- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Reassessing Fluence Energy (FLNC) Valuation After Landmark Polish Battery Storage Contract and AI-Driven Optimism

Reviewed by Kshitija Bhandaru

Fluence Energy (NasdaqGS:FLNC) recently secured a contract for a 133 MW battery storage system in Poland, which is the largest project of its kind in the country. This milestone win drew strong attention from investors and was further amplified by favorable sentiment toward the clean energy and artificial intelligence sectors.

See our latest analysis for Fluence Energy.

The recent surge in Fluence Energy’s share price was fueled by excitement over its Polish battery storage win and optimism related to strategic shifts among its major shareholders, especially as energy demand surges in the age of artificial intelligence. While the latest 12-month total shareholder return remains slightly negative at -0.39%, short-term momentum has built on this project news and anticipation of further growth. This has kept investor hopes high for a recovery as market sentiment shifts in favor of clean energy innovators.

If the momentum around smart grid and renewable infrastructure sparks your interest, this could be a prime moment to discover See the full list for free.

With shares up sharply on recent news, the key question now is whether the market is still undervaluing Fluence Energy, or if future growth has already been fully reflected in today’s price.

Most Popular Narrative: 69% Overvalued

Fluence Energy’s last close of $13.05 sits well above the most-followed narrative fair value estimate of $7.74, sparking debate about what is really driving analyst models.

Rapid global electrification and surging power demand, driven by data centers, transportation, and industrial sectors, are expected to sharply increase the need for grid resilience and flexibility. This is projected to lead to substantial growth for large-scale battery storage, driving material revenue growth for Fluence over the next several years.

Want a look inside the model powering this price target? The fair value relies on ambitious assumptions about future order backlogs and a shift to positive earnings. Are these a signal or just noise? See which numbers support these bold growth projections and what is driving the significant gap.

Result: Fair Value of $7.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and global supply chain shifts could delay contract execution, which may create revenue volatility and challenge the bullish narrative.

Find out about the key risks to this Fluence Energy narrative.

Another View: Multiples Suggest Value

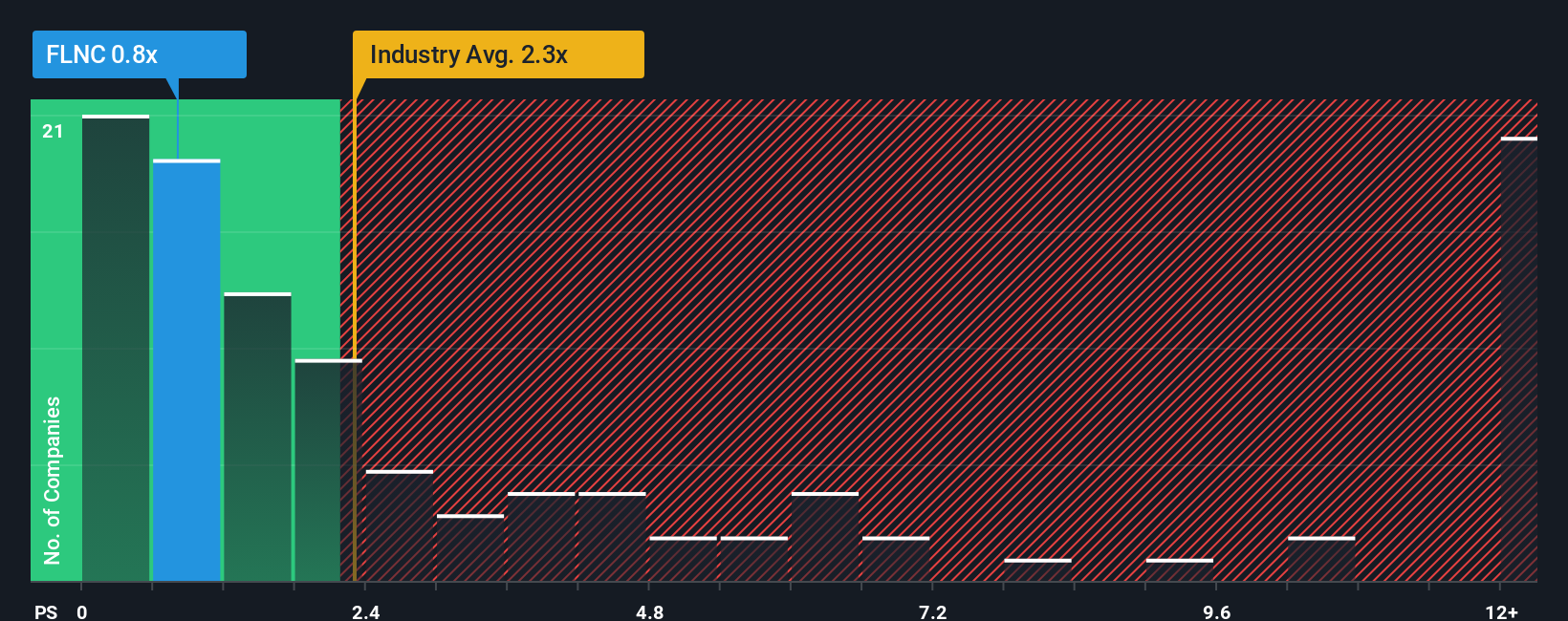

While many see Fluence Energy as overvalued based on fair value estimates, a look at its price-to-sales ratio offers a contrasting viewpoint. The company trades at 0.7x sales, sharply below both the US Electrical industry average of 2.2x and the peer average of 5.9x, and beneath the 1.6x fair ratio the market could eventually converge toward. This gap signals Fluence may actually be undervalued if sales growth delivers as expected. Does the market see untapped potential, or will sentiment turn once again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If you have a different take or want to dig into the details yourself, you can craft your own perspective and see the bigger picture in just minutes. Do it your way

A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their radar up for the next breakout sector. Don't let opportunities slip away. Unlock new possibilities with these high-potential stock ideas curated just for you.

- Target high yields by locking in stocks with attractive pay-outs through these 19 dividend stocks with yields > 3% offering over 3% returns and robust financials.

- Ride the AI wave and fuel your portfolio's growth with these 24 AI penny stocks reshaping industries with innovative technology and smart automation.

- Stay ahead of the market by hunting for bargains among these 907 undervalued stocks based on cash flows poised for a rebound based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives