- United States

- /

- Electrical

- /

- NasdaqCM:EOSE

Revenues Tell The Story For Eos Energy Enterprises, Inc. (NASDAQ:EOSE) As Its Stock Soars 26%

Those holding Eos Energy Enterprises, Inc. (NASDAQ:EOSE) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.4% in the last twelve months.

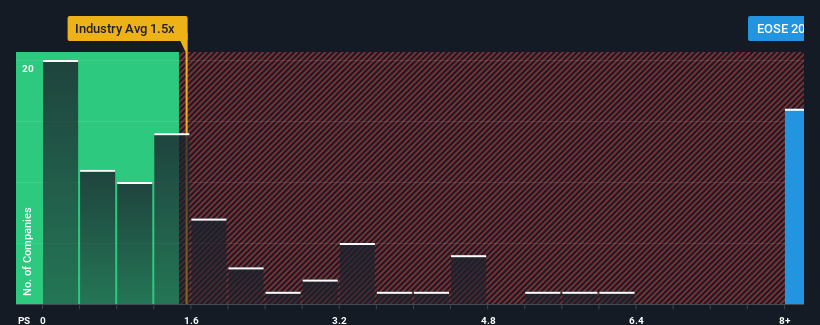

After such a large jump in price, given around half the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Eos Energy Enterprises as a stock to avoid entirely with its 20x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Eos Energy Enterprises

What Does Eos Energy Enterprises' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Eos Energy Enterprises' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Eos Energy Enterprises will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Eos Energy Enterprises?

Eos Energy Enterprises' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 357% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 46% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Eos Energy Enterprises' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Eos Energy Enterprises' P/S?

Eos Energy Enterprises' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Eos Energy Enterprises maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Eos Energy Enterprises that you should be aware of.

If these risks are making you reconsider your opinion on Eos Energy Enterprises, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EOSE

Eos Energy Enterprises

Designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States.

High growth potential low.

Similar Companies

Market Insights

Community Narratives