- United States

- /

- Machinery

- /

- NasdaqGM:BLBD

The Bull Case For Blue Bird (BLBD) Could Change Following Major Efficiency Investments and New Plant Unveiling

Reviewed by Sasha Jovanovic

- In recent days, Blue Bird reported progress on operational efficiency with investments in automation, lean manufacturing, and a newly constructed plant expected to enhance cost structures and margins.

- Investors appear focused on the company’s undervalued status, as valuation metrics and peer comparisons highlight potential for stronger long-term performance, even as industry risks continue.

- We’ll assess how Blue Bird’s operational efficiency investments may reshape its investment narrative and outlook for margin expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Blue Bird Investment Narrative Recap

To be a shareholder in Blue Bird, you need to believe in the longer-term electrification and modernization of school bus fleets, enabled by government incentives and the company's ability to improve operational efficiency. The recent progress in automation and a new plant could modestly support near-term margin expansion, but the primary catalyst remains sustained funding for electric vehicle programs, and the most immediate risk is a change in policy or incentives. At this stage, the news does not significantly shift the key short-term catalyst or risk.

Among recent announcements, the opening of the Micro Bird manufacturing facility in Plattsburgh, NY, stands out. This expansion is particularly relevant, as it adds production capacity to meet demand for electric and alternative-fuel buses, a major catalyst if fleet replacement cycles accelerate and government funding continues. The enhanced scale also aligns with Blue Bird's aim to improve operational efficiency and margins through automation and lean manufacturing investments.

Yet, despite these positive developments, investors should be aware that any reduction in government incentives could quickly shift the company’s outlook and...

Read the full narrative on Blue Bird (it's free!)

Blue Bird's outlook anticipates $1.6 billion in revenue and $152.3 million in earnings by 2028. This projection is based on a 4.0% annual revenue growth rate and a $36.4 million increase in earnings from the current $115.9 million.

Uncover how Blue Bird's forecasts yield a $59.12 fair value, a 6% upside to its current price.

Exploring Other Perspectives

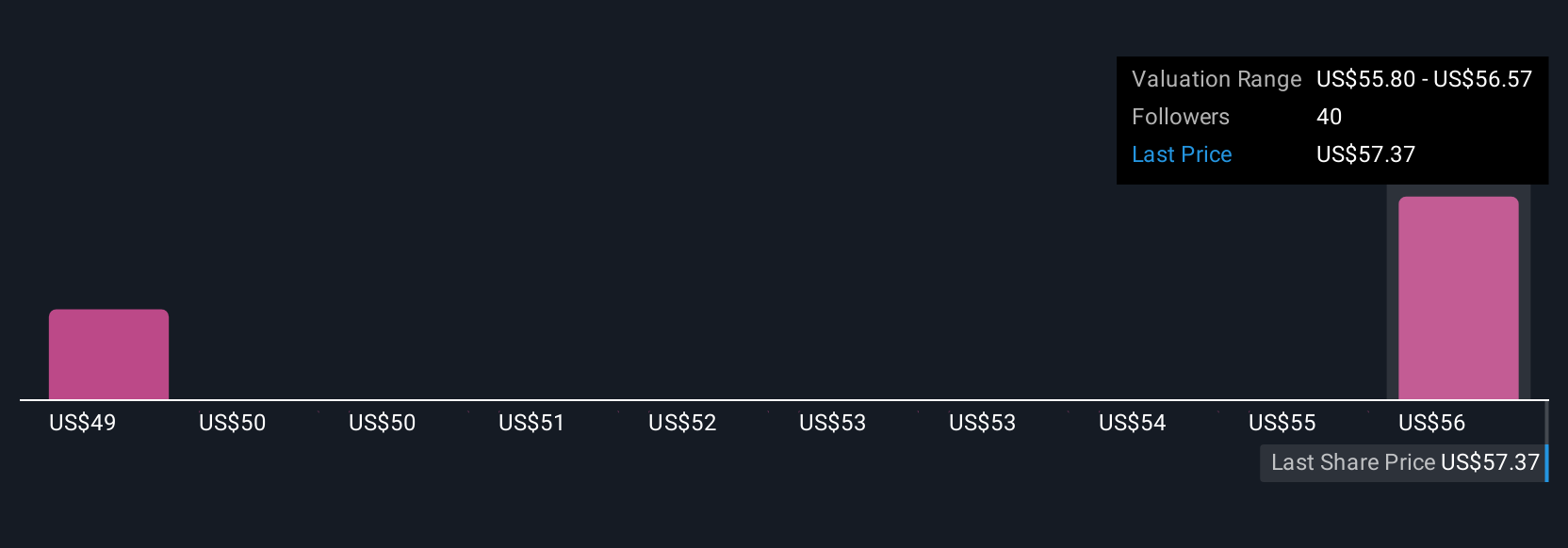

Private investors in the Simply Wall St Community assign Blue Bird fair value estimates ranging from US$59.13 to US$94.92, based on three individual analyses. With operational efficiency as a key catalyst, opinions differ widely on the company’s prospects, reflecting how assumptions can shape expectations and signaling the importance of reviewing several viewpoints.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth just $59.12!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BLBD

Blue Bird

Designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives