- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

It's Down 30% But Fluence Energy, Inc. (NASDAQ:FLNC) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Fluence Energy, Inc. (NASDAQ:FLNC) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

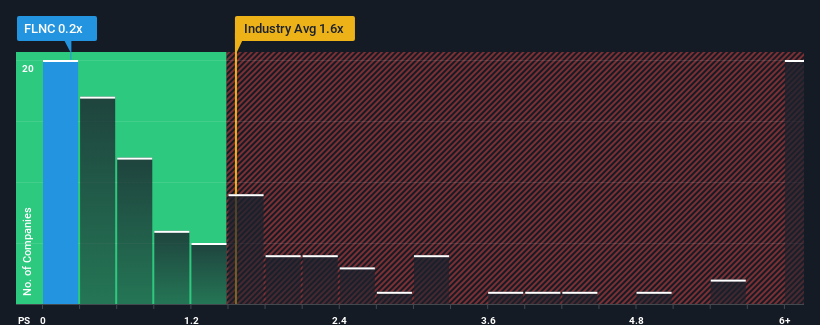

After such a large drop in price, Fluence Energy may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Fluence Energy

How Has Fluence Energy Performed Recently?

With revenue growth that's superior to most other companies of late, Fluence Energy has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Fluence Energy's future stacks up against the industry? In that case, our free report is a great place to start .How Is Fluence Energy's Revenue Growth Trending?

Fluence Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. The latest three year period has also seen an excellent 241% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 24% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 16% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Fluence Energy's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The southerly movements of Fluence Energy's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Fluence Energy currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Fluence Energy that you need to be mindful of.

If these risks are making you reconsider your opinion on Fluence Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives