- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Does Axon’s New Body Camera for Retail and Healthcare Expand the Growth Story for AXON?

Reviewed by Sasha Jovanovic

- In late September 2025, Axon Enterprise introduced the Axon Body Workforce Mini, a compact and durable body camera designed for retail, healthcare, and other frontline workers, featuring advanced communication tools and battery life.

- This move signals Axon's drive to broaden its customer base beyond law enforcement, responding directly to rising workplace safety issues and collaborating closely with industry leaders to tailor its solutions.

- We’ll examine how Axon’s expansion into retail and healthcare markets may influence the company’s future growth assumptions and investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Axon Enterprise Investment Narrative Recap

To be a shareholder in Axon Enterprise, you need to believe in the long-term adoption of advanced public safety technology across sectors, not just law enforcement, as well as Axon's ongoing ability to expand its ecosystem and recurring revenue. While the recent launch of the Axon Body Workforce Mini signals meaningful progress toward diversification, and may support near-term customer wins in retail and healthcare, it does not materially shift the biggest short-term catalyst: sustained revenue growth and margin expansion driven by government and public sector contracts. The most pressing risk remains Axon's dependence on these contracts and the potential impact of changes in government budgets and sentiment on earnings stability.

Among recent announcements, Axon’s raised 2025 revenue guidance to US$2.65 billion to US$2.73 billion stands out, reflecting confidence in demand for new products like the Workforce Mini and increased contract value per customer. This guidance reinforces the current growth catalyst, especially as Axon broadens its addressable market beyond government clients with partnerships in the private sector.

Yet compared to catalysts for growth, investors should be especially aware that...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's narrative projects $4.6 billion revenue and $476.0 million earnings by 2028. This requires 24.3% yearly revenue growth and a $149.7 million earnings increase from $326.3 million today.

Uncover how Axon Enterprise's forecasts yield a $884.69 fair value, a 26% upside to its current price.

Exploring Other Perspectives

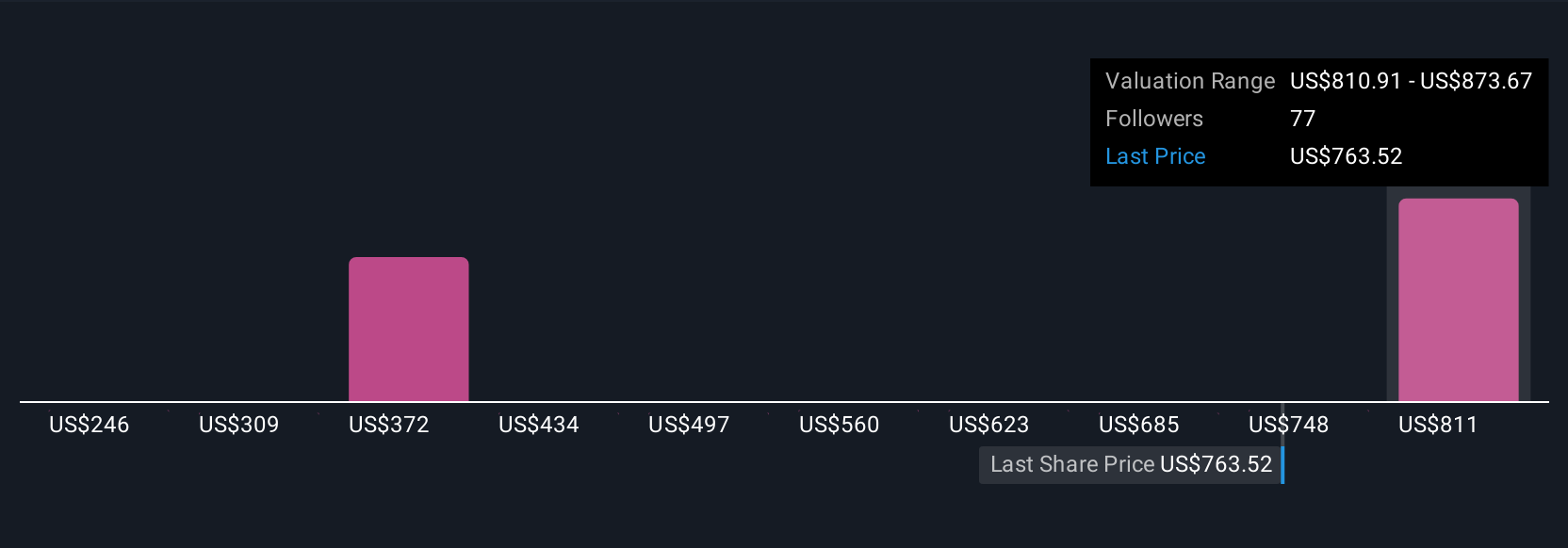

Simply Wall St Community members assigned fair values for Axon ranging from US$246 to US$895, with nine distinct estimates. While growth in digital public safety solutions is a key driver, your view on sector diversification could affect how you interpret these numbers.

Explore 9 other fair value estimates on Axon Enterprise - why the stock might be worth as much as 27% more than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives