- United States

- /

- Banks

- /

- OTCPK:RVRF

River Financial (RVRF) Net Margin Surges to 32.9%, Reinforcing Bullish Value Narratives

Reviewed by Simply Wall St

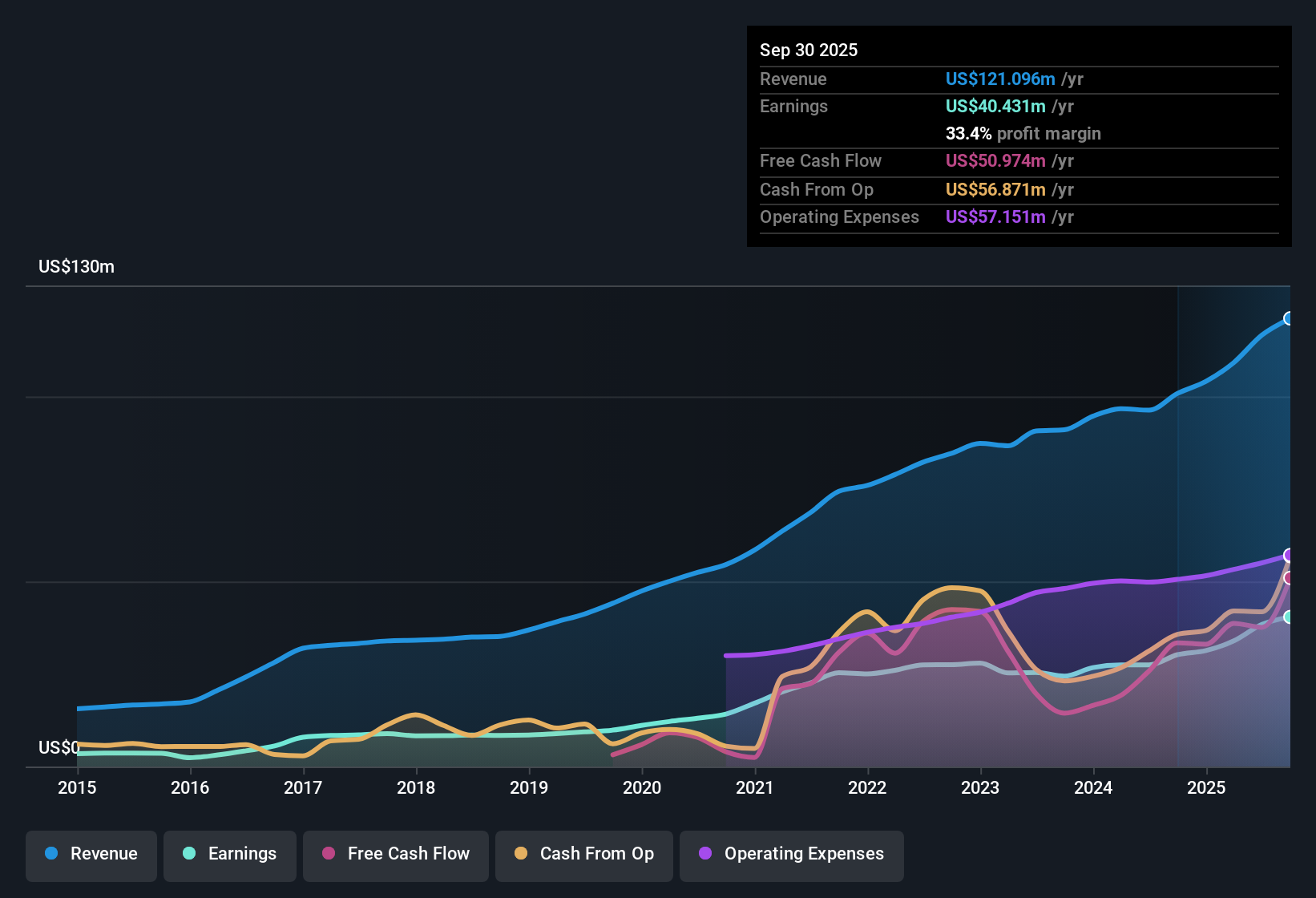

River Financial (RVRF) posted net profit margins of 32.9%, up from last year's 28.5%, with EPS growth for the past year coming in at 39.9%. The company’s strong momentum continues to show through a five-year annual earnings growth rate of 11.9% and high-quality profits that support these headline numbers. Investors looking for value may take notice, as shares trade at just 7x earnings, well below both the US Banks industry average of 11x and estimated fair value of $67.91, with the stock recently closing at $34.7. Market attention will likely remain high given the combination of low valuation, margin improvement, and robust earnings growth.

See our full analysis for River Financial.Now, let’s see how these results compare to the prevailing narratives. Both the consensus and crowd-sourced community views could be put to the test by this latest report.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Historical Growth

- Net profit margin rose to 32.9%, not only topping last year’s 28.5% but also standing out compared to the company’s five-year annual earnings growth rate of 11.9%.

- With profitability improving at a faster clip than its typical earnings pace, the prevailing market view highlights River Financial’s ability to generate high-quality profits that support meaningful shareholder value.

- Rapid margin expansion can help blunt concerns about banking sector headwinds, showing that the bottom line benefits from both revenue growth and cost control.

- Investors will note how this pace of growth outstrips the company’s own five-year trends, a detail that heavily supports optimism around future profit durability.

Value Gap Widens Against Peers

- Shares now trade at a price-to-earnings ratio of just 7x, notably lower than both the US Banks industry average of 11x and the peer average of 10.4x.

- The prevailing market view argues the valuation discount is particularly striking given River Financial's strong profit growth and a DCF fair value estimate of $67.91, far above the current share price of $34.70.

- This disconnect between robust margins and such a steep valuation gap could draw bargain-hunters and long-term investors who believe the stock’s price does not yet reflect its true earnings power.

- However, critics will keep an eye on whether low valuation is a sign of overlooked risks rather than just an underappreciated opportunity.

Share Price Stability Remains a Watchpoint

- Despite improving financial performance, River Financial's share price has not been stable over the past three months, which is a key risk flagged in filings.

- The prevailing market view suggests that even strong fundamentals can be overshadowed in the short term if market volatility or investor uncertainty takes hold.

- Share price swings might temper enthusiasm, especially for investors who prioritize steady, predictable price movement alongside earnings quality.

- Yet for those focused on fundamentals, ongoing margin and profit growth could outweigh near-term price instability, pointing to potential upside if sentiment stabilizes.

Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on River Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust profit growth, River Financial’s share price has remained unstable, raising concerns for investors who value predictability and steady performance.

If share price swings give you pause, discover stable growth stocks screener (2073 results) to focus on companies delivering consistent growth and less volatility through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:RVRF

River Financial

Operates as the bank holding company for the River Bank & Trust that provides financial services to small to medium-sized businesses, organizations, entrepreneurs, and individuals in the United States.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion