- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

Here's What To Make Of Array Technologies' (NASDAQ:ARRY) Decelerating Rates Of Return

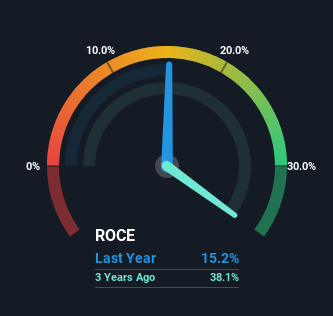

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Array Technologies (NASDAQ:ARRY) looks decent, right now, so lets see what the trend of returns can tell us.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Array Technologies:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = US$210m ÷ (US$1.8b - US$401m) (Based on the trailing twelve months to September 2023).

Thus, Array Technologies has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 13% generated by the Electrical industry.

See our latest analysis for Array Technologies

Above you can see how the current ROCE for Array Technologies compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Array Technologies here for free.

What Can We Tell From Array Technologies' ROCE Trend?

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has consistently earned 15% for the last four years, and the capital employed within the business has risen 301% in that time. Since 15% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

On a side note, Array Technologies has done well to reduce current liabilities to 23% of total assets over the last four years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

Our Take On Array Technologies' ROCE

In the end, Array Technologies has proven its ability to adequately reinvest capital at good rates of return. Yet over the last three years the stock has declined 63%, so the decline might provide an opening. For that reason, savvy investors might want to look further into this company in case it's a prime investment.

On a final note, we've found 1 warning sign for Array Technologies that we think you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Procter & Gamble - A Fundamental and Historical Valuation

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!