If you want to know who really controls L.B. Foster Company (NASDAQ:FSTR), then you'll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

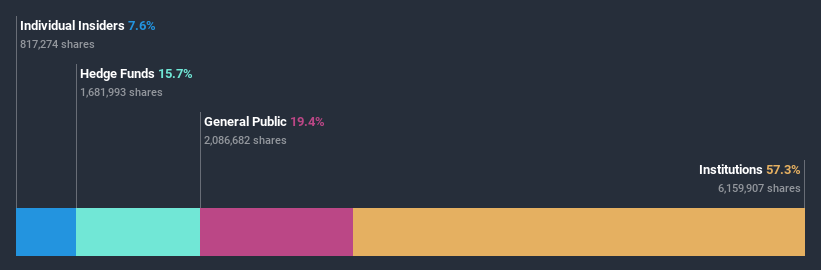

With a market capitalization of US$157m, L.B. Foster is a small cap stock, so it might not be well known by many institutional investors. In the chart below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about L.B. Foster.

See our latest analysis for L.B. Foster

What Does The Institutional Ownership Tell Us About L.B. Foster?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

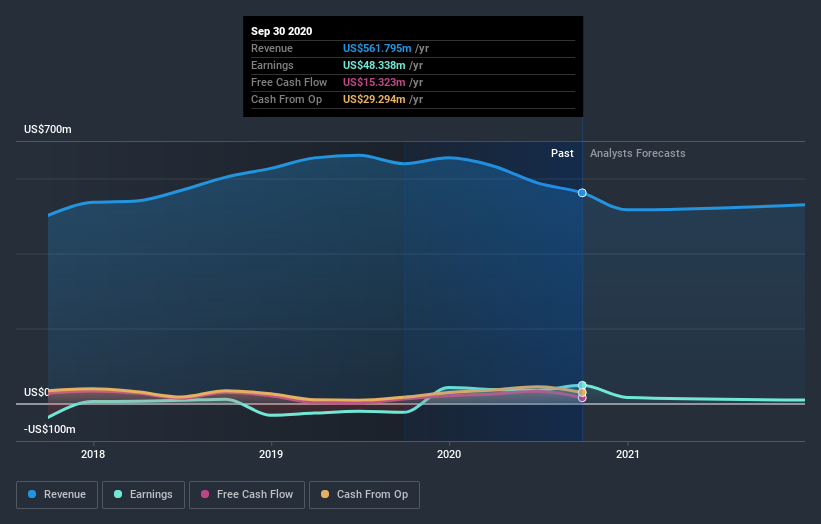

We can see that L.B. Foster does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at L.B. Foster's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. It looks like hedge funds own 16% of L.B. Foster shares. That worth noting, since hedge funds are often quite active investors, who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term. Our data shows that Legion Partners Asset Management, LLC is the largest shareholder with 9.7% of shares outstanding. The second and third largest shareholders are Dimensional Fund Advisors L.P. and BlackRock, Inc., with an equal amount of shares to their name at 6.2%. In addition, we found that Robert Bauer, the CEO has 1.5% of the shares allocated to his name

Looking at the shareholder registry, we can see that 50% of the ownership is controlled by the top 12 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of L.B. Foster

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in L.B. Foster Company. It has a market capitalization of just US$157m, and insiders have US$12m worth of shares, in their own names. Some would say this shows alignment of interests between shareholders and the board, though I generally prefer to see bigger insider holdings. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public holds a 19% stake in L.B. Foster. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for L.B. Foster you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade L.B. Foster, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:FSTR

L.B. Foster

Provides engineered and manufactured products and services for the building and infrastructure projects in the United States, Canada, the United Kingdom, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives