- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Assessing Firefly Aerospace After Shares Plunge 32% and Industry Turbulence in 2025

Reviewed by Bailey Pemberton

Wondering what to do with Firefly Aerospace stock? You are not alone. In just the last month, shares have shed almost a third of their value, sliding 31.8%, and the past week brought another sting with a 21.3% loss. Year-to-date, the price has plummeted 51.8%. This sort of dip gets both bargain hunters and risk-watchers talking. If you are eyeing Firefly Aerospace and thinking about growth potential or shifting market sentiment, you are right where you need to be.

Some of this dive ties back to broader market turbulence affecting the space sector. Growing competition and shifting investment appetite have nudged investors to rethink risk. While there has not been a single bombshell event, these moves suggest a change in how the market values both current performance and future opportunity for players like Firefly Aerospace. It's important to ask: is the recent slide a sign to steer clear, or a rare chance to buy in at a discount?

That is exactly where a solid look at valuation comes in. By evaluating the company across six key metrics, Firefly Aerospace currently scores a 3 for being undervalued, meaning it passes half of the main checks for a potential market bargain. Of course, numbers alone never tell the whole story. Let’s break down the approaches analysts use to value this high-flyer, and later, I will share an even more insightful angle to help you make the best call.

Approach 1: Firefly Aerospace Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting those figures back to today’s value to reflect the time value of money. For Firefly Aerospace, this method uses a two-stage Free Cash Flow to Equity approach, meaning cash flows are forecast for several years ahead and then extrapolated further to estimate long-term value.

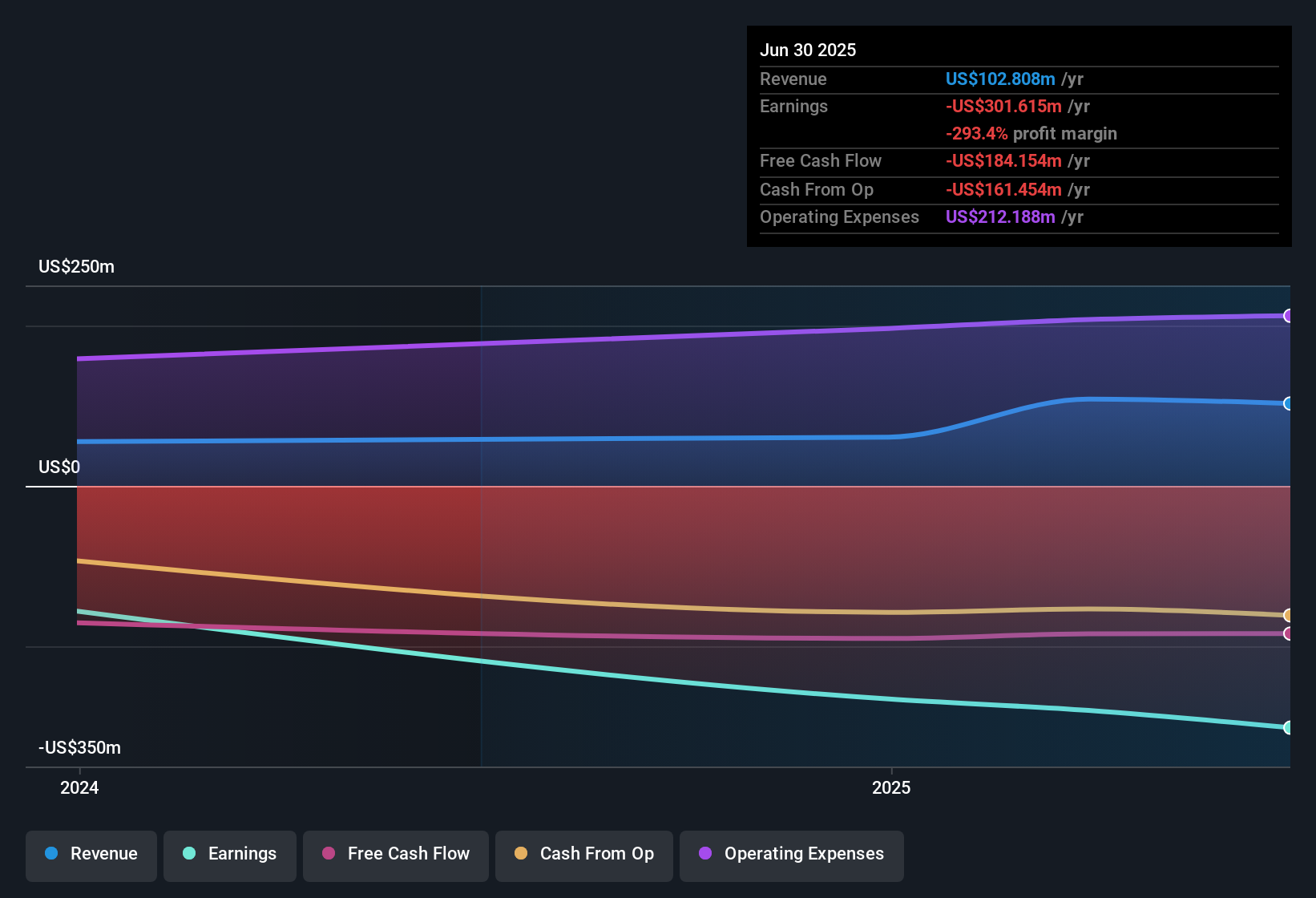

Firefly Aerospace reported a last twelve months Free Cash Flow (FCF) of -$161.5 million, reflecting current investments and still-negative cash generation as a growth company. Analyst estimates suggest rapid improvements, with FCF expected to climb dramatically over the next decade. Projections show FCF moving into positive territory and reaching $239.5 million by 2029, with incremental growth extending through 2035.

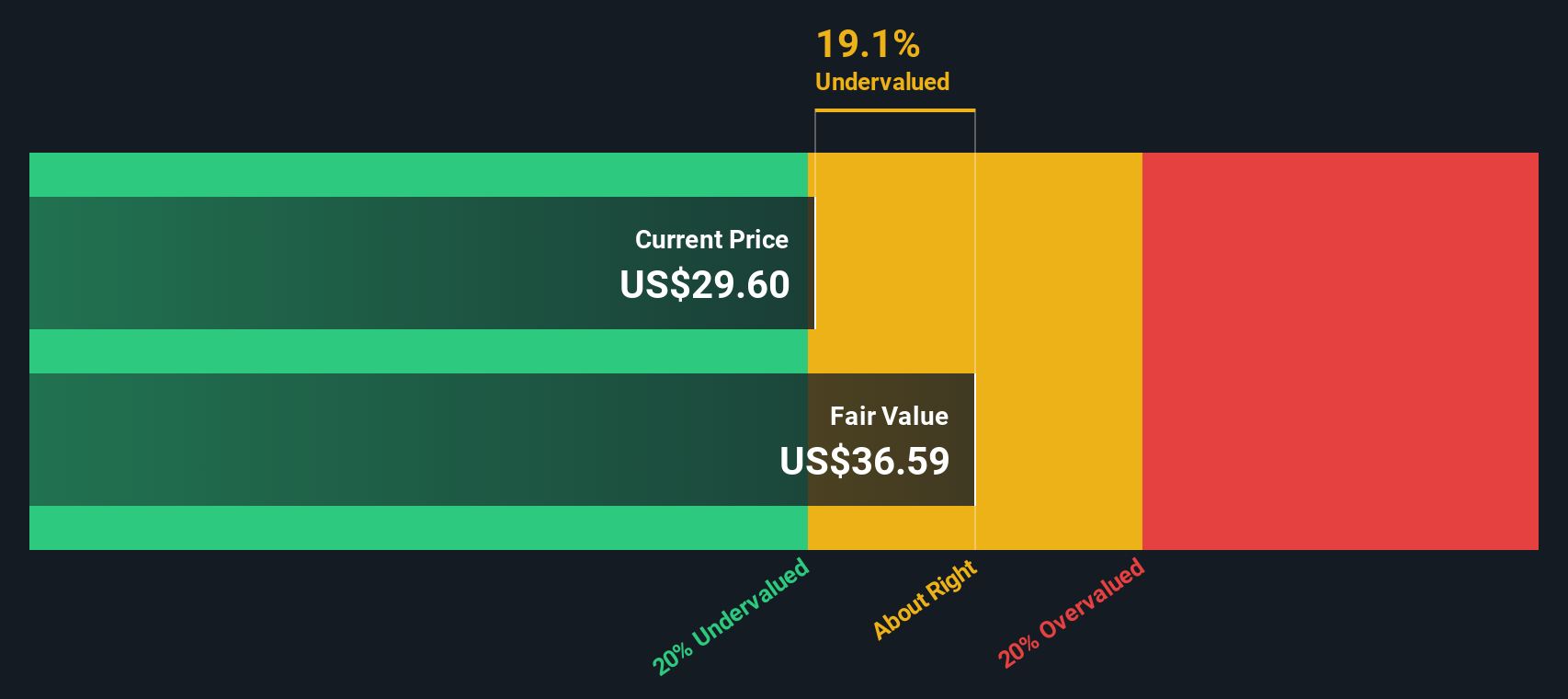

Based on these forecasts, the DCF model calculates an intrinsic fair value for Firefly Aerospace stock of $36.85 per share. Comparing this estimate against the current share price, the stock appears to be trading at a 21.1% discount. This suggests it is undervalued on a cash flow basis right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Firefly Aerospace is undervalued by 21.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Firefly Aerospace Price vs Sales

When a company is not yet consistently profitable, the Price-to-Sales (P/S) ratio is often used as a valuation tool because it focuses on revenue rather than earnings. This makes it a more stable benchmark for early-stage or high-growth businesses like Firefly Aerospace. The P/S ratio helps investors estimate what the market is willing to pay for each dollar of a company's sales, especially when profit metrics are volatile or negative.

What is considered a “normal” or “fair” P/S ratio can vary depending on a company’s growth prospects, risk profile, and industry conditions. Companies with higher growth rates and innovative offerings might command higher P/S ratios, as investors are willing to pay more for future potential, even if present profitability is limited.

