- United States

- /

- Electrical

- /

- NasdaqGM:ALNT

Allient Inc.'s (NASDAQ:ALNT) Share Price Is Still Matching Investor Opinion Despite 27% Slump

The Allient Inc. (NASDAQ:ALNT) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

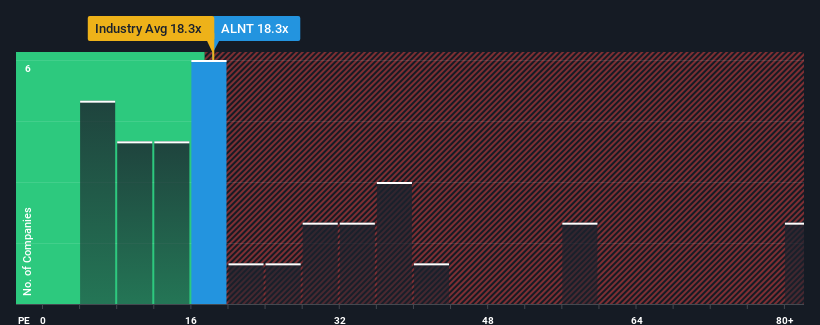

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Allient's P/E ratio of 18.3x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Allient as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Allient

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Allient's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. This means it has also seen a slide in earnings over the longer-term as EPS is down 30% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 10.0% each year as estimated by the three analysts watching the company. With the market predicted to deliver 10% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Allient's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Allient's P/E?

With its share price falling into a hole, the P/E for Allient looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Allient maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Allient (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Allient, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ALNT

Allient

Designs, manufactures, and sells precision and specialty-controlled motion components and systems for various industries in the United States, Canada, South America, Europe, and the Asia-Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives