- United States

- /

- Building

- /

- NasdaqGS:APOG

Apogee Enterprises (APOG) Margin Miss Reinforces Debate as One-Off $47.6M Loss Pressures Narratives

Reviewed by Simply Wall St

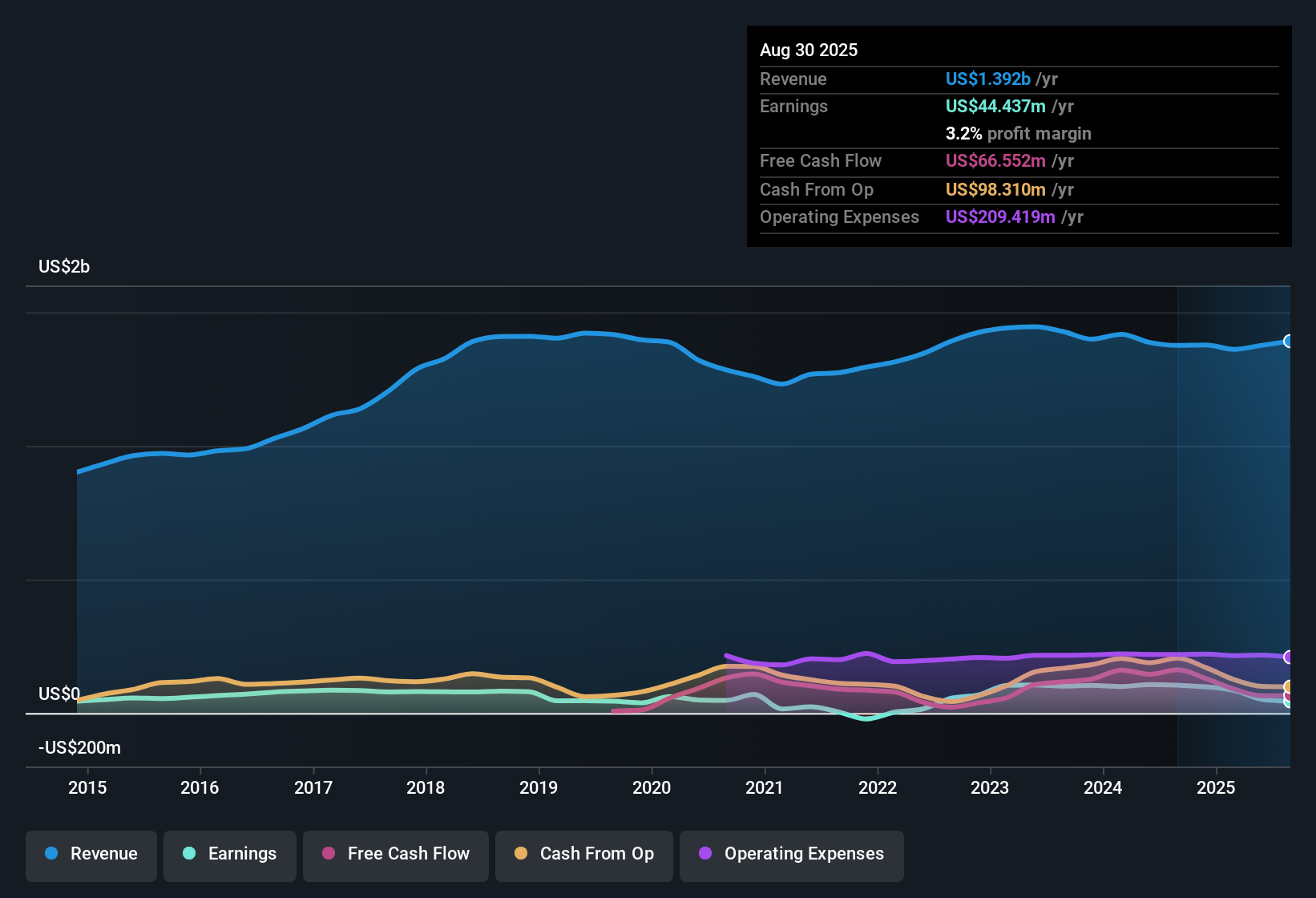

Apogee Enterprises (APOG) reported net profit margins at 3.2%, notably below last year’s 7.6%, as results for the latest 12 months were significantly affected by a non-recurring $47.6 million loss. Despite this, the company’s earnings are forecast to surge 47.5% per year, which is considerably higher than the broader US market’s 15.5% annual growth forecast. The combination of compressed margins and strong projected earnings growth has set the stage for a sharply divided investor reaction this quarter.

See our full analysis for Apogee Enterprises.Up next, we will see how these headline numbers measure up against the widely followed narratives shaping Apogee’s story for investors.

See what the community is saying about Apogee Enterprises

Expanding Margins in Analyst Forecasts

- Analysts estimate Apogee’s profit margins will climb from 3.7% today to 8.0% within three years, a substantial increase, especially relative to the recent low of 3.2% after a large one-off loss.

- According to the analysts' consensus view, operational efficiency programs like Project Fortify and a push into high-performance, sustainable building projects are expected to drive this margin recovery.

- Forecasted annualized cost savings of $13 to $15 million are central to getting net margins closer to those of peers, supporting the case for sustained margin expansion.

- Consensus narrative notes that this margin rebound contrasts the recent dip, highlighting the tension between short-term setbacks and longer-term potential as market demand for energy-efficient construction grows.

To see if analysts’ confidence in Apogee’s long-term resilience is warranted, check their full balanced view and narrative. Only the numbers tell the real story. 📊 Read the full Apogee Enterprises Consensus Narrative.

Industry-Low Price-Earnings Ratio Sparks Debate

- Apogee’s price-to-earnings ratio of 19.2x sits below its industry average of 21.9x and peer group average of 20.3x, signaling a discount for investors betting on a turnaround.

- Consensus narrative notes that while a valuation below industry levels increases appeal for value-focused investors, recent lower profit margins and the lingering impact of a one-time loss caution that a re-rating will hinge on proving margin recovery.

- Bulls highlight that the stock’s $39.60 share price trades below both the analyst price target of $52.67 and the DCF fair value of $42.16, supporting a potential upside if earnings rebound.

- Bears counter that long-term uncertainty, including continuing margin volatility and sluggish revenue growth of just 1.6% per year, may prevent Apogee from closing the valuation gap anytime soon.

Future Revenue Lags US Market but Shares Shrink

- Forecasts project revenue growth of just 1.6% annually, well behind the 10% annual US market average. Yet analysts also expect Apogee’s share count to drop by about 1.9% a year over the next three years.

- Consensus narrative points out this mix: while revenue growth remains slow as commercial construction volumes face headwinds, share repurchases provide a buffer for earnings per share, helping sustain long-term value for shareholders as the business evolves.

- This approach aims to offset sluggish top-line momentum by amplifying per-share results, aligning with value strategies often used in cyclical industries.

- Analysts agree that capturing value hinges on Apogee’s ability to combine cost savings with capital returns, keeping shareholder interests front and center despite broader market pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Apogee Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? It only takes a few minutes to transform your insights into a narrative that reflects your outlook. Do it your way

A great starting point for your Apogee Enterprises research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Apogee’s slow revenue growth and recent margin volatility suggest uncertainty may persist, even as cost cuts and buybacks aim to soften the impact.

If you want to focus on companies delivering steady results, check out our stable growth stocks screener for businesses showing consistent earnings and revenue growth through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APOG

Apogee Enterprises

Provides architectural products and services for enclosing buildings, and glass and acrylic products used for preservation, protection, and enhanced viewing in the United States, Canada, and Brazil.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)