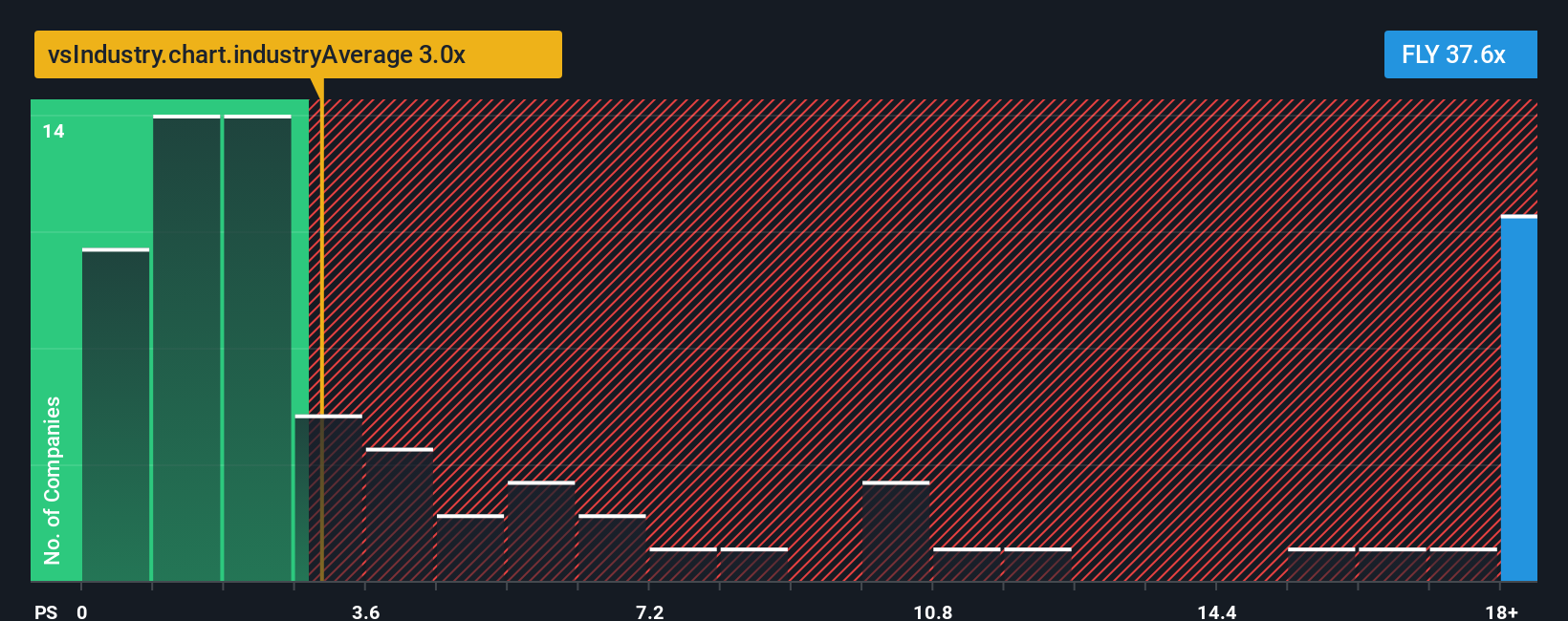

Currently, Firefly Aerospace is trading at a P/S ratio of 41.46x, which significantly exceeds both the industry average of 3.41x and the peer group average of roughly 2.94x. At first glance, this makes the stock look highly priced relative to others in the Aerospace & Defense sector.

However, Simply Wall St’s “Fair Ratio” metric goes further by factoring in growth outlook, risk, profit margin, industry norms, and company size, offering a more tailored and nuanced perspective. By adjusting for these variables, the Fair Ratio provides a truer sense of what would be reasonable for Firefly Aerospace’s situation, rather than relying on broad averages alone. This more advanced metric helps investors avoid the pitfalls of using raw comparison and instead focus on what is genuinely justified for the stock.

In this case, the Fair Ratio is not far off Firefly Aerospace’s actual P/S multiple, suggesting the market is pricing in the company’s long-term growth expectations. While the current multiple is elevated, it aligns with what is expected given the company’s future outlook and risk profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Firefly Aerospace Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your story about a company, an explanation of what you think the business can achieve, which is then linked directly to forecasts for revenue, profit margins, and fair value. By connecting your view of Firefly Aerospace’s future with the numbers behind the stock, Narratives make investing more personal and practical.

On Simply Wall St’s Community page, millions of investors already use Narratives to create and share their perspectives with just a few clicks. This tool helps you decide when to buy or sell by comparing your fair value with the current share price, powering decisions with both story and numbers. Narratives are not static; they automatically update as new earnings reports or news emerge, keeping your view current without extra work.

For example, one investor’s Narrative for Firefly Aerospace might predict rapid revenue growth and a $60 fair value, while another, more cautious investor may estimate just $24 per share based on slower progress. With Narratives, you can see the range of possibilities and decide which story best fits your expectations.

Do you think there's more to the story for Firefly Aerospace? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives