- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (FLNC): Assessing Valuation After Major U.S. Battery Storage Supply Chain Milestone

Reviewed by Simply Wall St

If you have been wondering when U.S. clean energy would take supply chain control back from overseas, Fluence Energy (FLNC) just gave investors a big answer. The company has shipped its first domestic content lithium-ion battery storage systems built using U.S.-made components, a move that strengthens American energy security and unlocks meaningful incentives for customers. It is a development that should catch any investor’s eye, especially if you have been following efforts to reshore critical technology manufacturing.

This announcement follows a year when Fluence’s share price has tumbled even as it ramps up U.S. supply partnerships and grows revenue. Despite a solid 16% annual jump in sales and net income swinging up even faster, the stock is down nearly 68% for the year. It has only bounced higher by roughly 39% over the past 3 months. The overall momentum has shifted more positive in the short term, particularly as investors digest the impact of domestically produced systems and related policy incentives.

So after a turbulent year and this supply chain milestone, is Fluence’s current share price underestimating what lies ahead, or is the recent growth already factored in?

Most Popular Narrative: 61.9% Undervalued

The narrative suggests Fluence Energy is trading at a substantial discount to its fair value, signaling strong upside potential. According to NateF, the company presents a compelling case for investors in the renewable energy space.

Analysts project significant revenue growth for Fluence Energy, with sales expected to increase from $2.218 billion in fiscal year 2023 to approximately $5.205 billion by fiscal year 2026. This represents a compound annual growth rate (CAGR) of around 32%. Additionally, the company is anticipated to transition to profitability, with adjusted earnings per share (EPS) improving from a loss of $0.40 in FY2023 to a profit of $1.36 by FY2026.

Curious about what drives such a bold valuation call? The key elements in this narrative are dramatic revenue projections, a major pivot to profitability, and significant earnings growth assumptions that reset expectations for what this sector can deliver. Wondering just how aggressive these forecasts are? The full narrative explains every key financial driver fueling this outsized fair value calculation.

Result: Fair Value of $17.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain bottlenecks or sudden regulatory policy shifts could quickly challenge Fluence’s growth projections and its current undervalued narrative.

Find out about the key risks to this Fluence Energy narrative.Another View: What Does Our DCF Model Say?

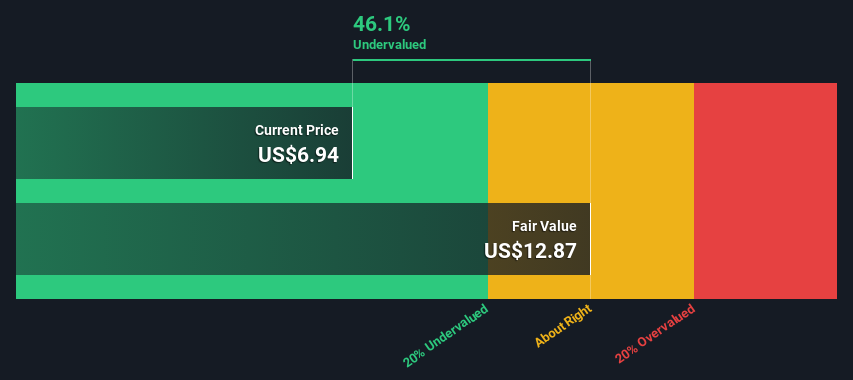

While the first approach points to significant upside for Fluence Energy, our SWS DCF model comes to a similar conclusion and indicates the stock is also undervalued. Could both perspectives be capturing the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fluence Energy Narrative

If you are interested in shaping your own perspective or want to dig into the numbers first-hand, you have the freedom to build your own view in just a few minutes. Do it your way

A great starting point for your Fluence Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let the best opportunities slip through your fingers. The next big winner could be waiting for you. Use these handpicked resources to uncover unique companies and trends shaping tomorrow’s market leaders.

- Tap into emerging technology breakthroughs by browsing AI penny stocks to uncover promising companies at the forefront of artificial intelligence.

- Strengthen your income strategy by searching for dividend stocks with yields > 3% and access a lineup of stocks with robust yields above 3%.

- Find high-growth bargains and maximize value with undervalued stocks based on cash flows to spot stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives