- We’ll now examine how the anticipated FAA approval for FTAI’s third PMA part could reshape the company’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

FTAI Aviation Investment Narrative Recap

To own FTAI Aviation, you need to believe in a long runway for mid‑life engine demand and the company’s ability to keep scaling its engine services model. The recent optimism from Jim Cramer and Tourlite does not materially change the near term focus on securing FAA approval for the third PMA part, nor does it reduce key risks around concentrated exposure to legacy engine platforms and operational execution.

Among recent developments, the anticipated FAA approval for FTAI’s third PMA part stands out as most relevant. PMA approvals are central to the company’s effort to deepen its engine aftermarket presence and support its engine focused revenue and earnings growth. How quickly this new part is adopted by customers will influence whether current expectations around margins and returns on invested capital continue to hold.

Yet even with these potential positives, investors should be aware that FTAI’s dependence on legacy engine platforms means any faster shift toward newer propulsion technologies could...

Read the full narrative on FTAI Aviation (it's free!)

FTAI Aviation's narrative projects $3.7 billion revenue and $1.1 billion earnings by 2028. This requires 19.8% yearly revenue growth and a roughly $700 million earnings increase from $416.5 million today.

Uncover how FTAI Aviation's forecasts yield a $227.10 fair value, a 35% upside to its current price.

Exploring Other Perspectives

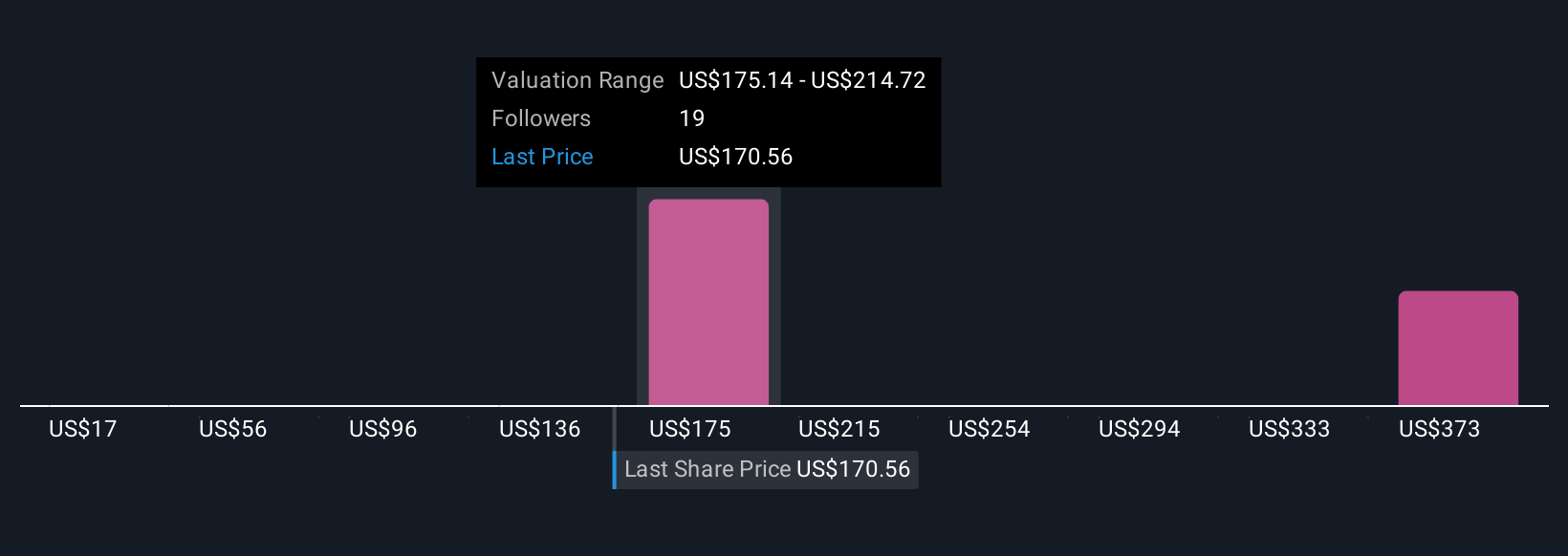

Four members of the Simply Wall St Community currently estimate FTAI’s fair value between US$16.83 and US$227.63, underscoring how far apart individual views can be. Set against this wide spread, the company’s reliance on legacy engine platforms and timely PMA approvals gives you clear focal points to test your own expectations and compare them with these differing perspectives.

Explore 4 other fair value estimates on FTAI Aviation - why the stock might be worth as much as 35% more than the current price!

Build Your Own FTAI Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FTAI Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTAI Aviation's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026