- United States

- /

- Electrical

- /

- NasdaqCM:DFLI

Further weakness as Dragonfly Energy Holdings (NASDAQ:DFLI) drops 16% this week, taking one-year losses to 65%

Even the best stock pickers will make plenty of bad investments. Anyone who held Dragonfly Energy Holdings Corp. (NASDAQ:DFLI) over the last year knows what a loser feels like. To wit the share price is down 65% in that time. We wouldn't rush to judgement on Dragonfly Energy Holdings because we don't have a long term history to look at. In the last ninety days we've seen the share price slide 74%.

Since Dragonfly Energy Holdings has shed US$29m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Dragonfly Energy Holdings

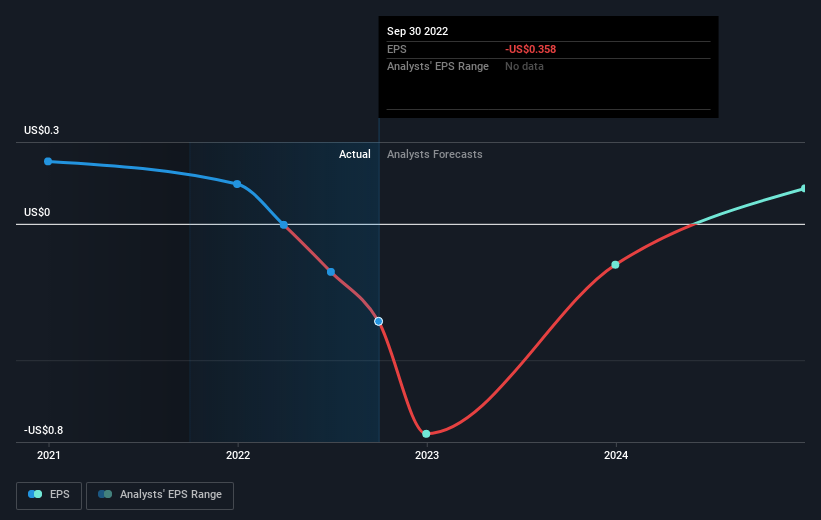

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Dragonfly Energy Holdings fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Dragonfly Energy Holdings shareholders are down 65% for the year, even worse than the market loss of 7.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's worth noting that the last three months did the real damage, with a 74% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Dragonfly Energy Holdings , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DFLI

Dragonfly Energy Holdings

Engages in the manufacturing and sale of deep cycle lithium-ion batteries for recreational vehicles, marine vessels, solar and off-grid residence industries, and industrial and energy storage markets.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives