- United States

- /

- Machinery

- /

- NasdaqGS:ASTE

Astec Industries (ASTE): Is the Recent Share Surge Reflected in Its Current Valuation?

Reviewed by Kshitija Bhandaru

See our latest analysis for Astec Industries.

Astec Industries’ impressive 51.4% total shareholder return over the past year reflects building momentum, with the stock up 21.9% over the last 90 days alone. This strong run suggests investors are responding to the company’s ongoing growth and improving outlook in capital goods.

If you’re looking for more dynamic outliers in the industrial space, it is a great moment to check out fast growing stocks with high insider ownership

With shares already surging and the fundamentals trending higher, the key question becomes whether Astec Industries is still undervalued or if the current price already reflects all its expected future growth.

Most Popular Narrative: 8.8% Undervalued

Astec Industries’ widely followed narrative pegs fair value at $52, which is meaningfully above the last close at $47.44. The outlook hinges on long-term revenue expansion and enhanced profit margins supported by the company's evolving business model.

Margin expansion is expected through operational improvements, high-margin acquisitions, and a strategic focus on sustainable, digital, and innovative product solutions. Heavy reliance on the U.S. market, limited product diversification, and exposure to macroeconomic, legislative, and integration risks threaten long-term growth, margins, and stability.

Curious which forecasts could drive the next rerating? The narrative’s bold profit margin assumptions and revenue growth projections form the backbone of its premium pricing. Eager to uncover which numbers are behind the discrepancy between today’s price and that higher fair value? Dive in to see what’s fueling this optimistic outlook.

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Astec’s heavy reliance on US infrastructure spending and vulnerability to shifts in demand could quickly undermine the optimistic outlook described above.

Find out about the key risks to this Astec Industries narrative.

Another View: Market Multiples Perspective

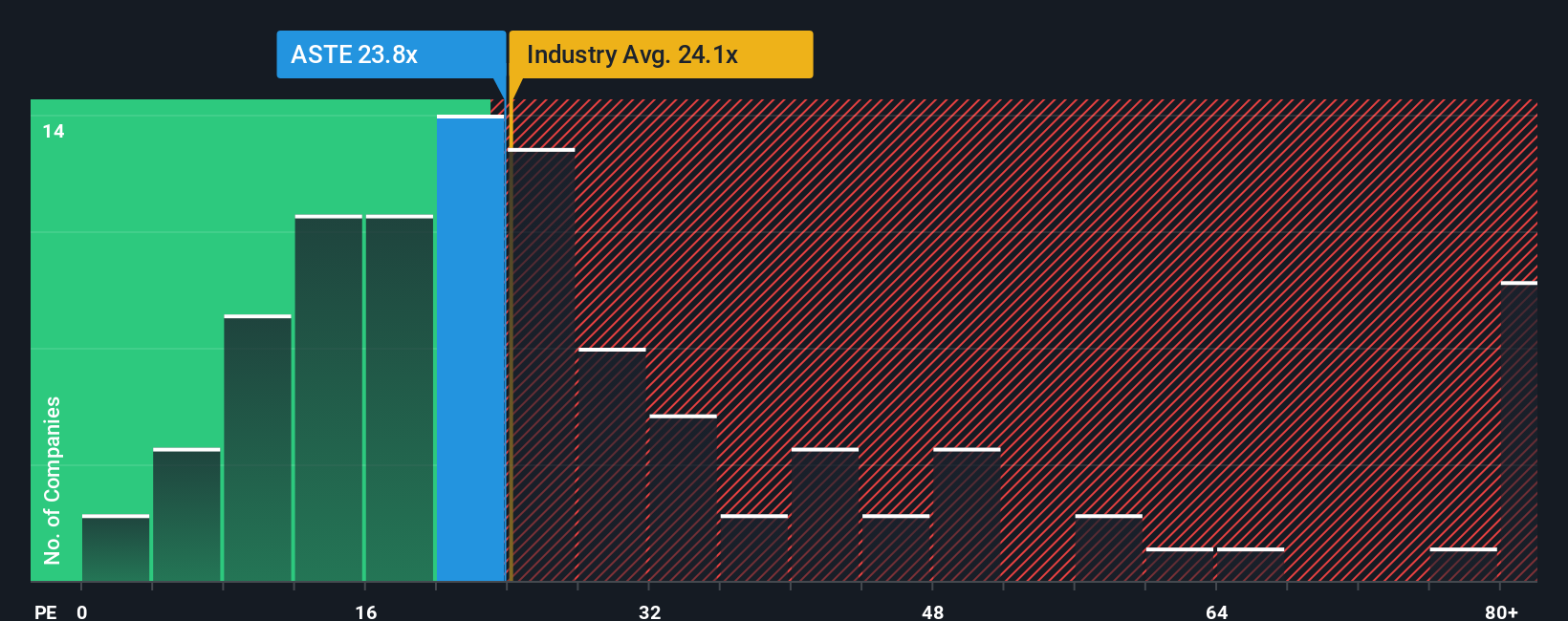

Looking at valuation through the lens of earnings multiples, Astec Industries trades at a price-to-earnings ratio of 23.6x, which is just below the US Machinery industry average of 23.8x and well below peers averaging 26.6x. The fair ratio, or what the market could eventually lean toward, stands at 24.9x. This close alignment suggests the stock is priced reasonably versus competitors, but it may also limit any margin of safety if industry sentiment shifts. Is the current price simply the market’s fair read, or is there hidden opportunity investors are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Astec Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Astec Industries Narrative

If you see the numbers differently or want to investigate further, crafting your own view is quick and easy. Take a few minutes to Do it your way.

A great starting point for your Astec Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Confidently power up your portfolio by tapping into new opportunities across the hottest trends and resilient sectors. These handpicked ideas could be your next winning move, so do not miss out.

- Tap into exponential growth by checking out these 24 AI penny stocks companies making breakthroughs in artificial intelligence and automation.

- Secure streamable passive income through these 18 dividend stocks with yields > 3% for consistently high-yielding stocks with returns above 3%.

- Get ahead of tomorrow’s technology wave by jumping into these 26 quantum computing stocks, which is shaping the quantum revolution and the next era of computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTE

Astec Industries

Designs, engineers, manufactures, markets, and services equipment and components used primarily in road building and related construction activities worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives