- United States

- /

- Electrical

- /

- NasdaqGM:FCEL

With A 29% Price Drop For FuelCell Energy, Inc. (NASDAQ:FCEL) You'll Still Get What You Pay For

To the annoyance of some shareholders, FuelCell Energy, Inc. (NASDAQ:FCEL) shares are down a considerable 29% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

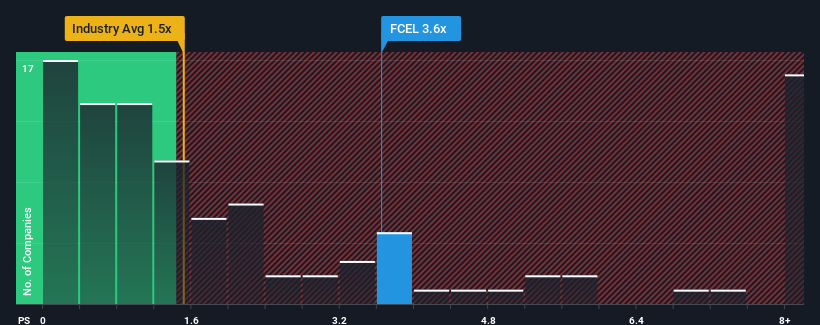

Although its price has dipped substantially, you could still be forgiven for thinking FuelCell Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.6x, considering almost half the companies in the United States' Electrical industry have P/S ratios below 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for FuelCell Energy

How Has FuelCell Energy Performed Recently?

FuelCell Energy hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on FuelCell Energy.Is There Enough Revenue Growth Forecasted For FuelCell Energy?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like FuelCell Energy's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's top line. Still, the latest three year period has seen an excellent 35% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 57% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially higher than the 45% per annum growth forecast for the broader industry.

In light of this, it's understandable that FuelCell Energy's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

FuelCell Energy's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of FuelCell Energy's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with FuelCell Energy.

If these risks are making you reconsider your opinion on FuelCell Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FCEL

FuelCell Energy

Manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives