- United States

- /

- Banks

- /

- NYSEAM:EVBN

Here's Why It's Unlikely That Evans Bancorp, Inc.'s (NYSEMKT:EVBN) CEO Will See A Pay Rise This Year

Shareholders will probably not be too impressed with the underwhelming results at Evans Bancorp, Inc. (NYSEMKT:EVBN) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 04 May 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Evans Bancorp

Comparing Evans Bancorp, Inc.'s CEO Compensation With the industry

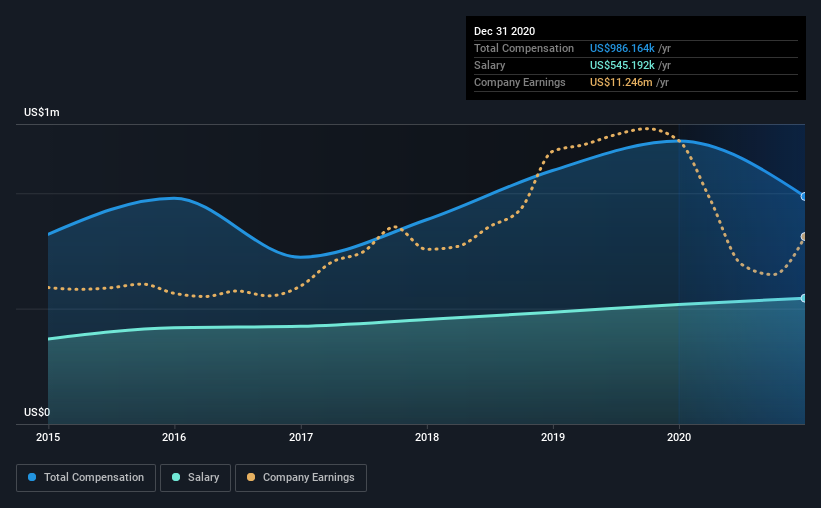

According to our data, Evans Bancorp, Inc. has a market capitalization of US$190m, and paid its CEO total annual compensation worth US$986k over the year to December 2020. We note that's a decrease of 20% compared to last year. Notably, the salary which is US$545.2k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$766k. So it looks like Evans Bancorp compensates David Nasca in line with the median for the industry. Moreover, David Nasca also holds US$2.9m worth of Evans Bancorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$545k | US$518k | 55% |

| Other | US$441k | US$708k | 45% |

| Total Compensation | US$986k | US$1.2m | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Evans Bancorp is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Evans Bancorp, Inc.'s Growth Numbers

Earnings per share at Evans Bancorp, Inc. are much the same as they were three years ago, albeit slightly lower. It achieved revenue growth of 1.3% over the last year.

The lack of EPS growth is certainly uninspiring. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Evans Bancorp, Inc. Been A Good Investment?

Since shareholders would have lost about 14% over three years, some Evans Bancorp, Inc. investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 3 warning signs for Evans Bancorp that investors should look into moving forward.

Switching gears from Evans Bancorp, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Evans Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Evans Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:EVBN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives