- United States

- /

- Media

- /

- NYSE:CTV

Top US Growth Stocks With High Insider Ownership For August 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the S&P 500 and Nasdaq Composite facing declines, investors are closely monitoring Federal Reserve comments on potential interest rate cuts. In this environment, growth companies with high insider ownership can offer a unique advantage, as significant insider stakes often signal confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.7% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Here we highlight a subset of our preferred stocks from the screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to various aviation sectors and offers maintenance, repair, and overhaul services worldwide, with a market cap of $272.42 million.

Operations: The company's revenue segments include Tech Ops - MRO Services ($102.33 million), Tech Ops - Product Sales ($21.49 million), Asset Management Solutions - Engine ($161.35 million), and Asset Management Solutions - Aircraft ($69.38 million).

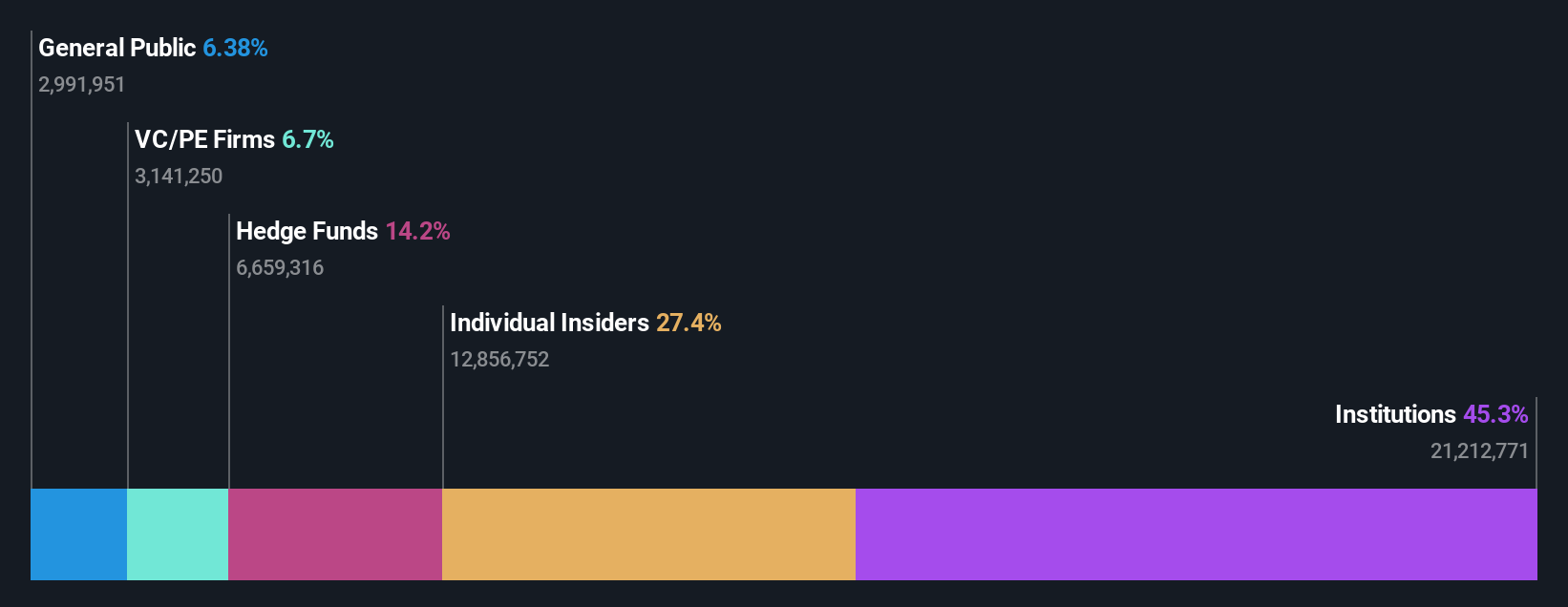

Insider Ownership: 24.1%

Earnings Growth Forecast: 87.3% p.a.

AerSale Corporation, a company with significant insider ownership, has shown promising revenue growth and is expected to become profitable within three years. Despite recent drops from key indices and a net loss in Q2 2024, AerSale's revenue increased to US$77.1 million from US$69.33 million year-over-year. The company's strategic expansion into Millington, Tennessee enhances its MRO capabilities. Insiders have been buying more shares than selling recently, indicating confidence in the company's future prospects despite past shareholder dilution.

- Click here to discover the nuances of AerSale with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that AerSale is trading behind its estimated value.

Southern States Bancshares (NasdaqGS:SSBK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Southern States Bancshares, Inc. (NasdaqGS:SSBK) operates as the bank holding company for Southern States Bank, offering community banking services to businesses and individuals with a market cap of $265.62 million.

Operations: Southern States Bancshares generates $80.76 million in revenue from its banking segment.

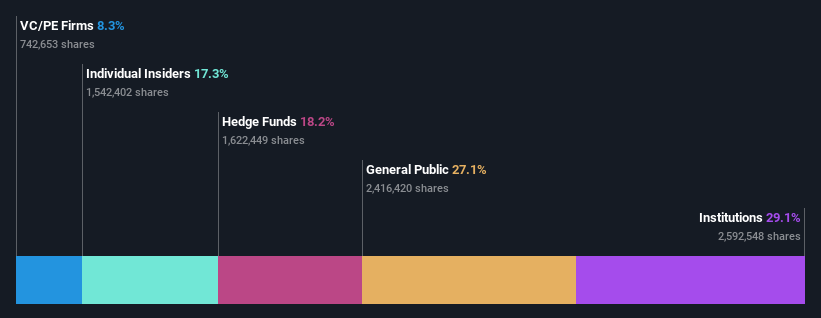

Insider Ownership: 17%

Earnings Growth Forecast: 20% p.a.

Southern States Bancshares, with substantial insider ownership, is expected to see its revenue grow at 20.8% per year, outpacing the US market's 8.8%. Despite recent significant insider selling and no share repurchases in Q2 2024, the company completed a strategic merger with CBB Bancorp. This move could bolster growth prospects as Richard E. Drews Jr., a seasoned banking executive, joins the board and key committees. The stock trades at a significant discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in Southern States Bancshares' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Southern States Bancshares shares in the market.

Innovid (NYSE:CTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovid Corp. (NYSE:CTV) operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $266.46 million.

Operations: Innovid Corp. generates $149.54 million in revenue from its Advertising and Creative Services segment.

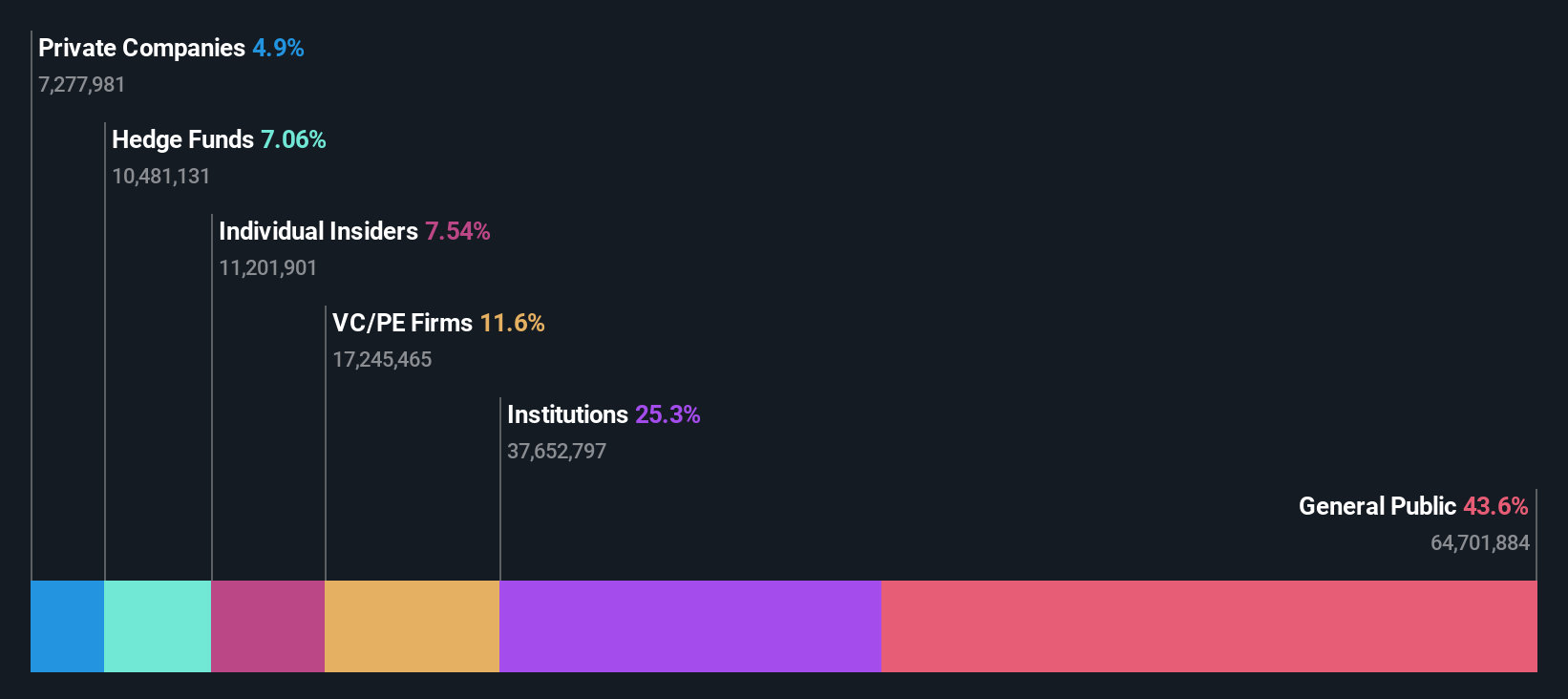

Insider Ownership: 10.8%

Earnings Growth Forecast: 101.7% p.a.

Innovid is a growth company with high insider ownership, trading at 84.9% below its estimated fair value. Analysts forecast earnings to grow 101.69% annually, with revenue projected to increase by 11.8% per year, outpacing the US market. Despite recent significant insider selling and shareholder dilution over the past year, Innovid's collaboration with Nielsen aims to enhance ad measurement capabilities, potentially driving future growth and profitability within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Innovid.

- Upon reviewing our latest valuation report, Innovid's share price might be too pessimistic.

Next Steps

- Explore the 175 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTV

Innovid

Operates an independent software platform that provides ad serving, measurement, and creative services.

Flawless balance sheet and good value.