- United States

- /

- Consumer Services

- /

- NasdaqGM:QSG

3 US Penny Stocks With Market Caps Under $200M To Watch

Reviewed by Simply Wall St

As U.S. markets rebound from a recent selloff, attention is shifting towards earnings and the Federal Reserve's upcoming policy meeting. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area despite being considered somewhat outdated. These stocks can offer unique growth opportunities when backed by solid financials, and today we explore three such examples that stand out for their financial strength and potential for future gains.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.69 | $11.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8985 | $6.25M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.283 | $10.58M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.73 | $84.93M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.11 | $52.57M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.29 | $23.06M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.90 | $79.98M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

QuantaSing Group (NasdaqGM:QSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: QuantaSing Group Limited offers online learning services in the People’s Republic of China and has a market cap of approximately $121.65 million.

Operations: The company generates CN¥3.74 billion in revenue from its operations within the People's Republic of China.

Market Cap: $121.65M

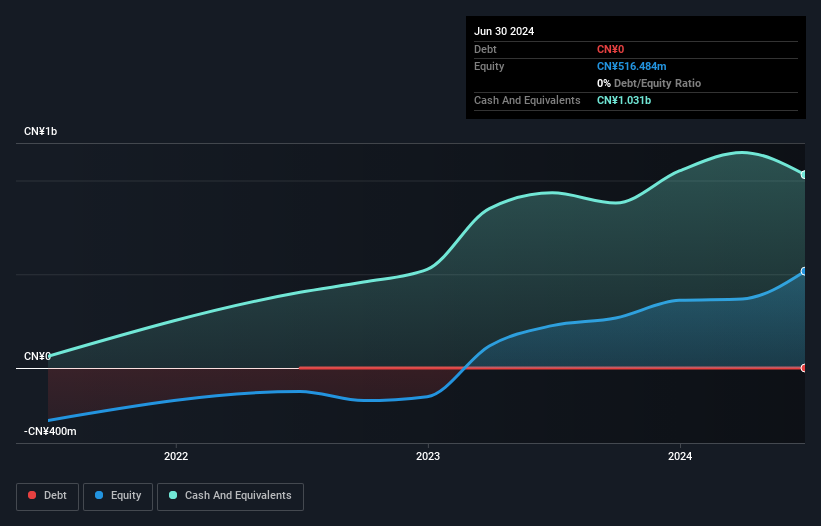

QuantaSing Group, with a market cap of US$121.65 million, is experiencing significant earnings growth, boasting an increase of 839.8% over the past year. Despite this impressive growth, its earnings are forecast to decline by an average of 25.6% annually over the next three years. The company remains debt-free and has not diluted shareholders in the past year, indicating financial prudence. However, its board is relatively inexperienced with an average tenure of 2.3 years, though recent changes have brought seasoned executives like Mr. Shunyan Zhu from Alibaba Health into leadership roles to potentially bolster governance and strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of QuantaSing Group.

- Learn about QuantaSing Group's future growth trajectory here.

Caesarstone (NasdaqGS:CSTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and markets engineered stone and other materials under the Caesarstone brand across multiple regions including the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel with a market cap of $146.79 million.

Operations: The company generates $473.88 million in revenue from its building products segment.

Market Cap: $146.79M

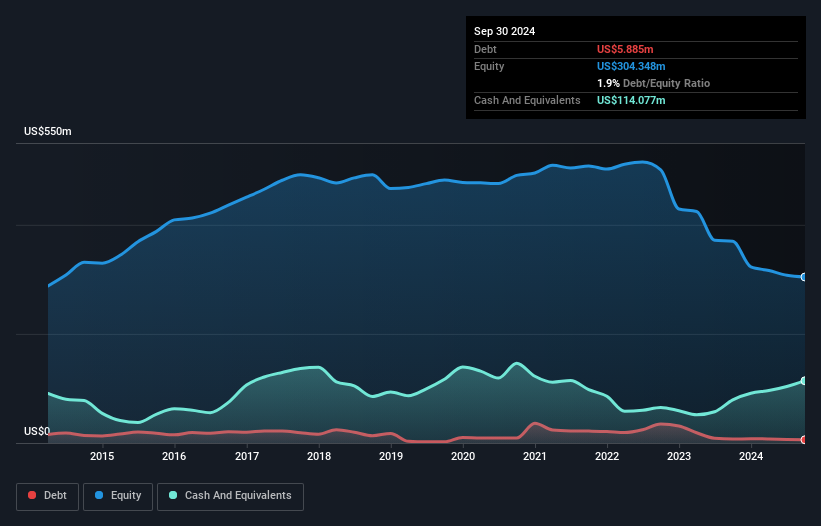

Caesarstone Ltd., with a market cap of US$146.79 million, faces challenges as it remains unprofitable, reporting increased net losses over the past five years at 64.5% annually. Despite this, its short-term assets of US$363.2 million comfortably cover both short and long-term liabilities, indicating solid liquidity management. The company’s debt is well-covered by operating cash flow at 818.7%, suggesting efficient cash flow management despite rising debt levels from 0.5% to 1.9%. Recent earnings show a decline in sales and an increase in net loss for Q3 2024 compared to the previous year, highlighting ongoing operational hurdles.

- Dive into the specifics of Caesarstone here with our thorough balance sheet health report.

- Explore Caesarstone's analyst forecasts in our growth report.

Xunlei (NasdaqGS:XNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xunlei Limited, along with its subsidiaries, operates an internet platform for digital media content in the People's Republic of China and has a market cap of approximately $159.75 million.

Operations: The company generates $359.61 million in revenue from operating its online media platform.

Market Cap: $159.75M

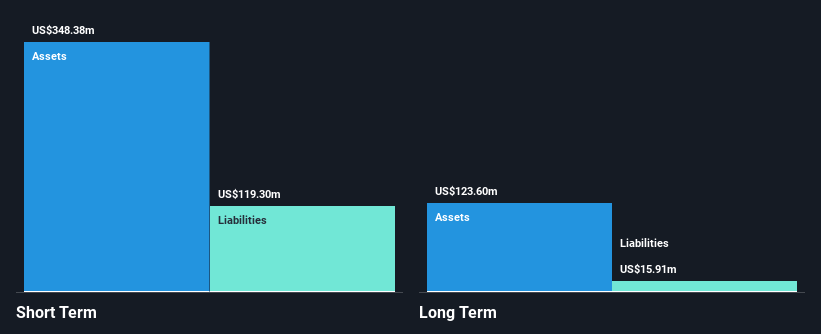

Xunlei Limited, with a market cap of US$159.75 million, has shown impressive earnings growth of 139.4% over the past year, surpassing the software industry average. The company maintains strong financial health, with short-term assets of US$348.4 million exceeding both short and long-term liabilities and more cash than total debt. Recent third-quarter results reported sales of US$80.14 million and net income growth to US$4.6 million from the previous year’s US$4.4 million, despite a slight revenue decline forecast for Q4 2024. Additionally, Xunlei completed a share buyback program enhancing shareholder value without significant dilution over the past year.

- Unlock comprehensive insights into our analysis of Xunlei stock in this financial health report.

- Gain insights into Xunlei's past trends and performance with our report on the company's historical track record.

Where To Now?

- Access the full spectrum of 709 US Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantaSing Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QSG

QuantaSing Group

Provides online learning services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives