- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Byrna Technologies (BYRN) Profit Margin Surges to 14.4%, Challenging Forecast Skepticism

Reviewed by Simply Wall St

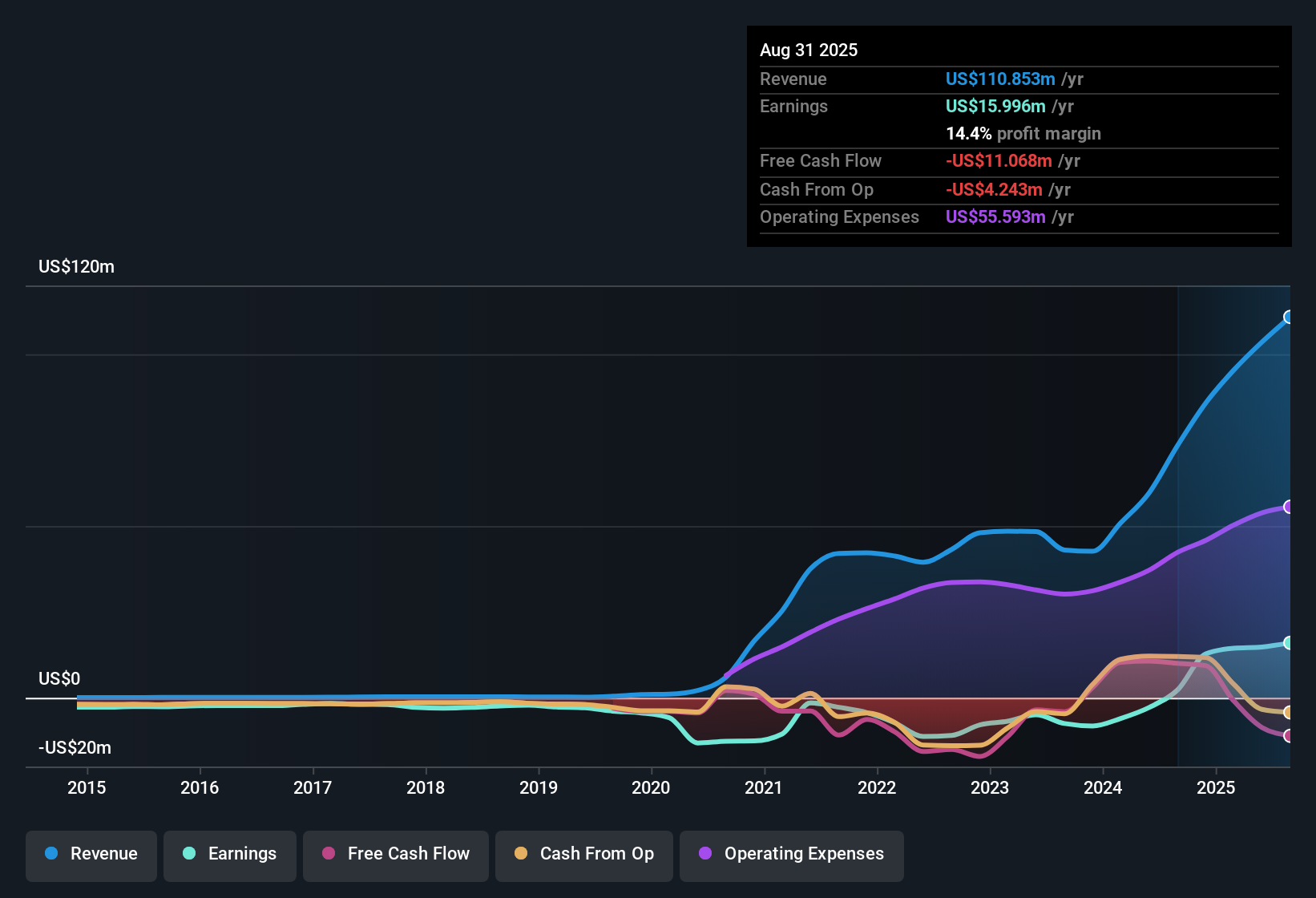

Byrna Technologies (BYRN) delivered a sharp upswing in profitability this quarter, turning in net profit margins of 14.4%, up from just 3.1% a year ago. The company has achieved profitability over the past five years, with average annual earnings growth of 54.7%. Earnings increased by 598.2% in the last year alone. Looking ahead, forecasted earnings growth of 22.02% per year and revenue growth of 21.6% both outpace the broader U.S. market and sharpen the company's growth profile for investors.

See our full analysis for Byrna Technologies.Next, we will see how Byrna’s headline-grabbing numbers compare to the consensus narratives on Simply Wall St, highlighting where expectations align with reality and where surprises have emerged.

See what the community is saying about Byrna Technologies

Margins Holding Firm Despite Supply Shifts

- Net profit margin reached 14.4%, a marked improvement from 3.1% last year, even as Byrna moved its supply chain sourcing to 87% to 92% U.S.-based suppliers, a strategic shift designed to reduce tariff exposure and stabilize operations.

- According to analysts' consensus view, shifting supply chains to the U.S. and reliance on Amazon are double-edged swords:

- The move to U.S. sourcing is expected to bring long-term margin stability, but already led to a 16% increase in launcher production costs, which could challenge future profitability if not offset by pricing power or higher volumes.

- With 32.6% of direct-to-consumer sales via Amazon, Byrna unlocks a vast e-commerce market but risks margin compression from fee changes or stricter platform policies.

- The consensus narrative claims that supply chain upgrades will eventually support margins, but competing risks from higher costs and Amazon dependency may keep bottom-line gains in check.

Analysts see Byrna’s supply chain shifts as a bold margin play, but the real win will be if gross profits hold up as costs climb. 📊 Read the full Byrna Technologies Consensus Narrative.

Growth Projections Face Mixed Analyst Expectations

- Analysts project annual revenue growth of 24.1% for the next three years, yet expect profit margins to narrow from 14.3% today to 11.5% by 2028, suggesting rising costs may partially offset sales momentum.

- Consensus narrative highlights disagreement over future earnings:

- Some analysts expect earnings to rise to $26.4 million by 2028 with continued margin improvements, while bearish estimates only see $16.6 million, indicating conflicting opinions about the durability of profit expansion.

- This debate puts a spotlight on whether new products and expanded Amazon sales can overcome increased cost pressures and margin drag from strategic initiatives.

Trading Below DCF Fair Value and Analyst Targets

- Byrna’s shares are priced at $26.36, which is below both the DCF fair value estimate of $33.05 and the analyst price target of $39.70, and its P/E ratio of 37.4x sits beneath the industry average of 39.2x despite robust recent growth.

- Consensus narrative interprets this valuation gap as a potential opportunity, but notes that to justify a $39.70 target, Byrna would need to grow earnings to $22.8 million and trade at a hefty 48.3x forward earnings by 2028:

- The current discount could attract growth investors, yet there is an embedded expectation for margins and market expansion to deliver outsized returns over multiple years.

- Uncertainty remains over whether high non-cash earnings and increased U.S. sourcing costs will challenge the quality and sustainability of future profits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Byrna Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on Byrna’s results? Share your analysis and craft your own perspective in just a few minutes. Do it your way

A great starting point for your Byrna Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Byrna Technologies faces uncertain profit sustainability, as increasing production costs and dependency on Amazon could squeeze margins, even with robust sales growth.

If you’re seeking more reliable earnings consistency, use our stable growth stocks screener to zero in on companies that have delivered steady growth and resilient margins over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives