- United States

- /

- Electrical

- /

- NasdaqCM:BEEM

Beam Global (NASDAQ:BEEM) Stock Rockets 37% But Many Are Still Ignoring The Company

Beam Global (NASDAQ:BEEM) shares have continued their recent momentum with a 37% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

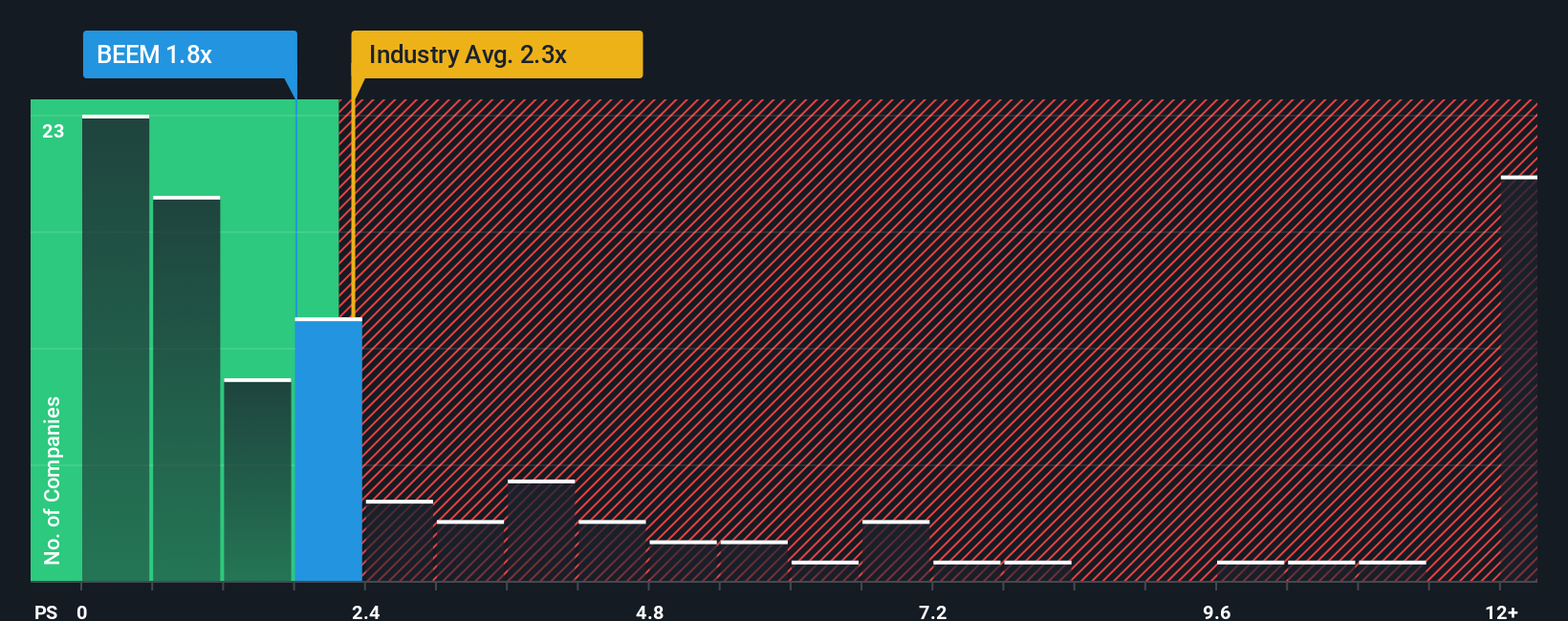

Even after such a large jump in price, it's still not a stretch to say that Beam Global's price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" compared to the Electrical industry in the United States, where the median P/S ratio is around 2.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Beam Global

What Does Beam Global's Recent Performance Look Like?

Beam Global hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Beam Global will help you uncover what's on the horizon.How Is Beam Global's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beam Global's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's top line. Still, the latest three year period has seen an excellent 157% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% each year during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 16% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Beam Global's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Beam Global appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Beam Global currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Beam Global (2 don't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Beam Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beam Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BEEM

Beam Global

A clean-technology innovation company, engages in the design, development, engineering, manufacture, and sale of renewably energized infrastructure products and battery solutions in the United States and Romania.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives