- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Should Franklin Electric's (FELE) Share Buyback and Dividend Plan Signal a Shift in Capital Strategy?

Reviewed by Simply Wall St

- Franklin Electric recently announced that its board approved a new share buyback program, authorizing the repurchase of up to 1,200,000 shares and confirming a quarterly dividend with a 1.1% yield paid in August 2025.

- These actions, along with increased institutional investment and several analyst upgrades, underscore rising confidence in the company’s value and outlook within the sector.

- Now, let's explore how the newly announced share buyback program influences Franklin Electric's investment narrative and market perception.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Franklin Electric Investment Narrative Recap

To be a Franklin Electric shareholder is to believe in the continued global need for water systems and infrastructure solutions, supported by resilient demand and technological innovation. While the newly announced share buyback program is indicative of management’s confidence, its impact on the company’s most immediate catalyst, sustained order flow from global water infrastructure investment, is likely incremental, rather than transformative, in the short term. The principal risk remains margin pressure from macro-driven product mix shifts and integration costs tied to recent acquisitions.

Among recent developments, the expanded share buyback authorization stands out given its direct connection to recent trading activity and analyst upgrades. This move reinforces the perception of disciplined capital allocation, but its true effect on company valuation and investor returns depends most on Franklin Electric’s ability to manage costs and achieve greater efficiency as it executes business expansion plans.

Yet, contrasting with these capital returns and upbeat analyst calls, investors should be aware of ongoing margin volatility tied to global dewatering and mining cycles…

Read the full narrative on Franklin Electric (it's free!)

Franklin Electric's narrative projects $2.4 billion revenue and $259.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $80.3 million earnings increase from $178.7 million today.

Uncover how Franklin Electric's forecasts yield a $108.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

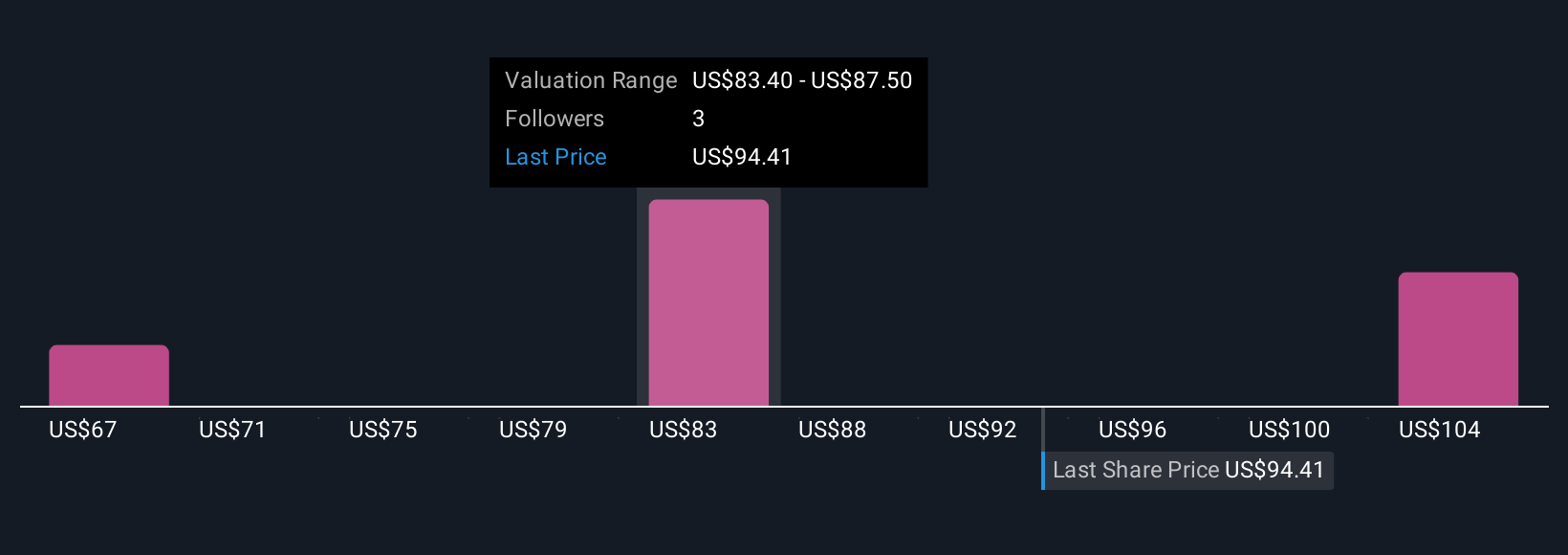

Three fair value estimates from the Simply Wall St Community span from US$67 to US$108 per share. While some expect strong growth from water infrastructure demand, others remain cautious about margin headwinds that could weigh on Franklin Electric’s future returns, explore multiple viewpoints to broaden your understanding.

Explore 3 other fair value estimates on Franklin Electric - why the stock might be worth 29% less than the current price!

Build Your Own Franklin Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Franklin Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Franklin Electric's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives