- United States

- /

- Banks

- /

- NYSE:WFC

Wells Fargo (WFC): Assessing Valuation After New Fixed-Income Offerings and Capital Moves

Reviewed by Simply Wall St

If you’re watching Wells Fargo (WFC) right now, you know it is not just another quiet trading session. The company has been busy, announcing and closing several new fixed-income offerings, ranging from senior unsecured notes due in five to twenty years to subordinated notes that come with higher yields. Moves like these typically prompt investors to pause and consider what they might signal about the company’s balance sheet, future funding needs, and strategic direction. Is Wells Fargo shoring up its flexibility for an uncertain credit market, or is it positioning for opportunities that could drive long-term value?

These fresh bond deals arrive on the heels of a period in which Wells Fargo’s stock has outperformed many peers. Shares have returned 48% over the past year, adding to a nearly 13% gain so far this year alone. That run has been supported by solid financials, with both annual revenue and net income growing around 5%. The momentum over the past three months has modestly lagged that longer-term rise, suggesting that the headline excitement may be giving way to more cautious price action as the dust settles from recent news.

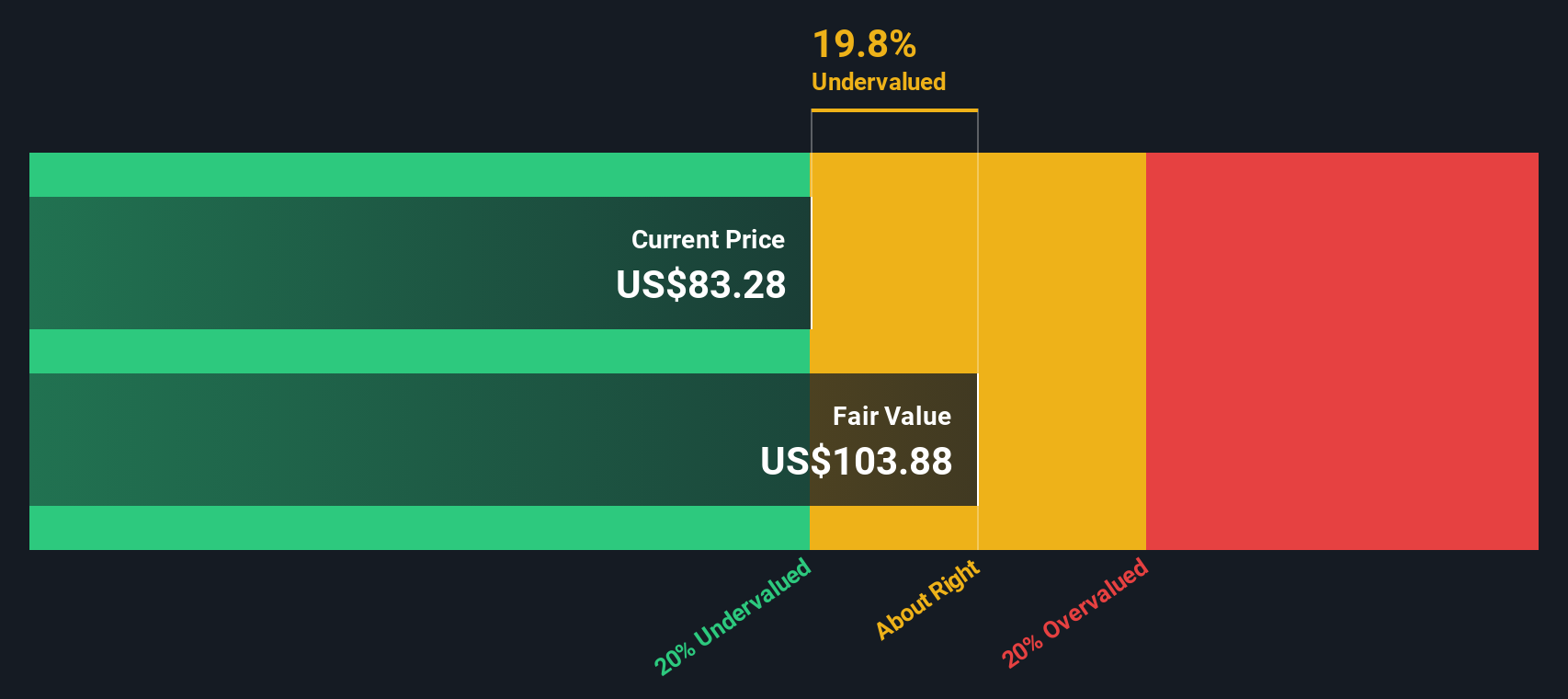

With the latest bond offerings on the table and the stock’s rally still visible in the rearview mirror, the real question is whether Wells Fargo is trading at a discount or if the market is already pricing in another leg of growth.

Most Popular Narrative: 5.7% Overvalued

According to the most widely followed narrative from mschoen25, Wells Fargo is currently seen as overvalued by 5.7% compared to its calculated fair value. The narrative is built on quantitative assumptions and considers a blend of the company’s fundamentals and sector influences.

One of the reasons for its undervaluation is related to the broader economic environment, particularly the sluggishness in the housing and manufacturing sectors. However, Wells Fargo has significant advantages, such as a wide economic moat from its large customer base and low funding costs. In addition, potential regulatory changes, such as the lifting of the asset cap that limits the bank's growth, could drive future profitability. In short, while Wells Fargo is trading below its intrinsic value, its strong fundamentals, expansive customer base, and strategic investments make it a compelling option for investors seeking undervalued opportunities in the banking sector.

Curious about what is fueling the debate around Wells Fargo’s valuation? The narrative points to factors beyond just recent stock performance. There are underlying growth expectations, profitability margins, and potential regulatory catalysts that could shift the company’s outlook and drive its future value higher. Want to uncover which assumptions are moving the price target? Take a closer look at what is powering this view on Wells Fargo’s true worth.

Result: Fair Value of $74.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential delays in regulatory reform or a downturn in economic conditions could present challenges to the optimistic outlook for Wells Fargo’s long-term growth.

Find out about the key risks to this Wells Fargo narrative.Another View: The SWS DCF Model Weighs In

Taking a different approach, the SWS DCF model tells a less traditional story than broad market measures. This method currently points in the opposite direction and highlights a possible value not fully reflected in price. Which approach paints the truer picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Wells Fargo Narrative

If you would rather challenge these perspectives or rely on your own analysis, you can quickly develop your own take in just a few minutes. Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Don’t settle for just one idea. Set yourself up for smarter investing by actively searching out categories where genuine growth, innovation, and value are waiting right now. Miss out and you could leave potential profits on the table.

- Uncover growing income streams by tapping into dividend stocks with yields > 3%, which highlights companies with solid yields and the strength to reward investors year after year.

- Supercharge your portfolio by focusing on game changers shaping tomorrow’s technology landscape through AI penny stocks.

- Spot untapped bargains with undervalued stocks based on cash flows, offering a path to companies underpriced based on their future cash flows and market potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in