- United States

- /

- Trade Distributors

- /

- NasdaqGS:DXPE

Is Market Sentiment Shaping DXP Enterprises' (DXPE) Long-Term Position Among Industrial Distributors?

Reviewed by Sasha Jovanovic

- In the past week, industrial distributor DXP Enterprises saw its stock respond to negative economic headlines and a broader pullback across industrials, driven by shifting inflation expectations and muted market optimism.

- This episode highlights how macroeconomic sentiment can quickly ripple across non-tech sectors, revealing the interconnectedness of industrial stocks with wider economic trends and investor behavior.

- We'll explore what the recent caution toward industrial distributors, triggered by rising inflation expectations, means for DXP Enterprises' long-term investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

DXP Enterprises Investment Narrative Recap

To be a shareholder in DXP Enterprises, you usually need to believe in its ability to drive margin expansion and revenue growth through acquisitions, digital transformation, and sector diversification beyond energy. The recent news-driven decline, sparked by inflation expectations and broad investor caution, is unlikely to materially affect DXP’s most important near-term catalyst: successful execution of new acquisitions. However, a key short-term risk remains integration challenges and cost control if labor or margin pressures intensify against a weaker economic backdrop.

Among recent announcements, management reiterated on August 7, 2025, that they expect to complete three to four additional acquisitions in the second half of this year, citing increased liquidity and credit access. This commitment to M&A is especially relevant, as new deals are central to DXP’s growth story, yet they come with ongoing risks of integration complexity and cost discipline, particularly in times of economic uncertainty. But investors should also be aware that...

Read the full narrative on DXP Enterprises (it's free!)

DXP Enterprises' narrative projects $2.2 billion revenue and $122.9 million earnings by 2028. This requires 4.7% yearly revenue growth and a $36.3 million earnings increase from $86.6 million today.

Uncover how DXP Enterprises' forecasts yield a $125.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

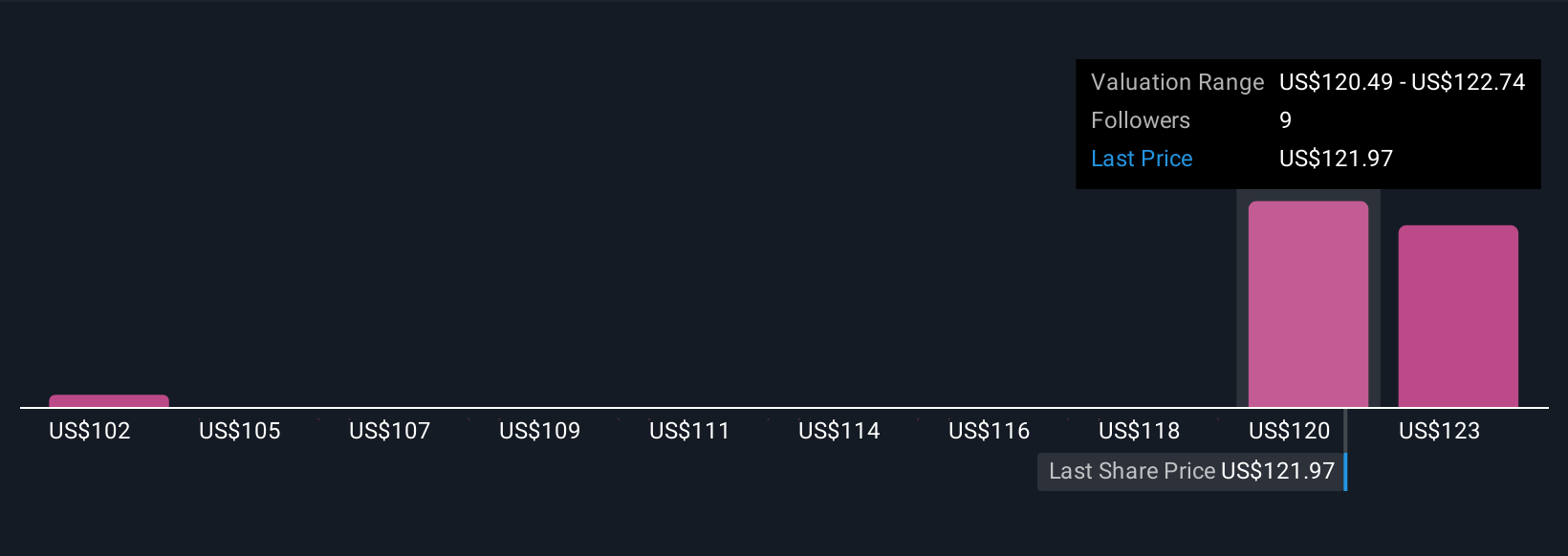

Simply Wall St Community members shared three fair value estimates on DXP Enterprises ranging from US$102.44 to US$125. Persistent inflation risks remain an important factor to monitor, influencing both sentiment and potential segment profitability for the business.

Explore 3 other fair value estimates on DXP Enterprises - why the stock might be worth as much as 6% more than the current price!

Build Your Own DXP Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXP Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DXP Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXP Enterprises' overall financial health at a glance.

No Opportunity In DXP Enterprises?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXPE

DXP Enterprises

Engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States, Canada, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives