- United States

- /

- Banks

- /

- OTCPK:PSBQ

PSB Holdings (PSBQ): Profit Margin Jumps to 25.4%, Challenging Prior Earnings Decline Narrative

Reviewed by Simply Wall St

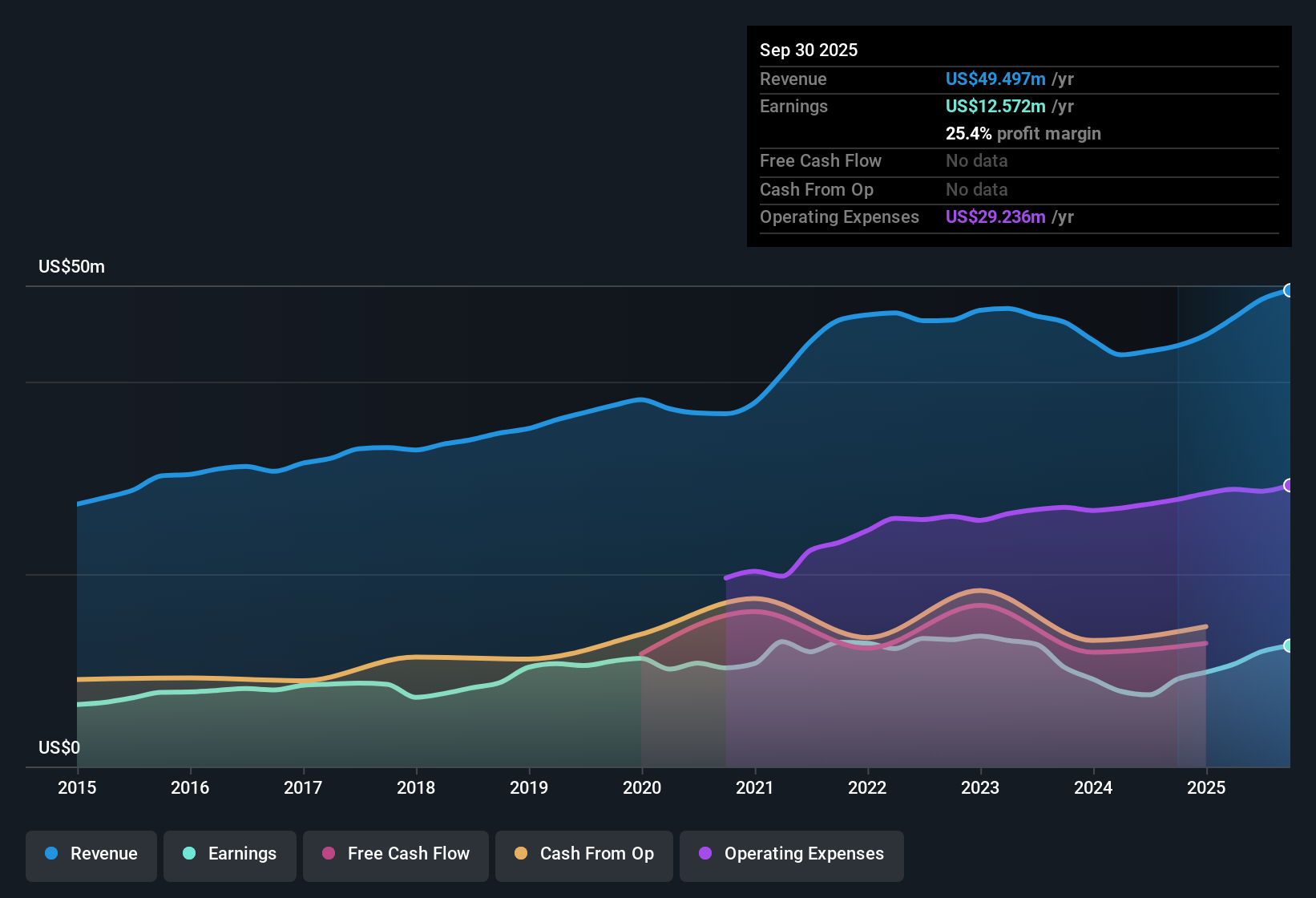

PSB Holdings (PSBQ) posted a net profit margin of 25.4%, up from 20.8% in the prior year, and recorded earnings growth of 38.3% over the past year, sharply reversing its five-year average decline of -3.9% per year. Shares are trading at $25.31, which comes at a discount to an estimated fair value of $32.56. The company also has a notable 8.3x Price-to-Earnings ratio, which is well below both industry and peer averages. This surge in profitability, combined with high-quality earnings and an appealing dividend, creates an intriguing setup even as the outlook for future growth remains muted.

See our full analysis for PSB Holdings.The next step is to see how these latest results measure up against the key narratives that shape expectations for PSB Holdings. We will examine how the headline numbers align with or potentially upset the broader market story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Leaps to 25.4% Despite Growth Headwinds

- PSB Holdings posted a net profit margin of 25.4% for the year, up from 20.8% the prior year, but neither revenue nor earnings are projected to grow much looking ahead.

- Pushing past its prior five-year average decline of -3.9% per year, the recent margin jump heavily supports the bullish side of the narrative. This emphasizes that the company is generating high-quality profits in the face of muted future growth expectations.

- This margin expansion stands out alongside a noted period of long-term earnings contraction. It signals a reversal that bullish investors could view as a pivotal turning point.

- Still, muted forward-looking growth remains a risk and tempers how much weight investors should give to short-term margin expansion.

Valuation Discount Widens Gap to DCF Fair Value

- Shares trade at $25.31, which is meaningfully below a DCF fair value estimate of $32.56 and is accompanied by a Price-to-Earnings ratio of 8.3x compared to the peer average of 12.4x.

- The valuation gap heavily favors buyers who are betting on a rebound, since the low P/E ratio signals that investors remain cautious about PSBQ's outlook even as underlying profitability turns up.

- This discount is more pronounced than the average in both the US banks industry (P/E 11.2x) and among selected peers. This points to skepticism despite margin gains.

- The current DCF fair value premium of over $7 per share may encourage value-focused investors to look beyond the muted near-term growth narrative and consider potential upside if recent trends persist.

Dividend and Profit Quality Attract Value Seekers

- PSB Holdings' reported earnings quality is high and its dividend is considered attractive when compared to many industry alternatives.

- Prevailing analysis notes that the combination of solid profit margins, a discounted share price, and a reliable dividend stream creates appealing value, even if growth is expected to be subdued.

- Stable earnings and consistent dividend payouts may provide important downside protection, especially for more risk-averse investors looking for yield and dependability.

- With profitability now overtaking its longer-term trend of declines, value investors can point to both income and quality as support for maintaining or initiating positions despite growth risks.

Want to see how the numbers fit the bigger market picture? Read the full analyst narrative before the next move. 📊 Read the full PSB Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PSB Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While PSB Holdings is delivering high-quality profits, its muted growth outlook could limit long-term upside and may disappoint those seeking steady expansion.

If dependable growth is crucial for your portfolio, focus on companies with proven consistency across cycles by searching through stable growth stocks screener (2117 results) now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:PSBQ

PSB Holdings

Operates as a bank holding company for Peoples State Bank that provides a range of retail consumer and commercial banking products and services to individuals and businesses in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives