- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

Enovix (NasdaqGS:ENVX) Sees 17% Drop As Revenue Climbs To US$10 Million

Reviewed by Simply Wall St

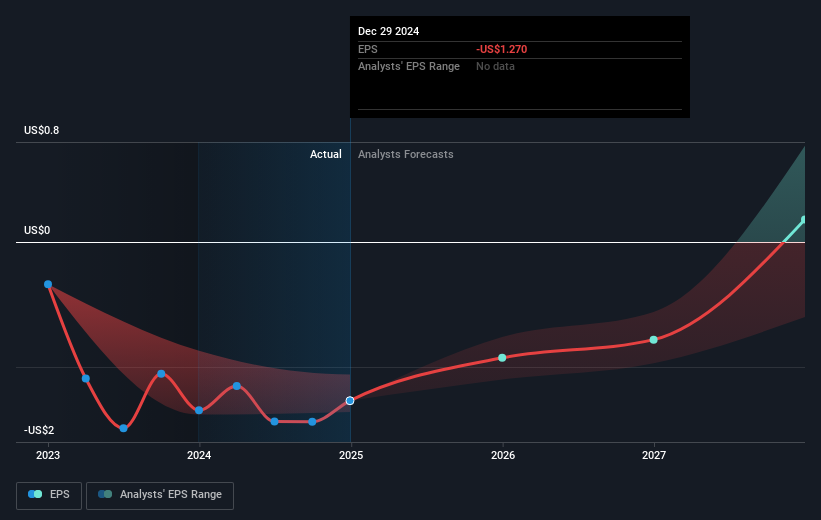

Enovix (NasdaqGS:ENVX) recently reported its fourth-quarter earnings, showing a revenue increase to $9.72 million and a reduced net loss of $37.47 million. Despite this improved financial performance year-over-year, the company's shares declined by 16.9% over the past week. This substantial drop may have coincided with broader market turmoil; for instance, the S&P 500 suffered its largest one-day decline of 2025 following newly imposed U.S. tariffs on Canada, Mexico, and China, contributing to a general market decline of 2.5%. The tech sector, to which Enovix belongs, has faced pressures with major players such as Tesla and Nvidia also losing ground. Although Enovix's improved earnings might be seen positively, its stock performance appears to have been significantly overshadowed by external market pressures, including the impact of tariffs and the broader sell-off in tech and financial stocks. This underlines the importance of considering macroeconomic trends in assessing individual stock movements.

Dig deeper into the specifics of Enovix here with our thorough analysis report.

Over the past year, Enovix's total shareholder return was a 15.70% decline. This performance lagged behind both the overall US market, which gained 15.3%, and the US Electrical industry, which rose by 1.3%. In February 2025, Enovix announced its Q4 2024 results, reporting sales of US$9.72 million and a reduced net loss of US$37.47 million, both improvements from the previous year. However, its shares experienced ongoing pressure throughout the year due to persistent losses, including a full-year net loss of US$222.24 million.

Despite positive developments, such as a January 2025 prepaid order from a Silicon Valley AI leader for mixed reality wearables, investors remained cautious. This hesitancy may have been influenced by Enovix's high Price-To-Book Ratio of 6.3x, significantly above the industry average of 1.5x. Additionally, development agreements with major firms, including a global smartphone OEM, highlight potential, yet losses in profitability continued to weigh on its stock performance.

- Unlock the insights behind Enovix's valuation and discover its true investment potential

- Assess the downside scenarios for Enovix with our risk evaluation.

- Hold shares in Enovix? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives