- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (FLNC): Evaluating Valuation After S&P Global Tier 1 Cleantech Recognition

Reviewed by Kshitija Bhandaru

Fluence Energy (FLNC) has just landed a prominent place in the inaugural S&P Global Commodity Insights Premier List of Tier 1 Cleantech Companies. This recognition spotlights its standing as a bankable and innovative leader in energy storage, which is no small feat given the ongoing transformation in global energy markets. For anyone weighing a move on Fluence stock, this kind of validation from a major industry body is the sort of development that stands out amid the usual headlines.

This accolade comes as part of a string of recent awards for Fluence Energy, each reinforcing its credibility and influence across the cleantech sector. Despite facing some bumps over the past year, as the stock delivered a negative return, there are hints of changing sentiment. The shares have surged more than 66% in the past three months, suggesting a shift in momentum that sets up an intriguing narrative for long-term investors who value both recognition and resilience.

With the stock chart looking livelier and new market accolades stacking up, the big question is whether this validation is a springboard for further upside or if the market has already factored Fluence Energy's growth potential into the share price.

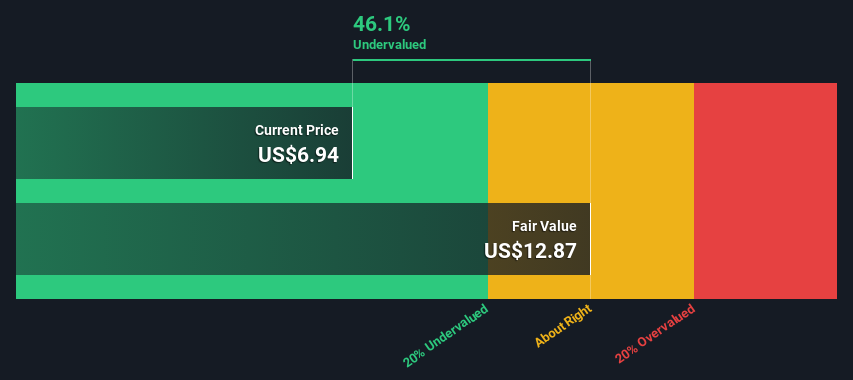

Most Popular Narrative: 47.3% Undervalued

According to the most widely followed narrative, Fluence Energy is currently trading at a substantial discount to its estimated fair value. This suggests considerable upside from here if key assumptions play out.

Analysts project significant revenue growth for Fluence Energy, with sales expected to increase from $2.218 billion in fiscal year 2023 to approximately $5.205 billion by fiscal year 2026. This represents a compound annual growth rate (CAGR) of around 32%. Additionally, the company is anticipated to transition to profitability, with adjusted earnings per share (EPS) improving from a loss of $0.40 in FY2023 to a profit of $1.36 by FY2026.

Curious what drives this bold undervaluation call? There is a compelling revenue surge and profit swing projected, with numbers that may be unexpected and which fuel a valuation far above today’s price. Want to know which figure in their financial model is getting the most aggressive upgrade? The narrative’s largest bets may surprise you.

Result: Fair Value of $17.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising raw material costs or unexpected supply chain hiccups could quickly temper optimism and challenge even the most bullish projections for Fluence Energy.

Find out about the key risks to this Fluence Energy narrative.Another View: Discounted Cash Flow Model

Looking from a different angle, our DCF model paints a less optimistic picture than the multiples-based view. It suggests Fluence Energy may be trading above fair value. How do these conflicting models impact your confidence?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fluence Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fluence Energy Narrative

If you have a different perspective on these figures or want to dig into the details yourself, it takes just a few minutes to shape your own outlook. So why not Do it your way?

A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your portfolio’s full potential by finding your next opportunity. Don’t let great companies and bold trends pass you by just because you didn’t look. Try out these strategies right now and see what you could be missing:

- Capture reliable income by scanning for high-yield opportunities with dividend stocks with yields > 3%, featuring companies consistently rewarding shareholders.

- Target tomorrow’s tech winners and get ahead of artificial intelligence breakthroughs through AI penny stocks, where innovation meets investability.

- Zero in on assets trading well below their intrinsic value to find true bargains by checking out undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives