- United States

- /

- Banks

- /

- OTCPK:FMCB

Farmers & Merchants Bancorp (FMCB): Slower Earnings Growth Reinforces Value-Focused Narrative

Reviewed by Simply Wall St

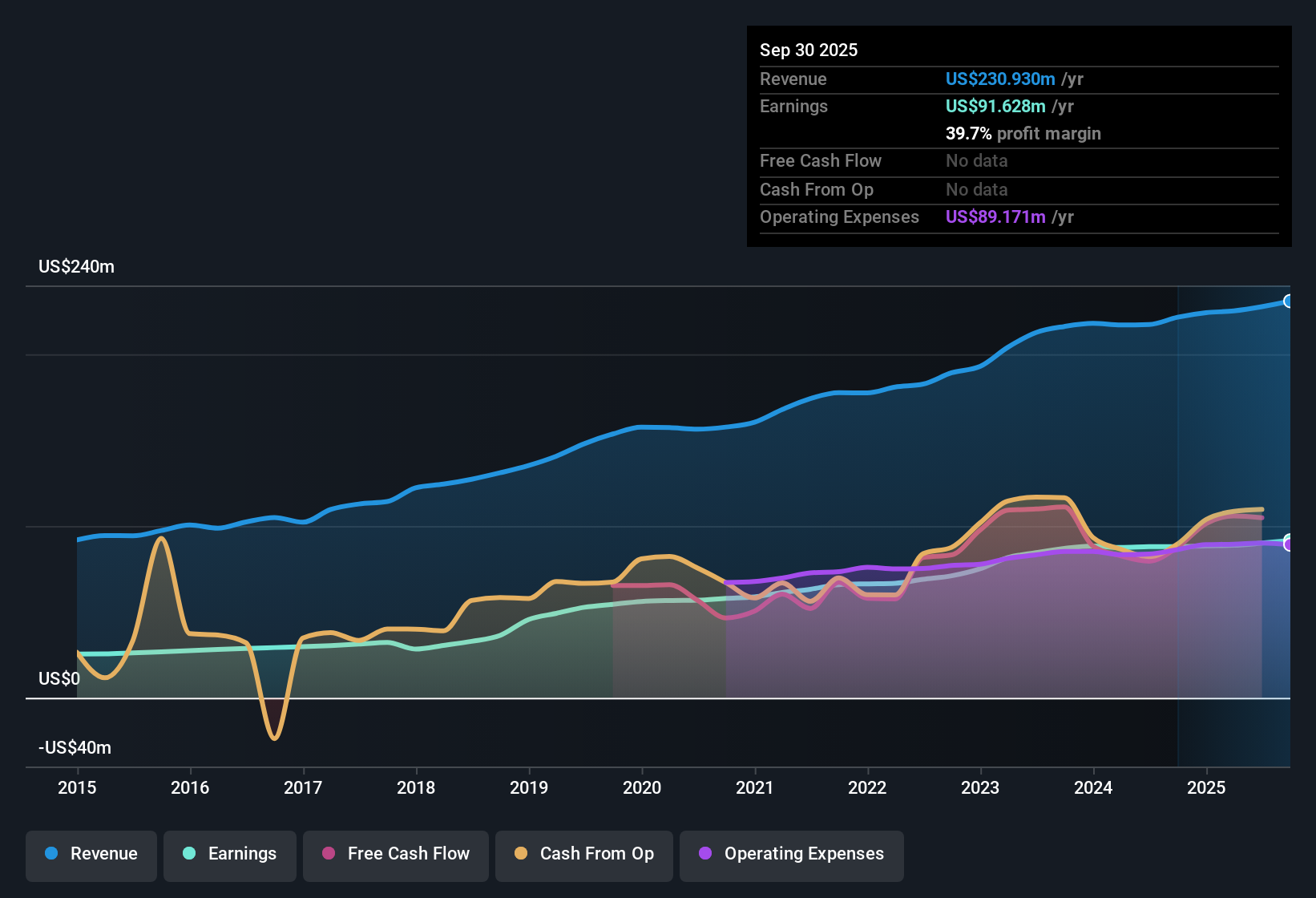

Farmers & Merchants Bancorp (FMCB) delivered average annual earnings growth of 10.1% over the past five years, but the most recent annual earnings growth measured 2.4%, signaling profit expansion is slowing. Net profit margins also slipped slightly to 39.6%, down from 40.5% the prior year. With no flagged risks and several ongoing growth drivers, investors have reason to watch how the next chapter unfolds despite the softer results.

See our full analysis for Farmers & Merchants Bancorp.Now let’s see how these headline numbers compare to the most widely followed narratives around Farmers & Merchants Bancorp. Some perspectives may be reinforced, while others could get called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Stay High Despite Slight Decline

- Net profit margins came in at 39.6%, just below last year's 40.5%. This highlights that the company still manages to retain a substantial portion of its earnings as profit even as incremental pressure on margins emerges.

- The prevailing investment case urges attention to Farmers & Merchants Bancorp’s resilience, as this level of margin supports the view that steady, traditional banking operations remain firmly intact.

- While momentum has eased, the continued ability to maintain margins near 40% contrasts with some regional banks that experience much sharper margin compression during challenging years.

- Notably, no new risks have been flagged, strengthening the argument that even with slower expansion, the bank's underlying profitability is more resilient than critics might think.

Price-to-Earnings Discount Widens Against Peers

- Farmers & Merchants’ current P/E ratio is 8x, meaning investors pay less for every dollar of profit compared to the US banks industry average of 11.6x and the peer group at 10.2x. This deepens its value appeal relative to the group.

- Supporters of the value argument highlight that this valuation gap, combined with high-quality earnings, substantially supports the case for long-term holders.

- Compared to many regional banks trading at higher multiples, FMCB essentially offers similar profit quality at a market discount, which amplifies its reputation as a traditional value play.

- Bears who worry about fading growth must consider how little is priced in for optimism, but also how much downside protection the low valuation appears to offer in less robust years.

Market Price Well Below DCF Fair Value

- At a share price of $1,000.00, FMCB trades notably lower than its DCF fair value calculation of $2,561.02. This presents a sizable disconnect between intrinsic value models and what investors are currently paying.

- The investment case relies on this significant discount to fair value, emphasizing that even without headline-grabbing catalysts, the fundamentals support patient, value-oriented investors.

- This gap is unusually large compared to what is typical for regional banks, underscoring both how overlooked the stock may be and why it remains attractive to investors with a longer horizon.

- Importantly, with all reward signals favorable and no red-flagged risks, the magnitude of this valuation disconnect could become a focal point if the sector’s view of stability turns more favorable.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Farmers & Merchants Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Farmers & Merchants Bancorp boasts resilient profits and deep value, its slowing earnings growth and incremental margin pressure may concern investors seeking stronger near-term momentum.

If you want steadier expansion and less volatility, use our stable growth stocks screener (2097 results) to pinpoint companies that consistently deliver solid performance and growth in every cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCB

Farmers & Merchants Bancorp

Operates as the bank holding company for Farmers & Merchants Bank of Central California that provides various banking services to businesses and individuals in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives